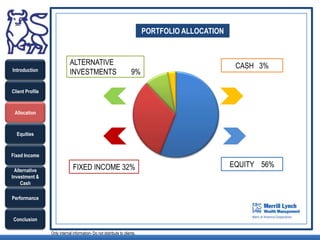

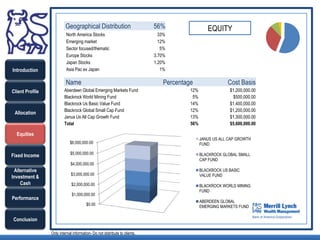

The document provides a summary of a client's portfolio, including allocation across equities, fixed income, alternative investments, and cash. It tracks the performance of various funds within each category from July 16-28, 2010. Overall, the portfolio gained 2.42% over this period, outperforming suggested benchmarks. Key recommendations include maintaining a diversified, medium-to-long term approach consistent with the client's risk profile and allocation.