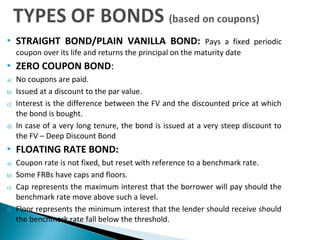

Debt instruments are contracts where one party lends money to another at a predetermined interest rate and repayment schedule. There are various types of bonds like straight bonds, zero coupon bonds, and floating rate bonds. Bond prices are inversely related to yields, and bond values are sensitive to interest rate changes. Duration measures a bond's sensitivity to interest rate risk.