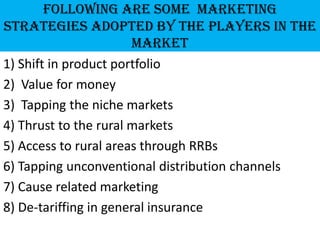

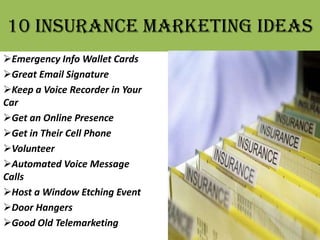

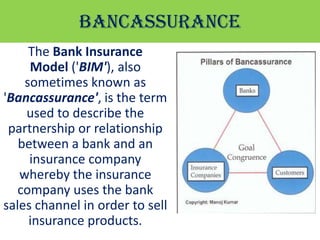

The document discusses various marketing strategies used by insurance companies in India, including shifting product portfolios, targeting rural markets, and unconventional distribution channels. It also lists 10 insurance marketing ideas like emergency wallet cards, email signatures, and voice recordings in cars. Common distribution channels are agents, brokers, corporate agents, and bancassurance partnerships between banks and insurers. Other channels discussed are worksite marketing targeting employees and internet/digital marketing promoting products online. Microinsurance is also summarized as low-cost insurance for low-income individuals covering life, health and livestock/crops.