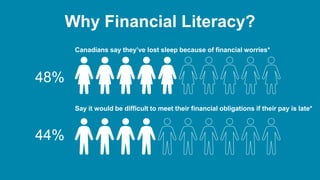

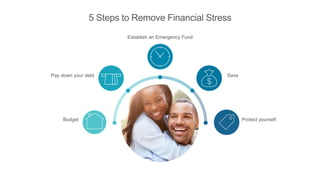

The document discusses the importance of financial literacy in managing stress related to financial obligations, with statistics revealing that a significant number of Canadians experience sleep loss due to financial worries. It outlines five steps to remove financial stress: budgeting, paying down debt, establishing an emergency fund, saving for goals, and protecting oneself through insurance. It encourages individuals to seek assistance in organizing their finances to alleviate stress and achieve their financial goals.