Embed presentation

Downloaded 113 times

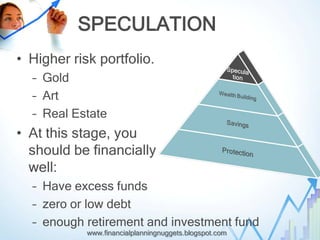

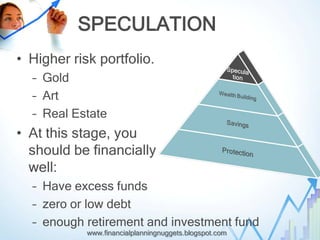

The document describes a financial pyramid model for managing investments from low to high risk. The bottom level focuses on low-risk protections like debt repayment, savings, and insurance. The middle level includes slightly higher growth investments like time deposits, mutual funds, and bonds. The top speculative level involves high risk investments like gold, art, and real estate speculation. It recommends climbing the pyramid one level at a time from protections to savings to wealth building and finally speculation only after becoming financially secure with excess funds and low or no debt.