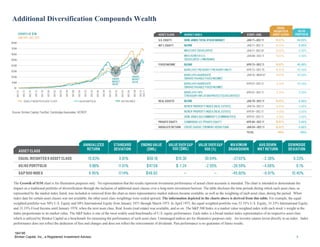

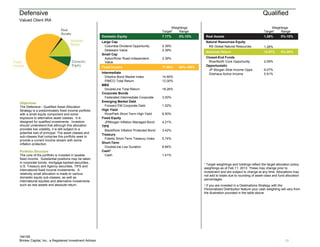

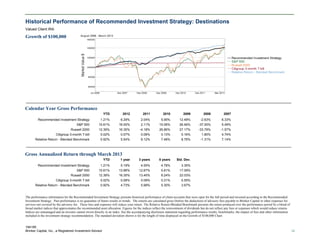

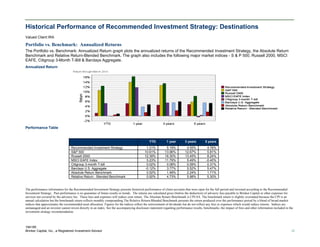

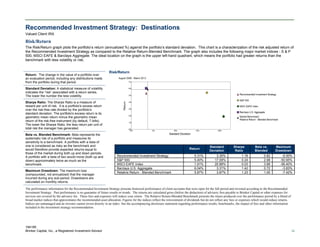

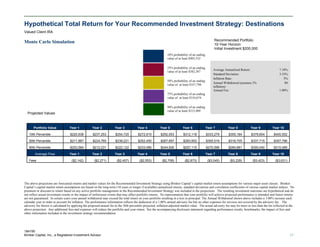

This document provides investment recommendations for a client's qualified retirement account. It recommends a portfolio with a target allocation of 77.5% to fixed income investments like bonds and cash, 7.17% to domestic equities, 1.26% to real assets, and 14.07% to absolute return strategies. The portfolio aims to provide current income and some inflation protection while maintaining low volatility suitable for the account type. Historical returns are provided showing the recommended strategy has outperformed blended benchmarks over various periods since inception.