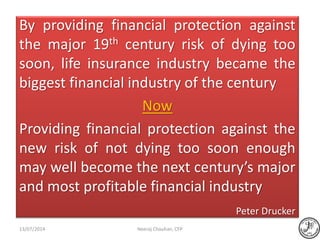

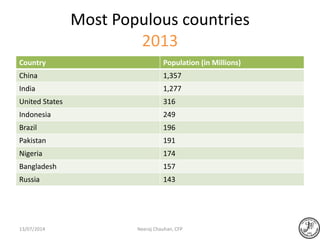

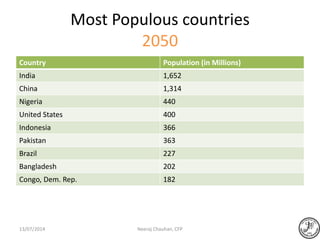

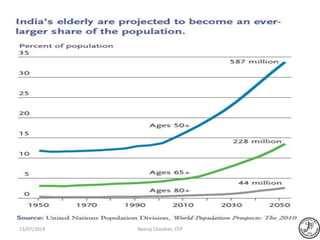

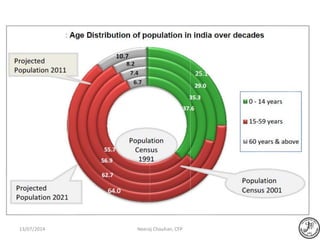

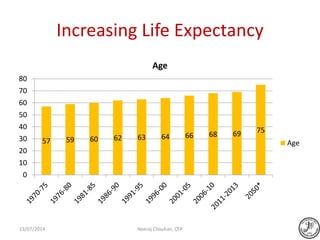

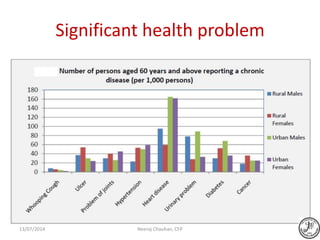

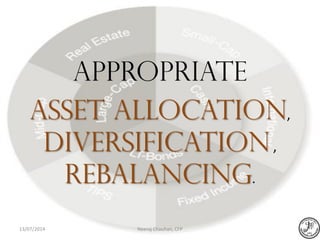

The document discusses the evolving landscape of retirement planning in the context of an aging population and increasing life expectancy, particularly in India. Key challenges include low financial literacy, reliance on property investments, and inadequate health insurance among older adults. The emphasis is on shifting from traditional investment strategies to a focus on lifetime income and risk management to ensure financial security during retirement.