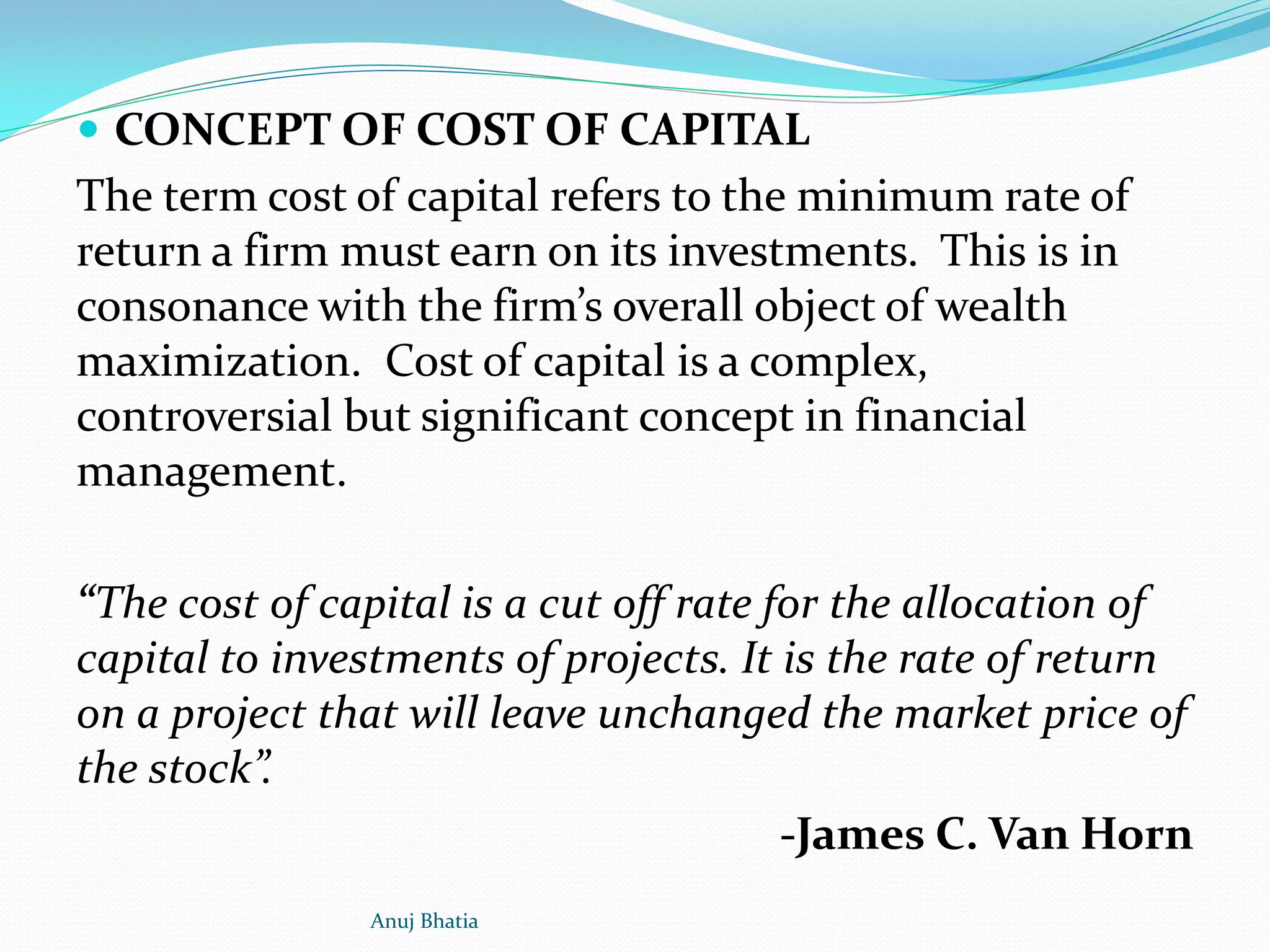

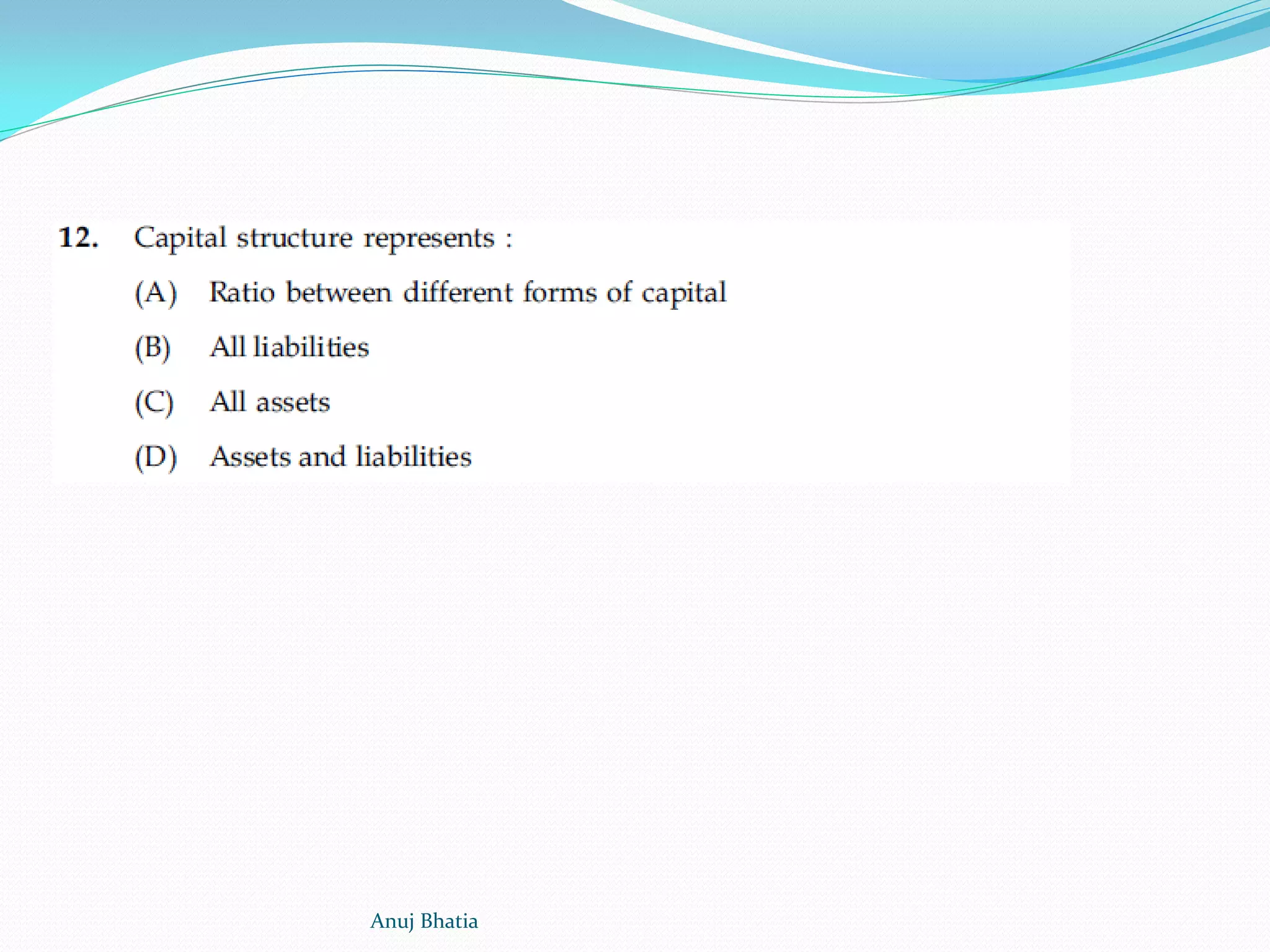

1) The document discusses the concept of cost of capital, which refers to the minimum rate of return a firm must earn on its investments.

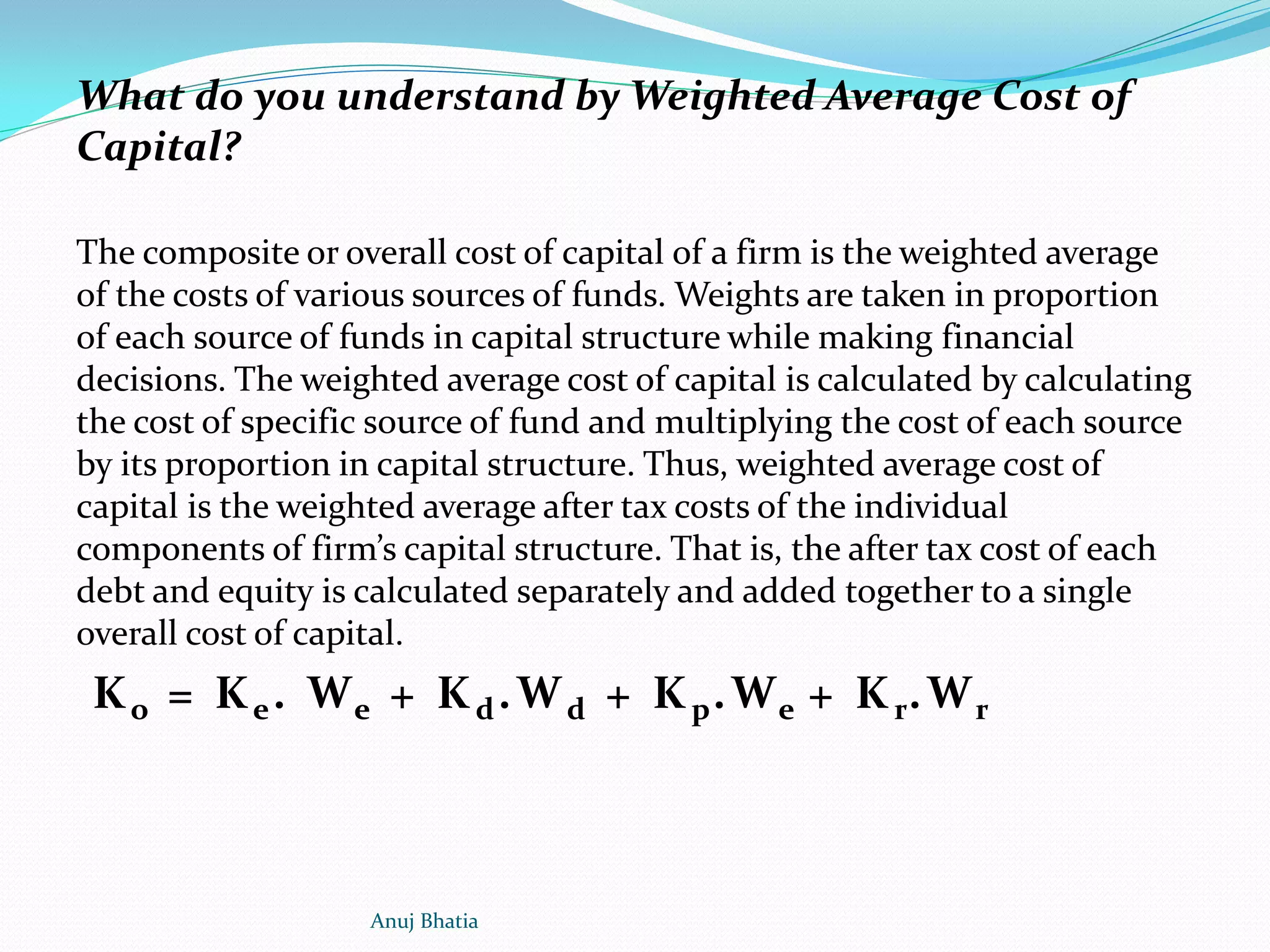

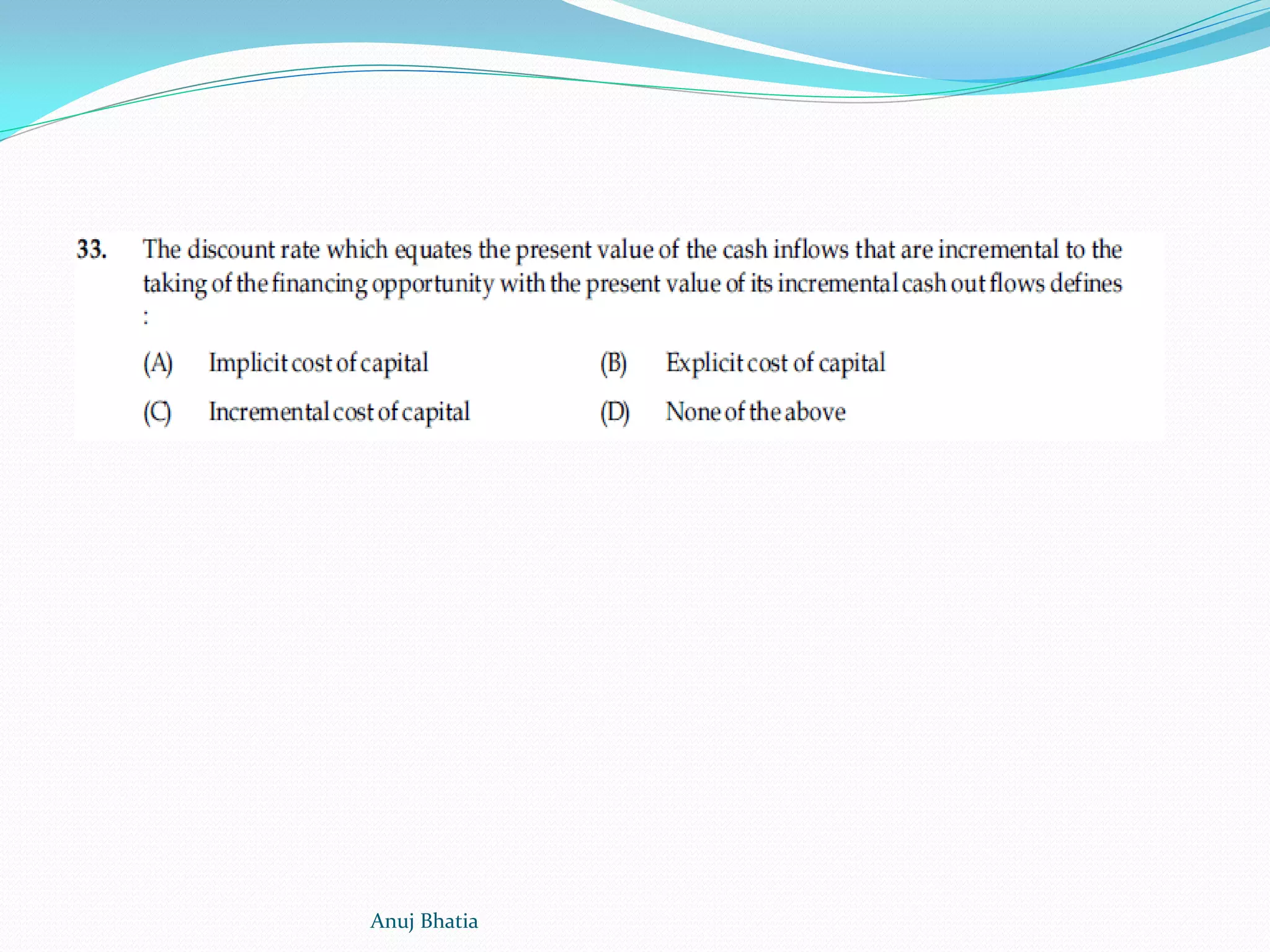

2) Cost of capital includes the cost of debt, preference shares, and equity. It is classified as historical or future, specific or composite, explicit or implicit, and average or marginal.

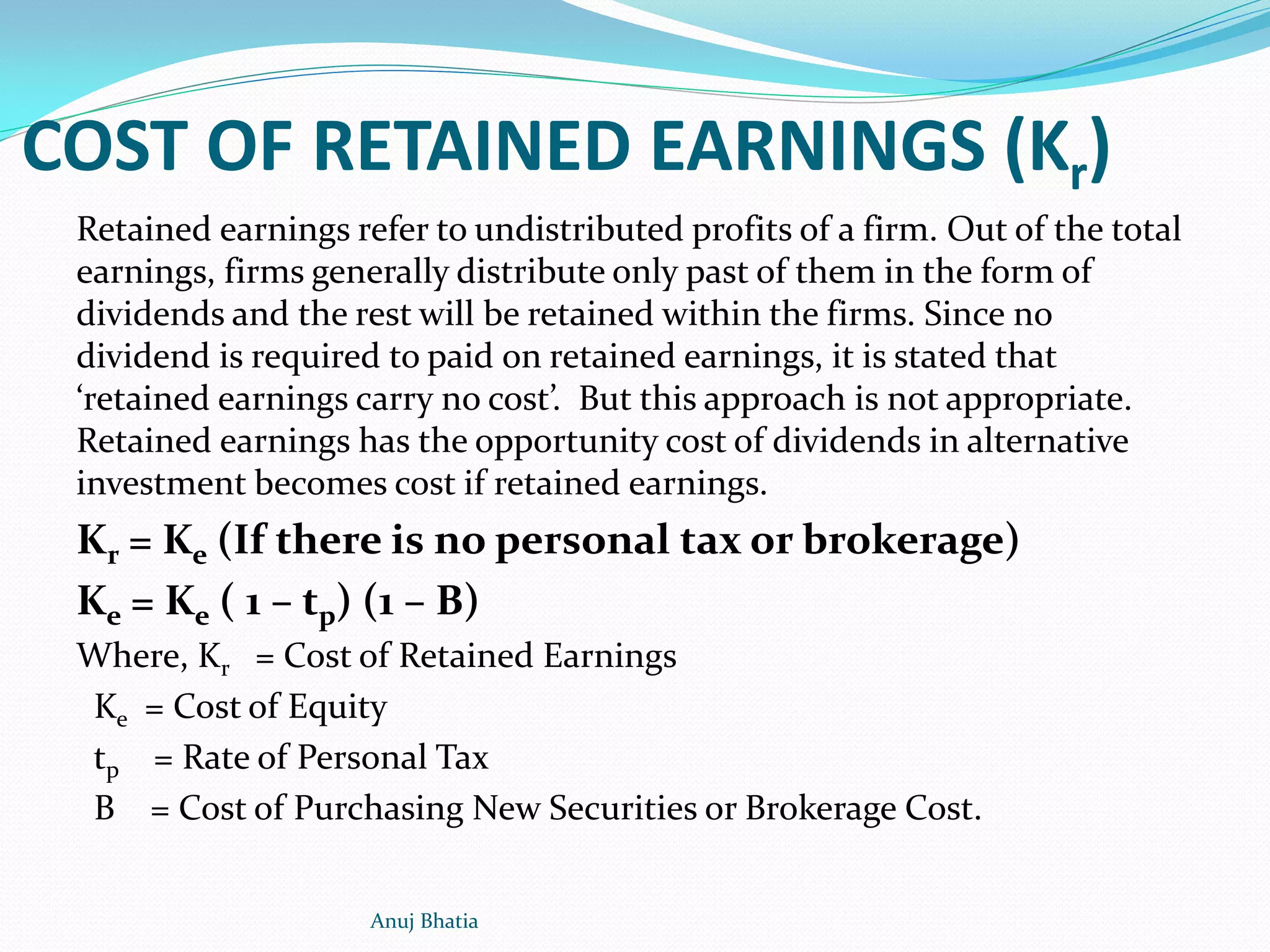

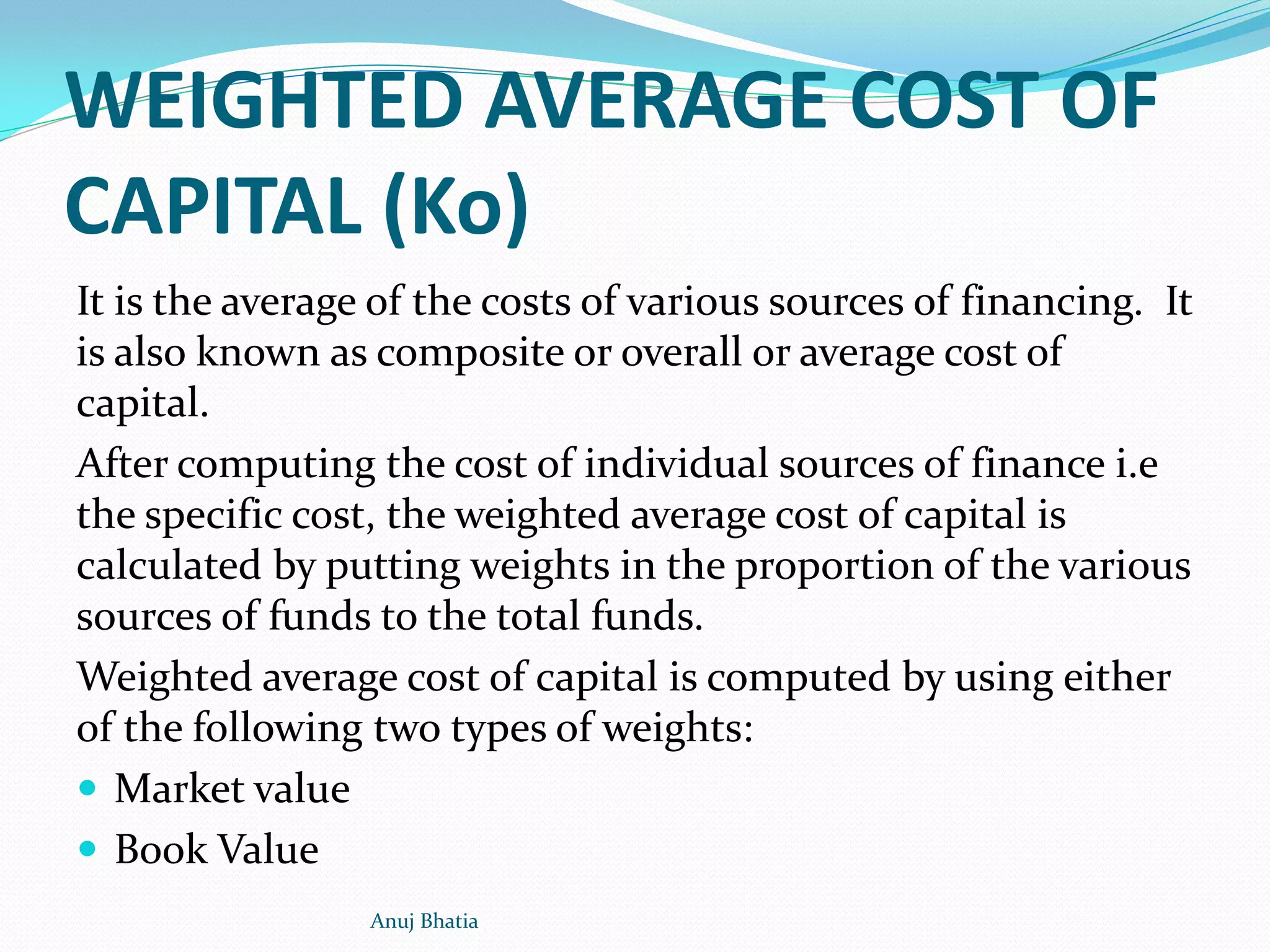

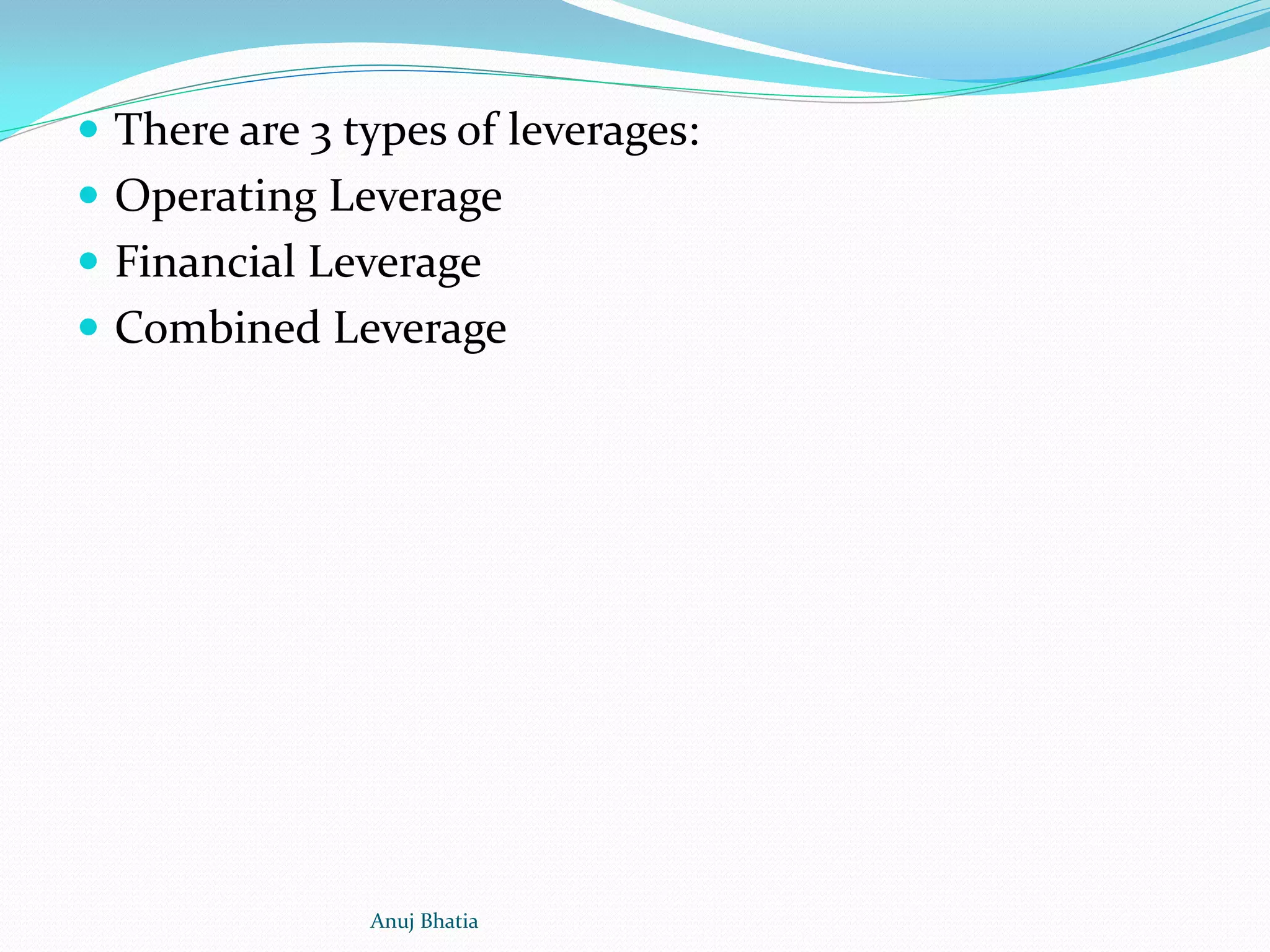

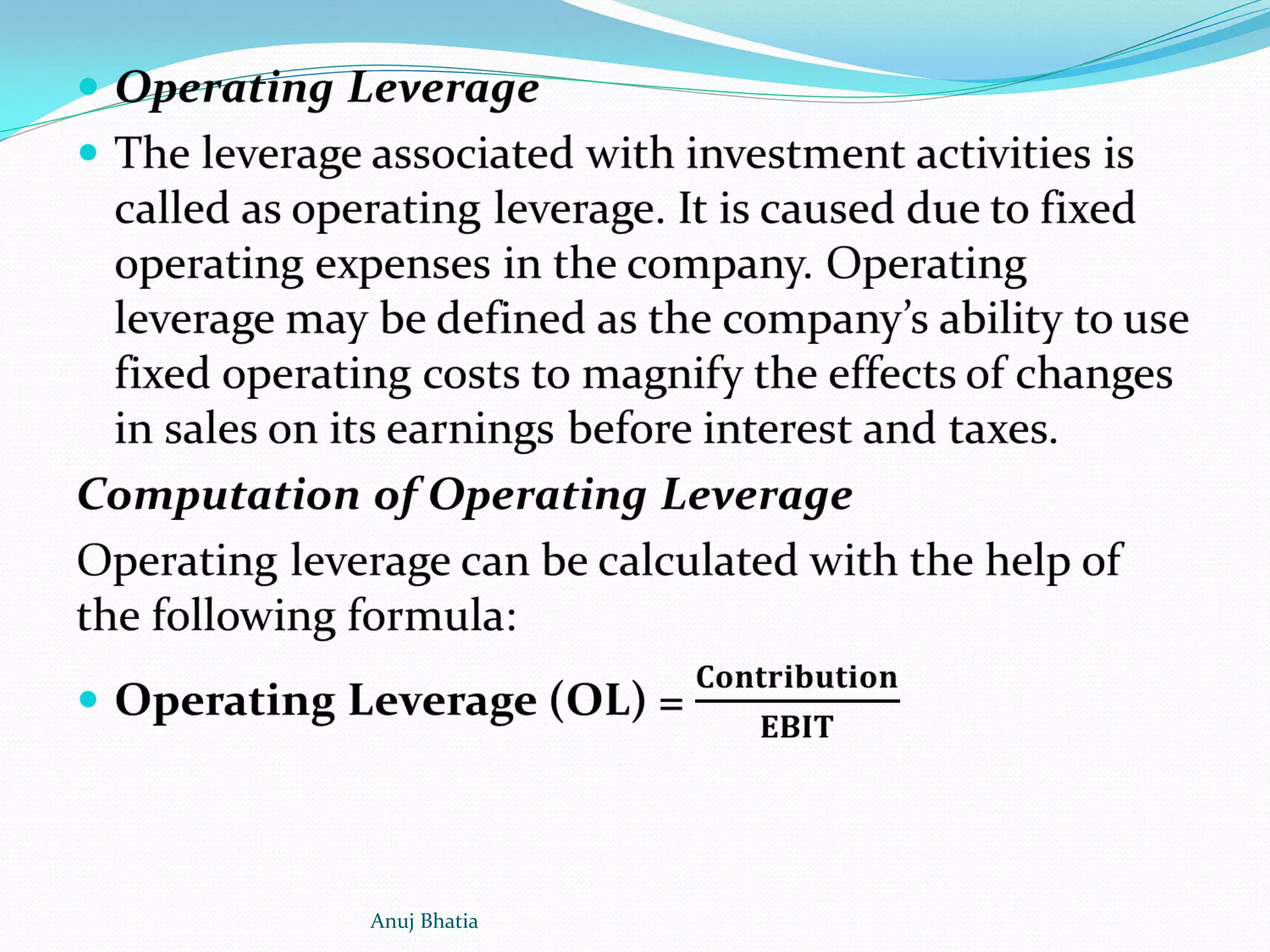

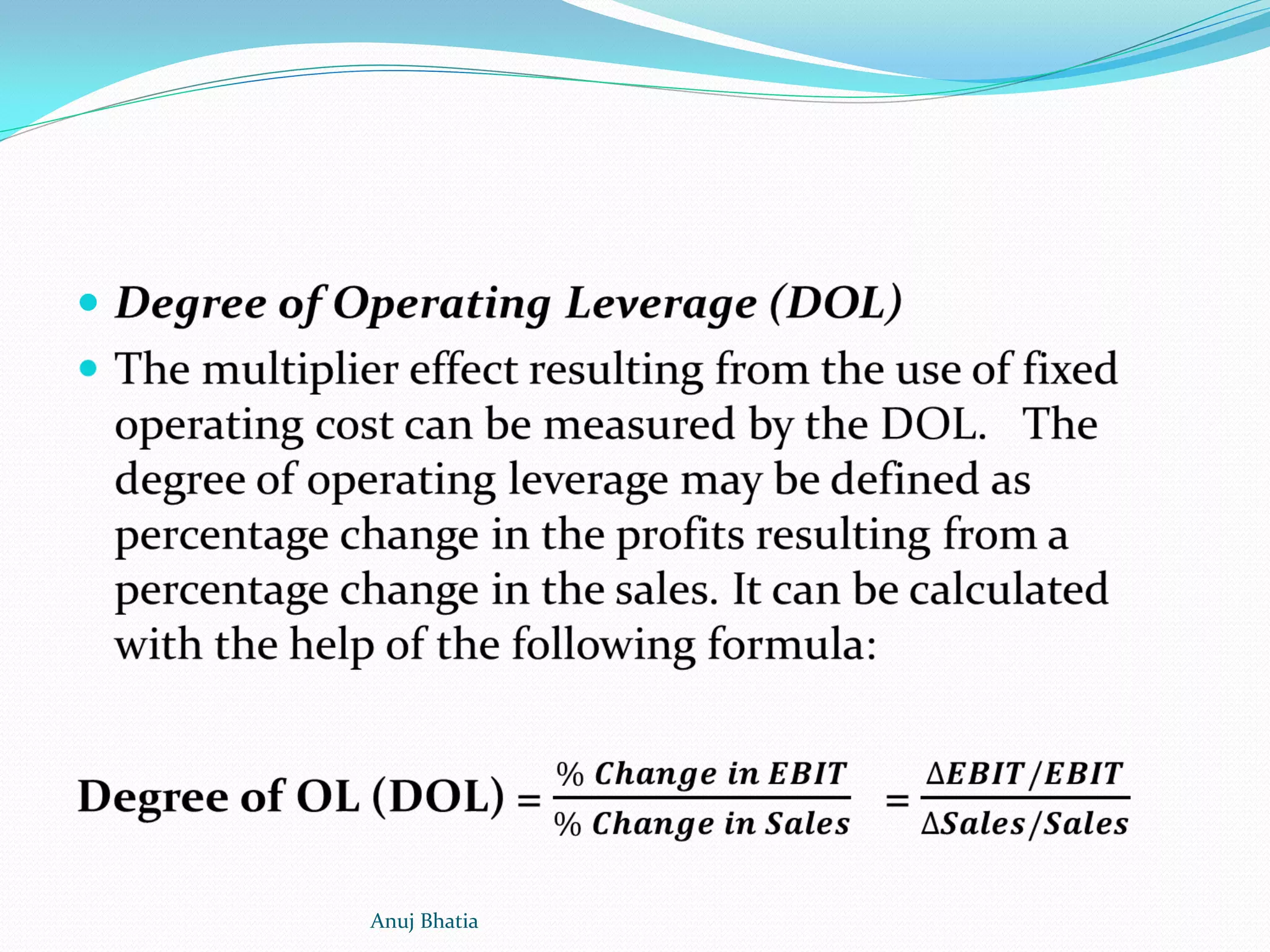

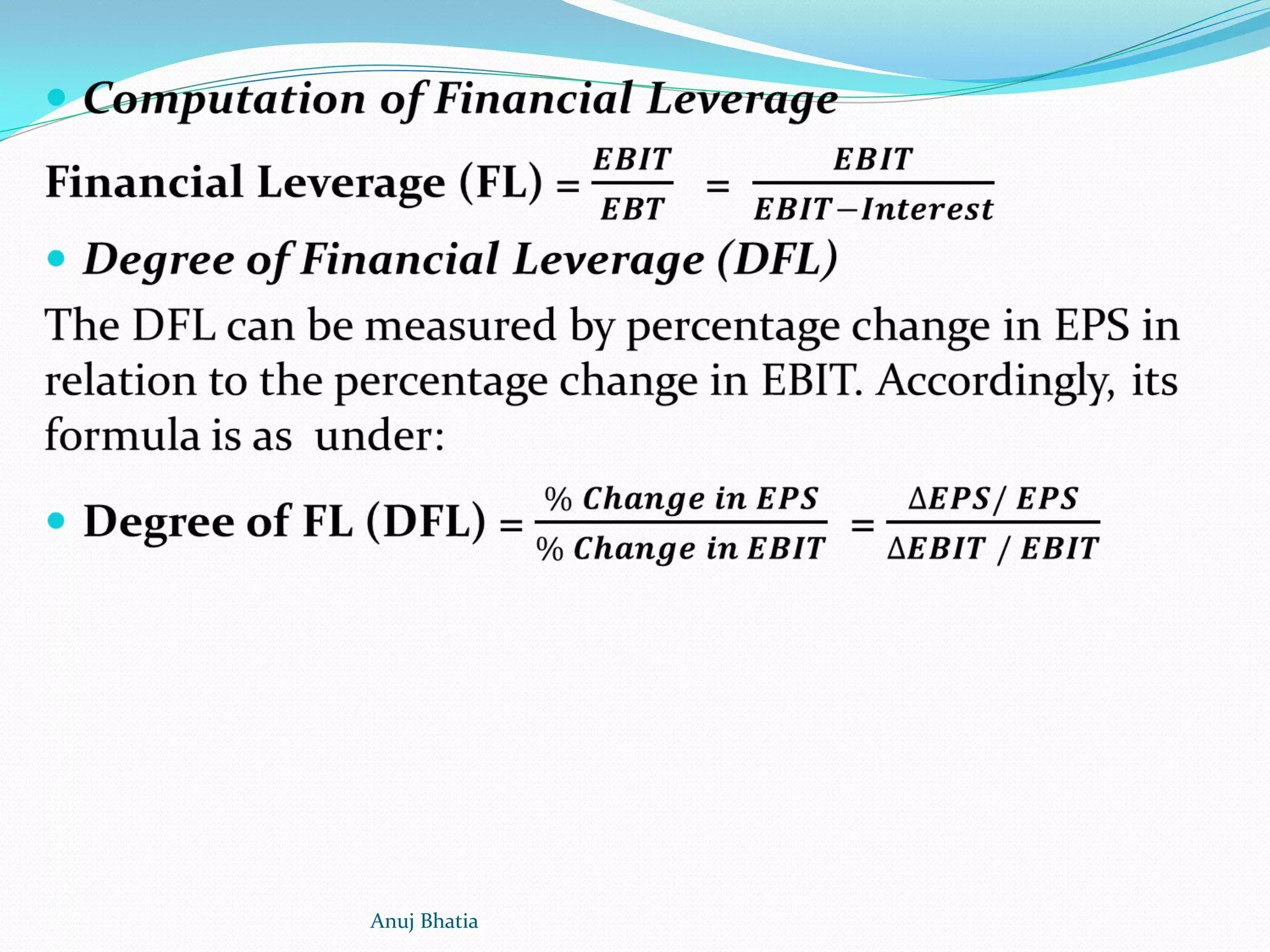

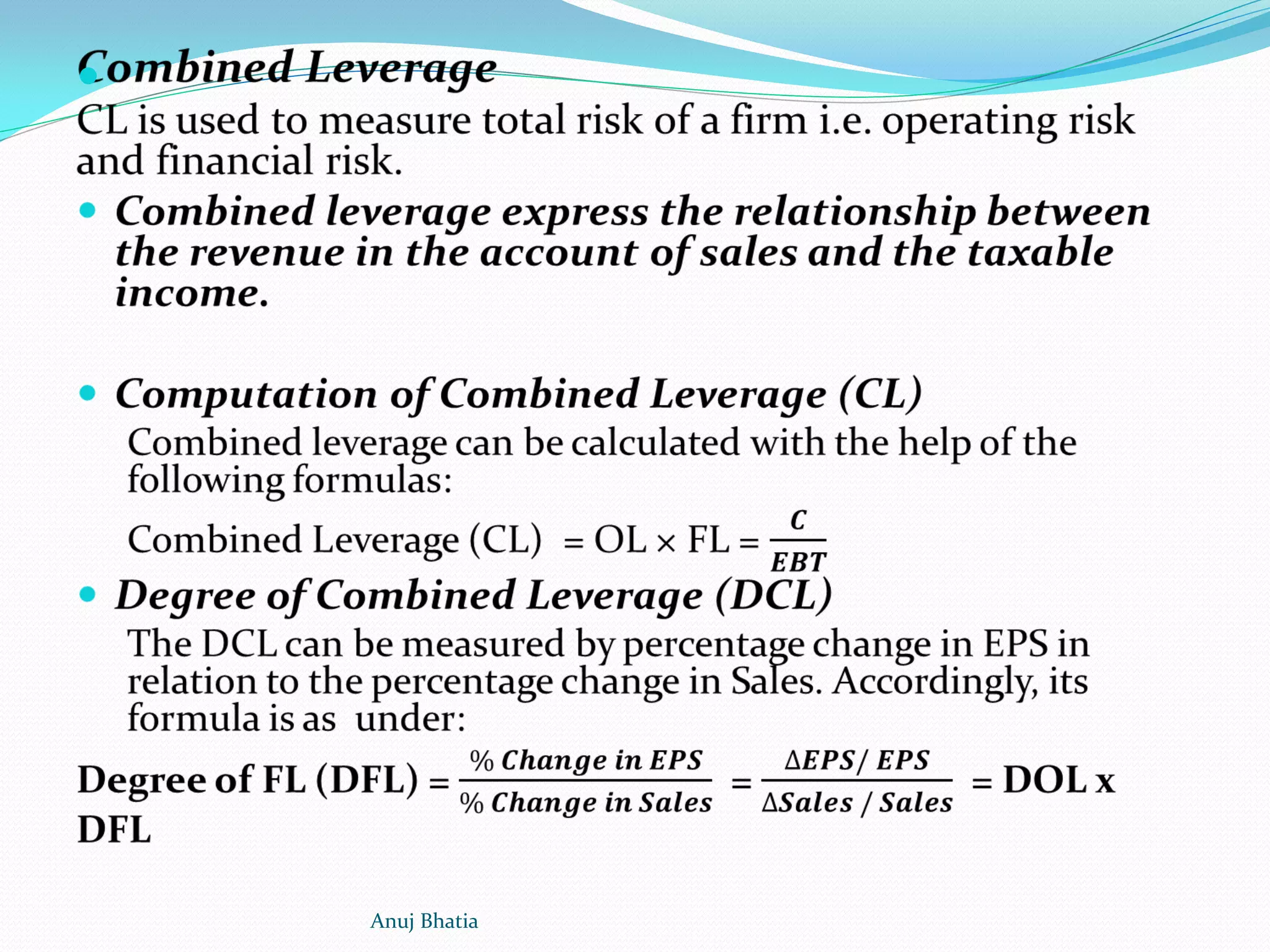

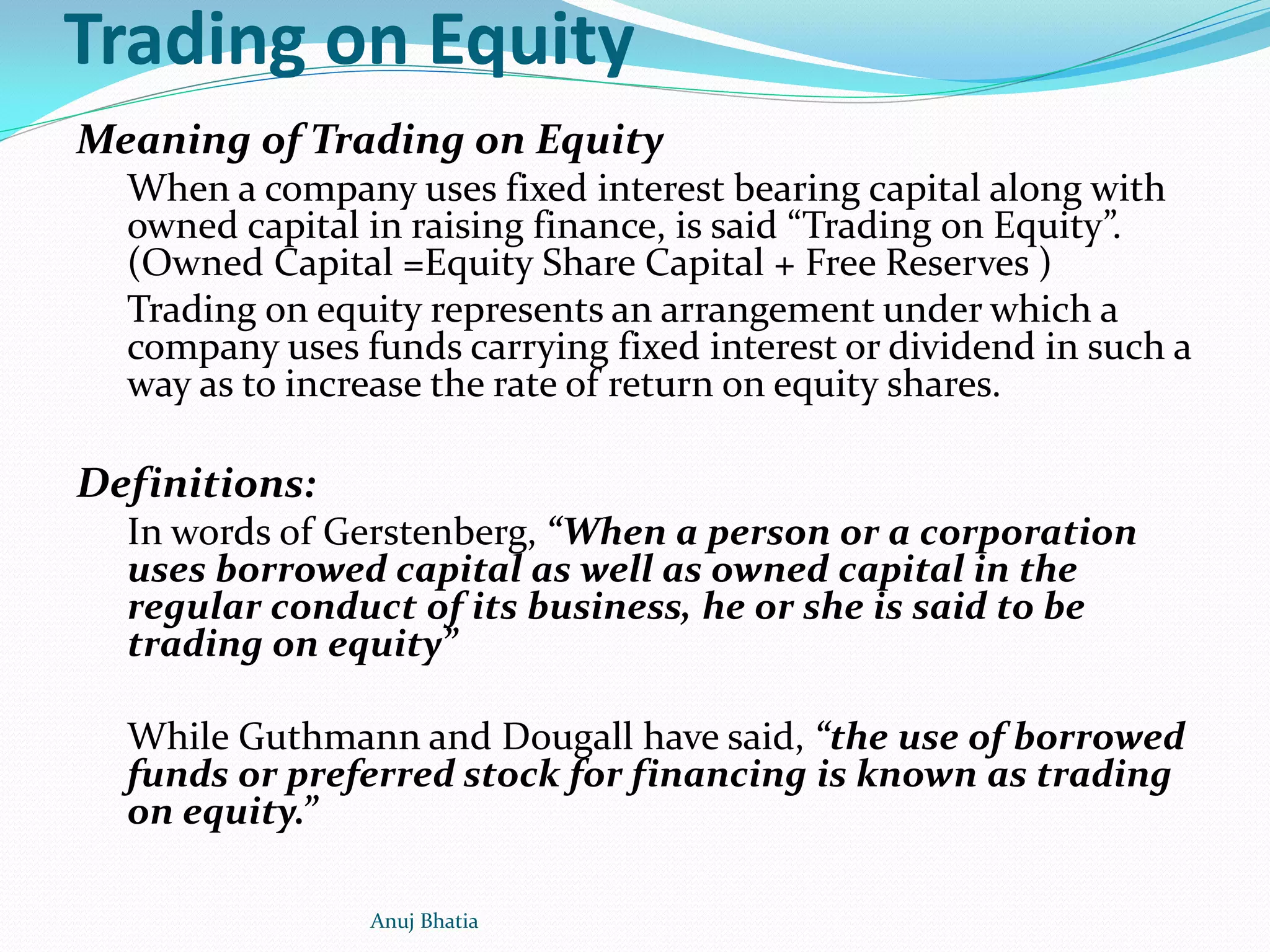

3) The costs are calculated using different formulas based on whether the securities are perpetual or redeemable, and issued at par, premium or discount.

4) Cost of capital is a key concept in financial management as it is used to evaluate investment projects and make capital structure decisions.

![Anuj Bhatia

BBA (Gold Medalist), M.Com (Gold Medalist), CA(Inter.),

CMA(Inter.), GSET, UGC NET-JRF, Ph.D (Pur.)]

Research Scholar,

Department of Business Studies,

Sardar Patel University](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-1-2048.jpg)

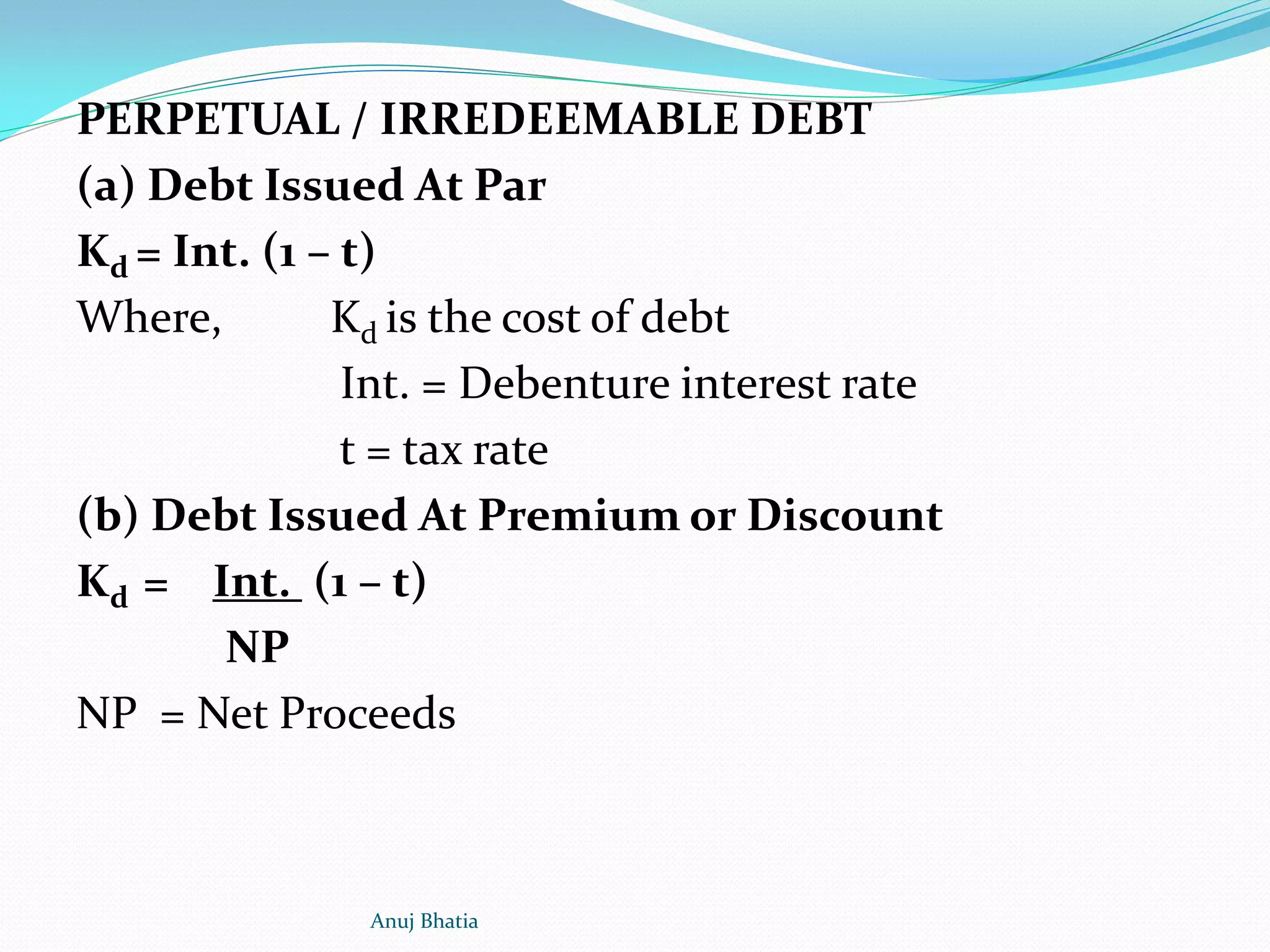

![Kd = Int. (1-t) + [F – P / n]

[F + P / 2 ]

F = Maturity/Redemption Value

P = Net Proceeds

Net Proceeds:

(A) At Par = Face Value – Flotation Cost (f)

(B) At Premium = Face Value + Premium – Flotation Cost (f)

(C) At Discount = Face Value – Discount – Flotation Cost (f)

COST OF REDEEMABLE DEBT

If the debentures are redeemable after the expiry of a fixed period the

effective cost of debt is calculated by using the following formula:

Anuj Bhatia](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-32-2048.jpg)

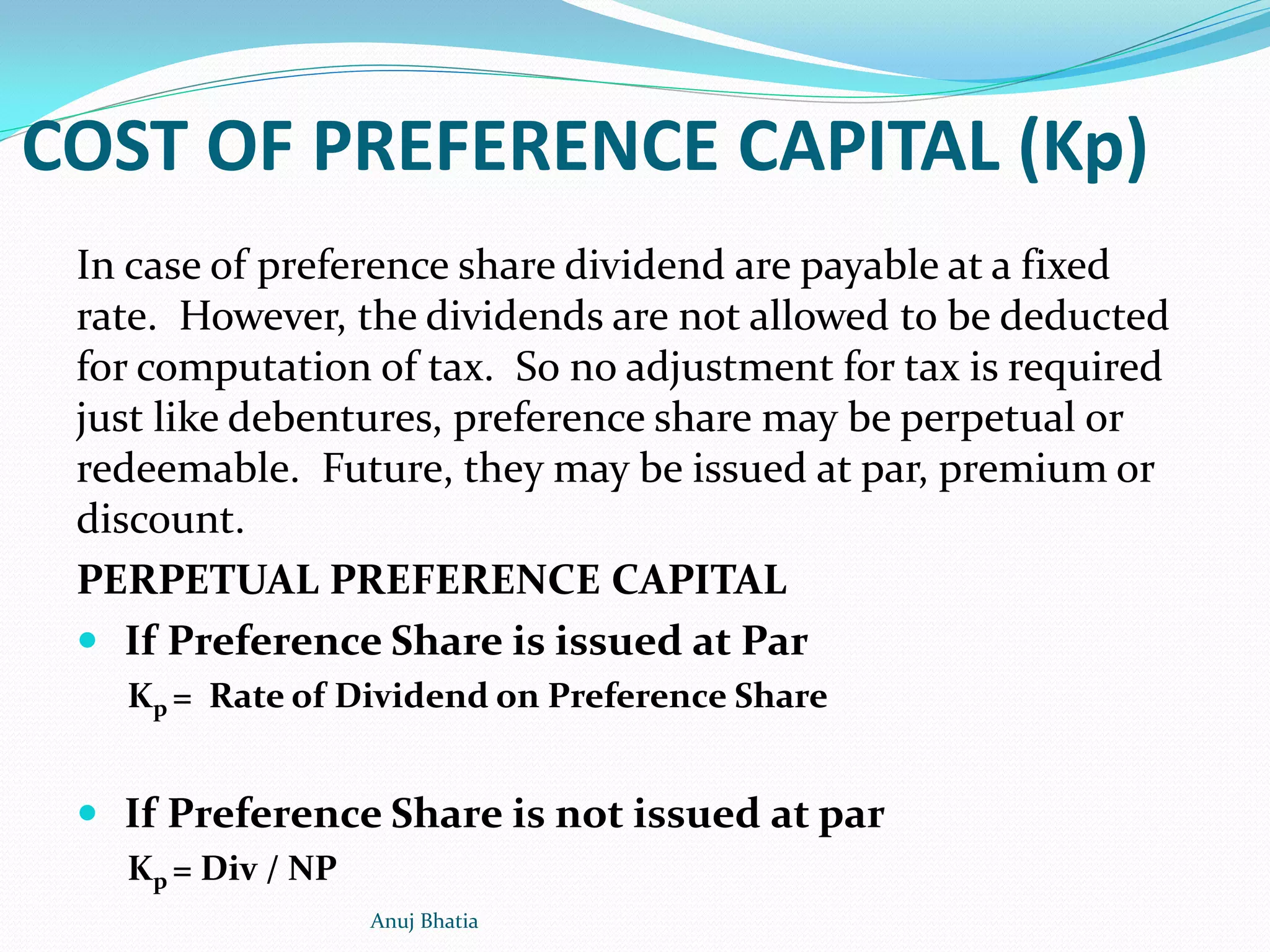

![ REDEEMABLE PREFERENCE SHARES

In the case of redeemable preference shares, the cost of

capital is the discount rate that equals the net proceeds of

sale of preference shares with the present value of future

dividends and principal repayments. It can be calculated

using the following formula:

Kp = Div + [ F – P / n ]

[ F + P / 2]

Anuj Bhatia](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-34-2048.jpg)

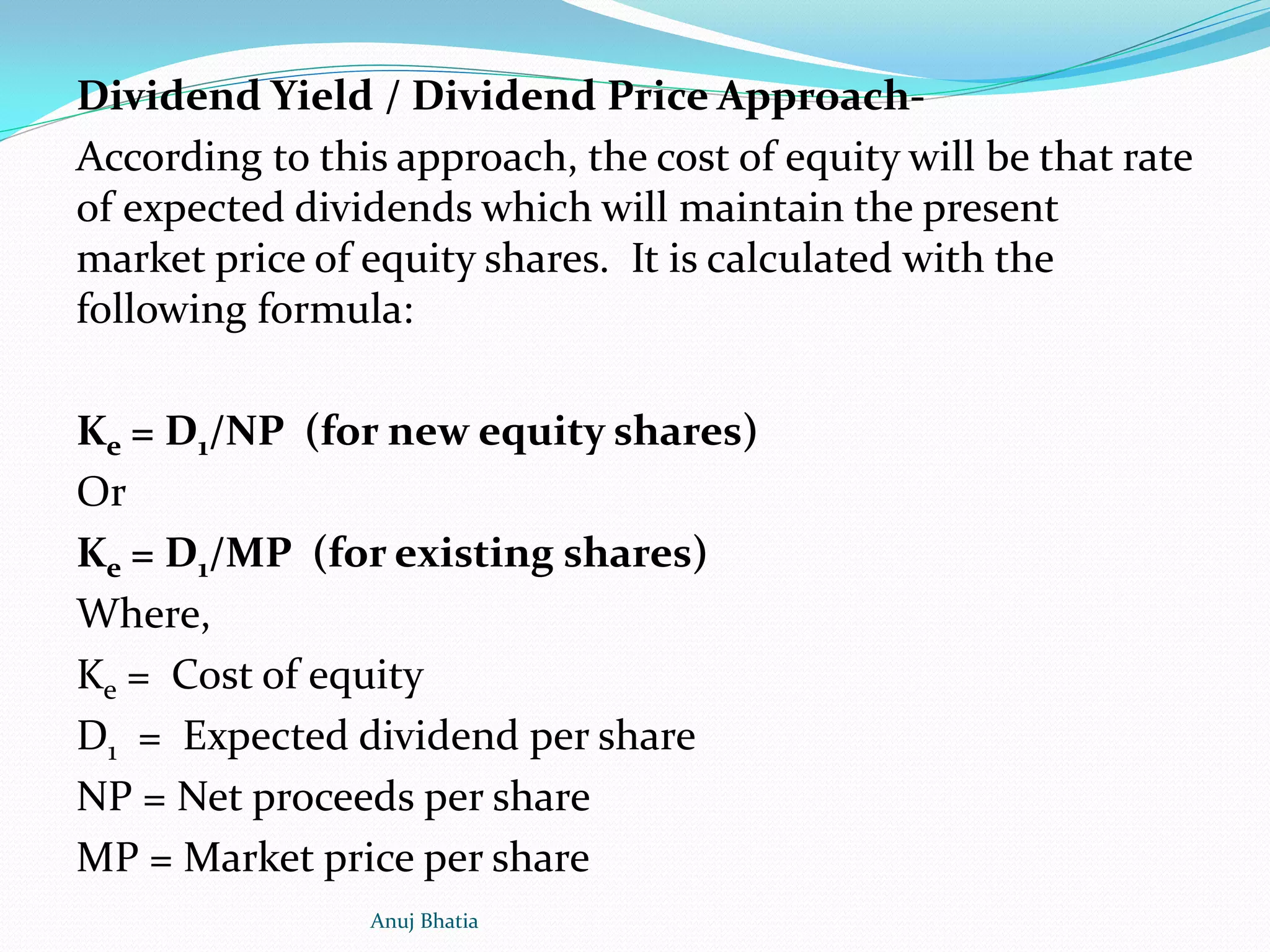

![ Dividend Yield Plus Growth In Dividend

Methods

According to this method, the cost of equity is determined on the basis if

the expected dividend rate plus the rate of growth in dividend. This

method is used when dividends are expected to grow at a constant rate.

Cost of equity is calculated as:

Ke = D1 + g (for new equity issue)

NP

Where,

D1 = Expected dividend per share at the end of the year. [D1 = Do (1 + g)]

NP = Net proceeds per share

g = Growth in dividend

Anuj Bhatia](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-37-2048.jpg)

![Earnings Yield Method

According to this approach, the cost of equity is the

discount rate that capitalizes a stream of future earnings

to evaluate the shareholdings. It is called by taking

earnings per share (EPS) into consideration. It is

calculated as:

i) Ke = Earnings per share / Net proceeds = EPS / NP

[For new share]

ii) Ke = EPS / MP [ For existing equity]

Anuj Bhatia](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-38-2048.jpg)

![NET INCOME (NI) APPROACH

[CAPITAL STRUCTURE IS RELEVANT, IT MATTERS]

Developed by David Durand

It is relevance theory, i.e. Capital Structure decision is

relevant to the market value of the firm.

A change in Debt proportion in capital structure will

lead to a corresponding change in the cost of capital as

well as total value of the firm.

In other words, A change in proportion of capital

structure will lead to a corresponding change in Cost

of Capital and Value of the Firm.

Anuj Bhatia](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-63-2048.jpg)

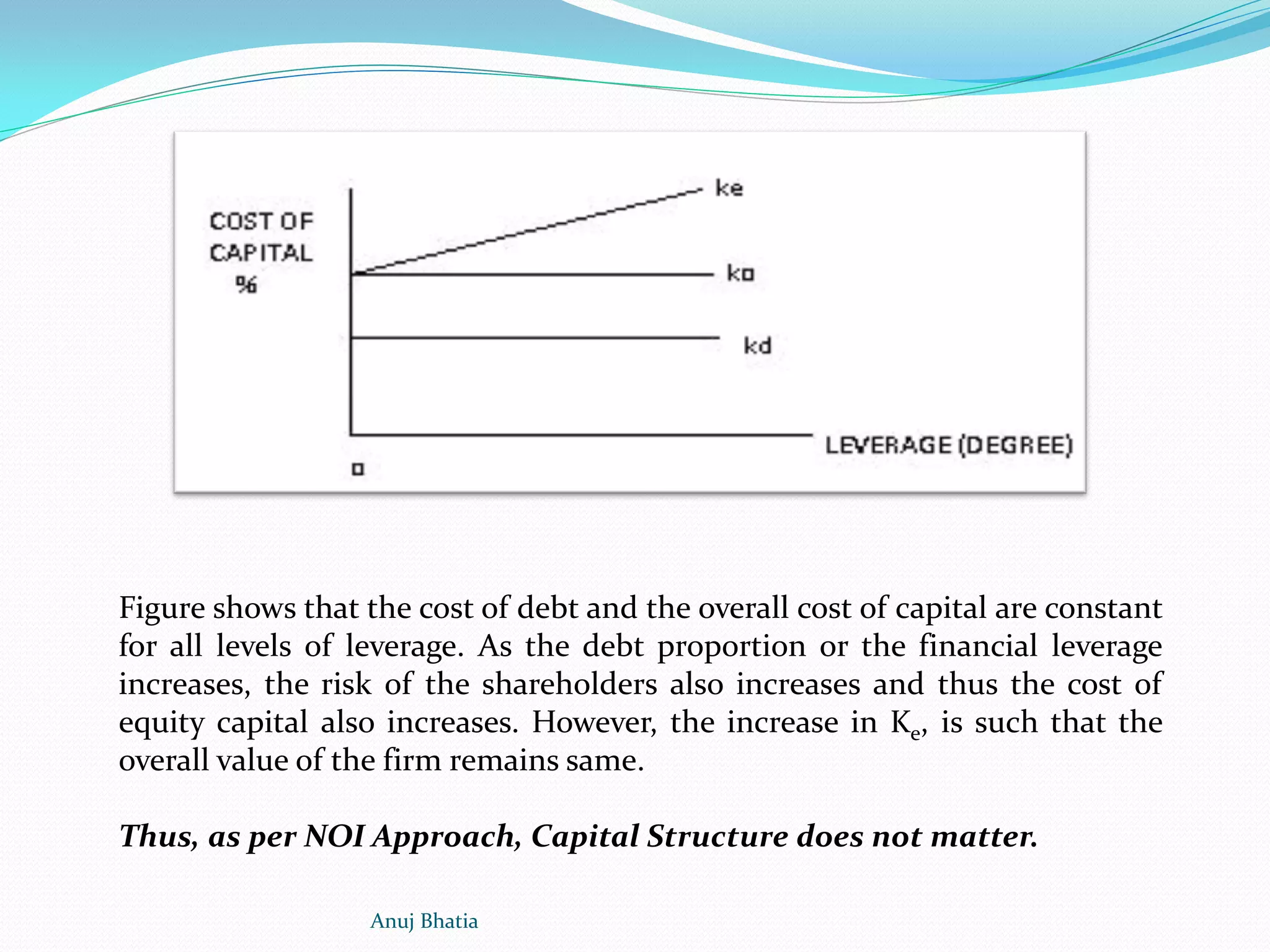

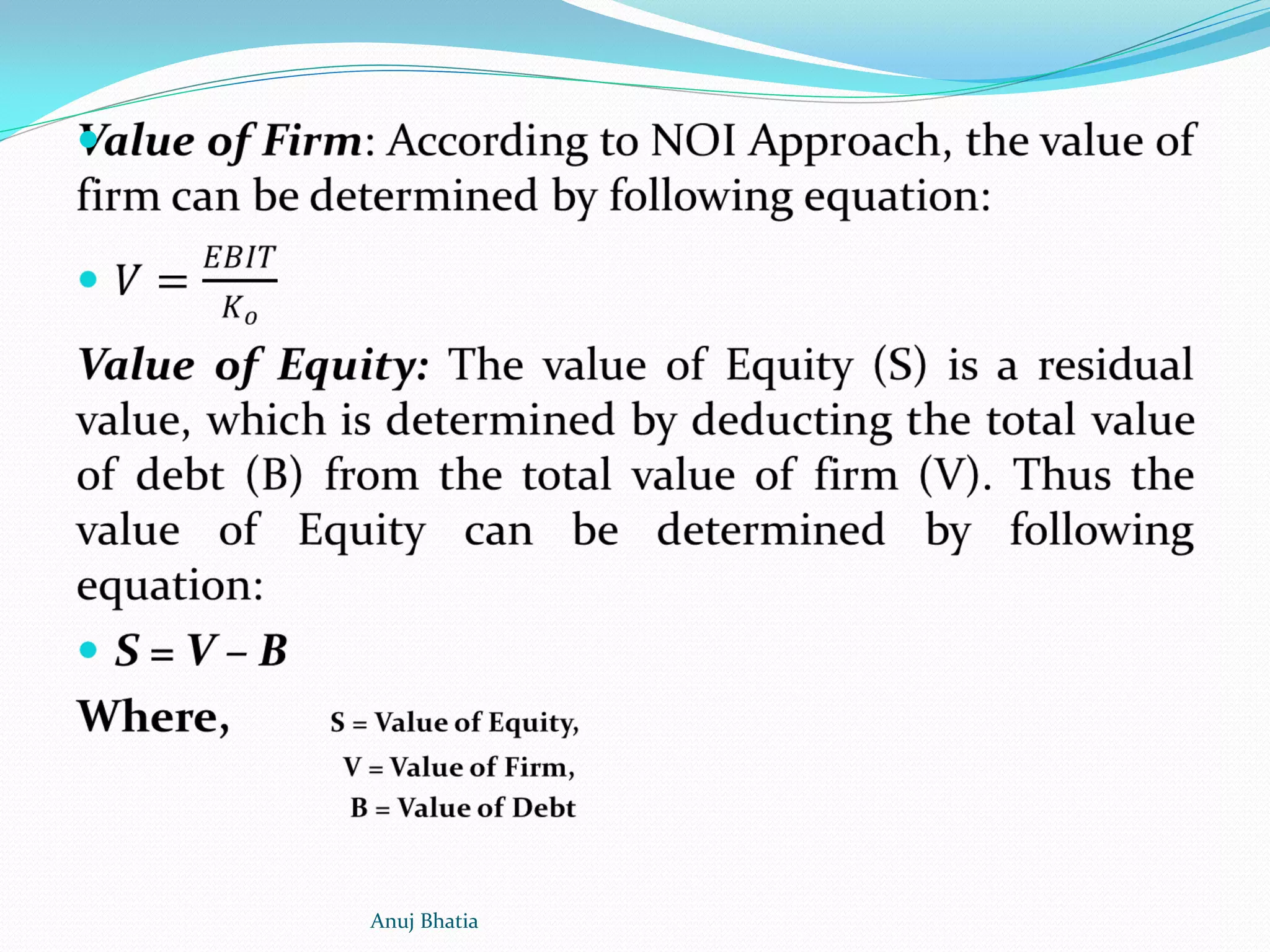

![NET OPERATING INCOME (NOI) APPROACH

[CAPITAL STRUCTURE IS IRRELEVANT, IT DOES

NOT MATTER]

Suggested by David Durand.

Irrelevance of Capital Structure, i.e. there is no

relation between the Capital Structure, Firms Value

and Cost of Capital.

Any change in Debt will not lead to a change in the

Value of the Firm.

They are independent of financial leverage.

Anuj Bhatia](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-66-2048.jpg)

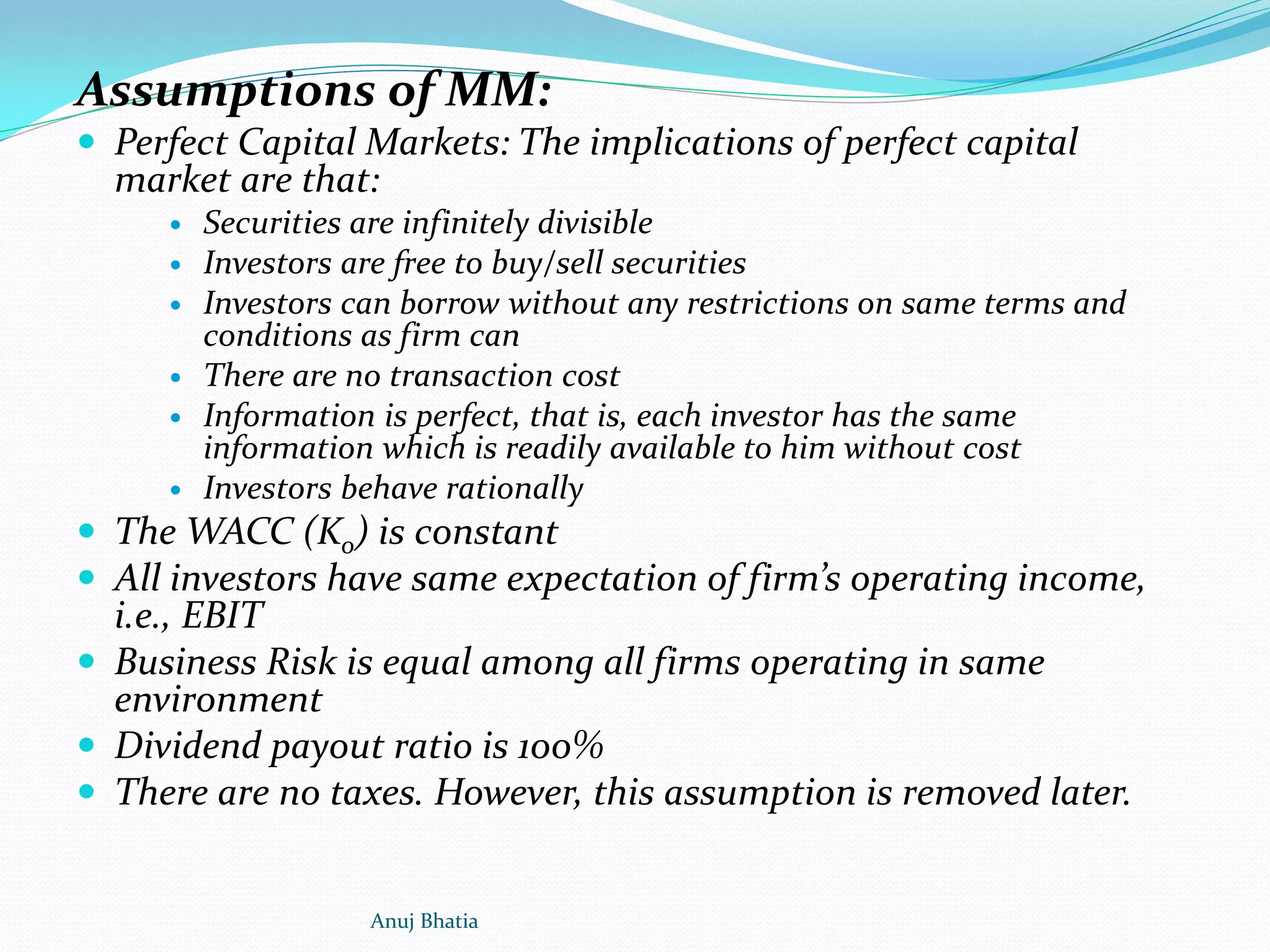

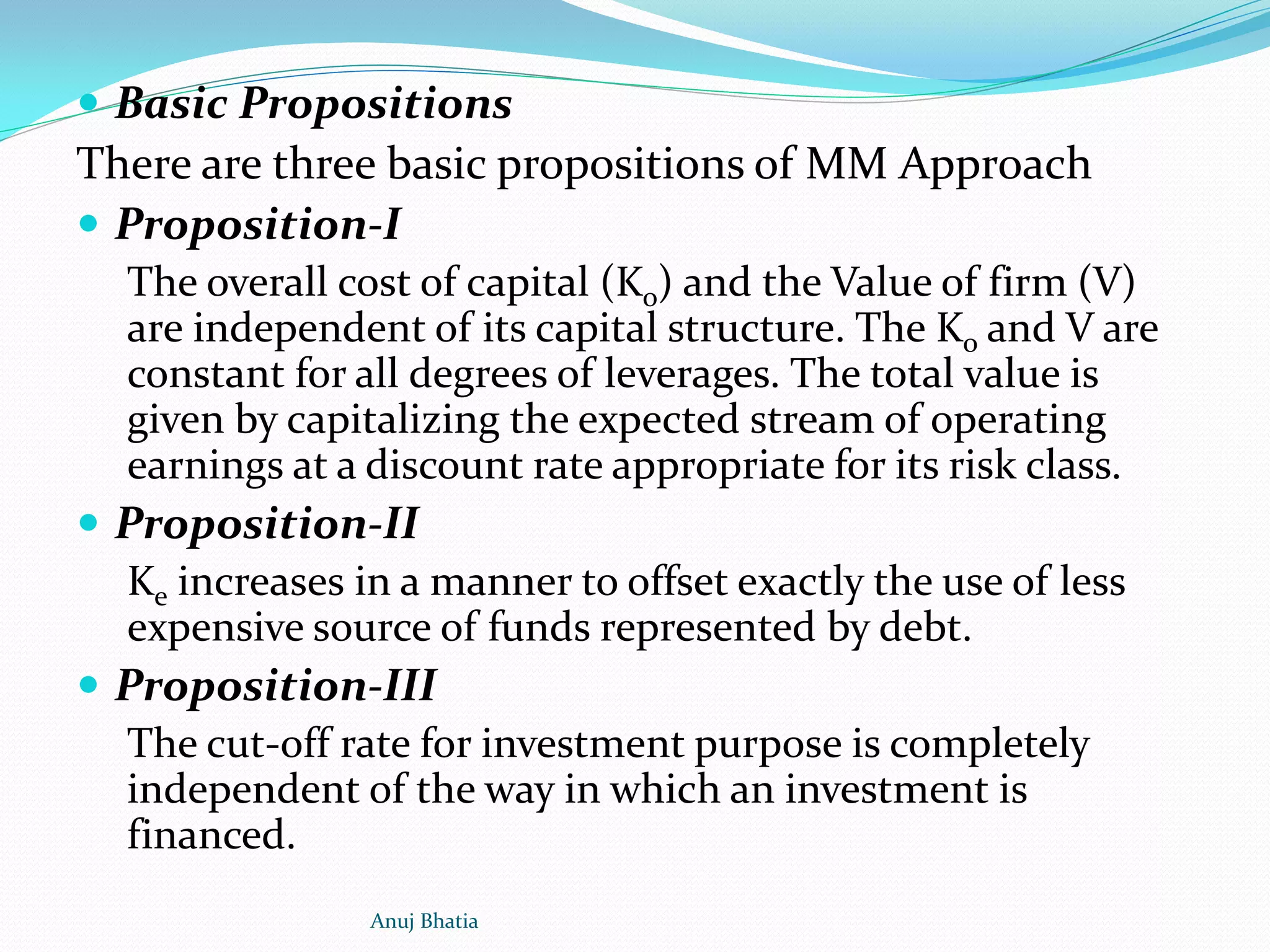

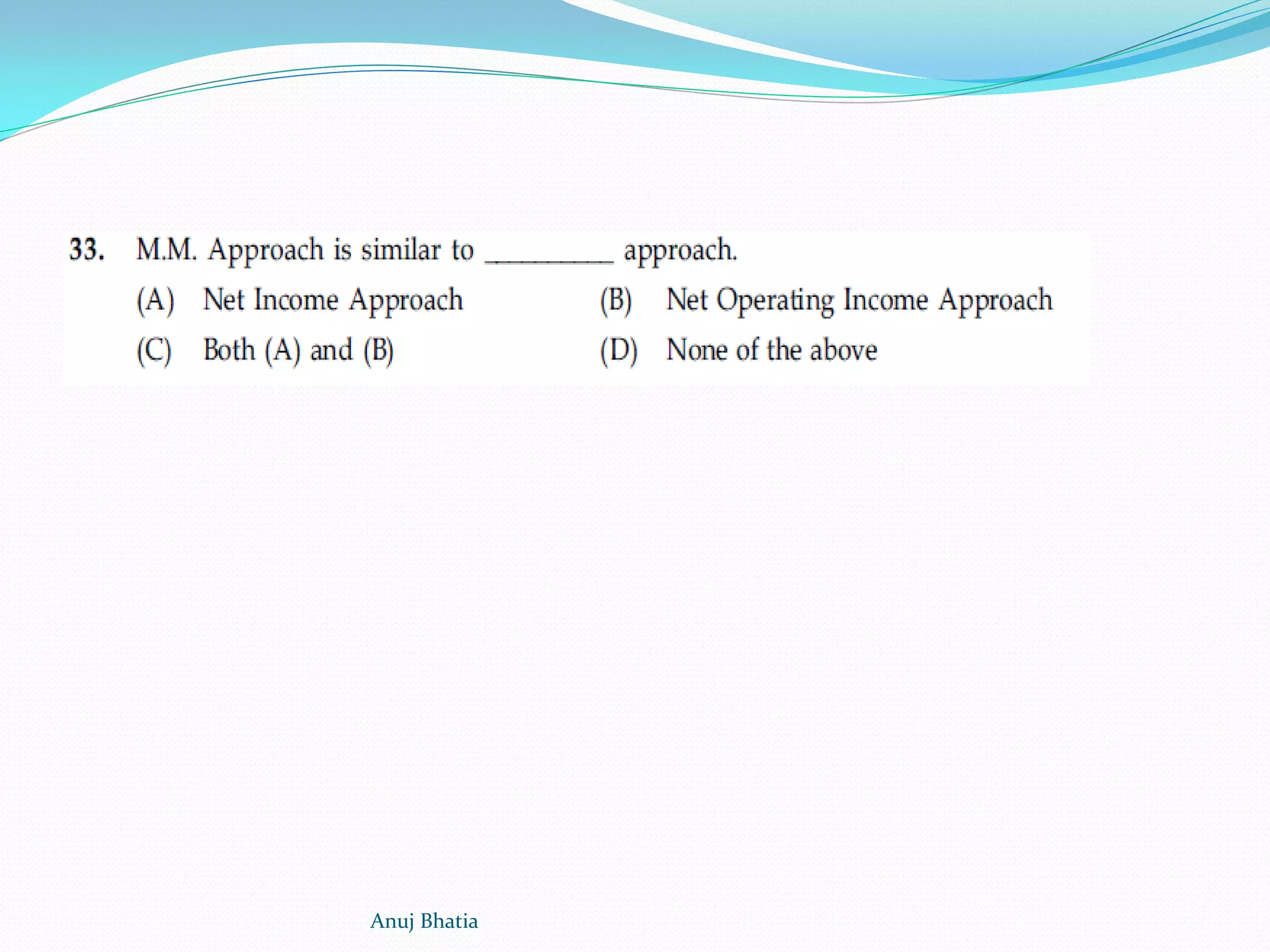

![MODIGLIANI-MILLER (MM) APPROACH

[CAPITAL STRUCTURE IS IRRELEVANT, IT DOES

NOT MATTER]

The MM Approach relating to the relationship

between the capital structure, cost of capital and

valuation is akin to the NOI Approach. The NOI

approach is conceptual and does not provide

operational justification for the irrelevance of the

capital structure. The MM Approach supports the NOI

Approach relating to the independence of the cost of

capital and degree of leverage at any level of debt-

equity ratio.

Anuj Bhatia](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-71-2048.jpg)

![TRADITIONAL APPROACH

[INTERMEDIATE APPROACH]

The traditional capital structure theory has been popularized by Ezra

Solomon. This view is also known as Intermediate Approach, because it

is a compromise between NI and NOI Approach.

According to this Approach, the value of the firm can be increased or

Cost of capital can be reduced by a judicious mix of debt and equity.

Anuj Bhatia](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-76-2048.jpg)

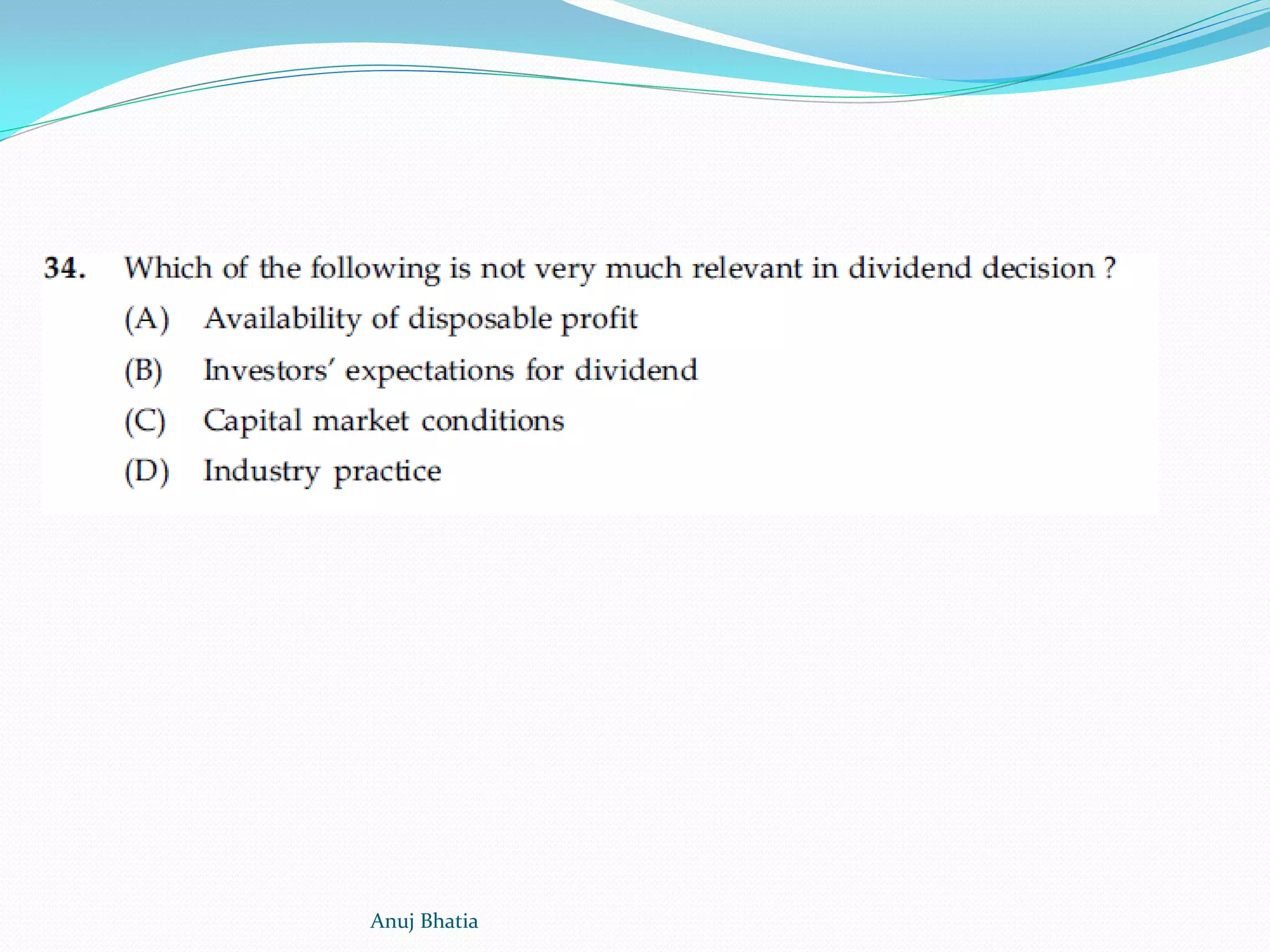

![Walters ModelAssumptions:

1. Finance through retained earnings

2. r and k are constant

3. 100% D/P or 100% retention

4. EPS and DPS are constant

5. The firm has perpetual life

P = [D + (r/k)(E-D)]/ K

Anuj Bhatia](https://image.slidesharecdn.com/financialmanagementfornet-161212165514/75/Financial-management-for-net-140-2048.jpg)