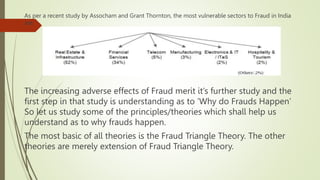

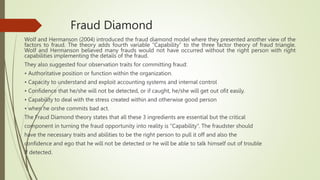

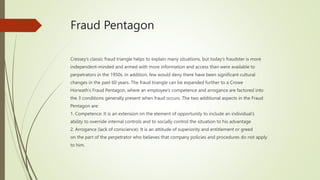

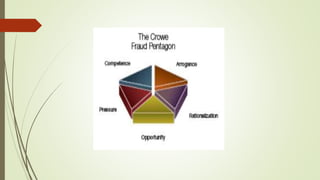

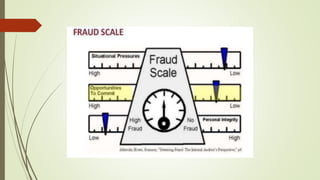

This document discusses various theories related to why frauds occur, including the fraud triangle, fraud diamond, fraud pentagon, fraud scale, and fraud circle. The fraud triangle theory, developed by Donald Cressey, proposes that fraud results from three factors: perceived pressure, perceived opportunity, and rationalization. The fraud diamond theory adds a fourth factor of capability. The fraud pentagon adds the additional factors of competence and arrogance. The fraud scale examines the relationship between situational pressures, opportunities, and personal integrity. Finally, the fraud circle theory recognizes that fraud is omnipresent where money exists.