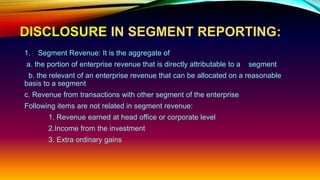

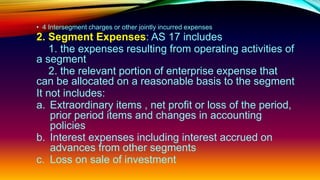

The document discusses segment reporting, which involves reporting the operating segments of a company in its financial statement disclosures. Segment reporting is intended to provide investors and creditors with information about the most important operating units of a company to help them make decisions. It discusses the benefits of segment reporting, such as helping users better understand and assess the performance, risk, and returns of a company. However, there are also challenges to implementing segment reporting, such as allocating common costs and maintaining comparability. The document then provides details on the various components that must be disclosed in segment reporting.