This document provides an overview of key concepts in financial management including:

- The meaning and definitions of finance, business finance, financial management, and their objectives.

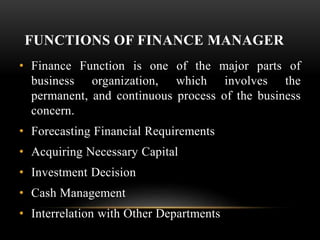

- The traditional and modern approaches to financial management, including the functions of finance managers.

- The importance of concepts like agency theory, corporate governance, and corporate social responsibility in modern corporations where ownership is separated from management.

- Key investment, financing, and asset management decisions that financial managers are responsible for.