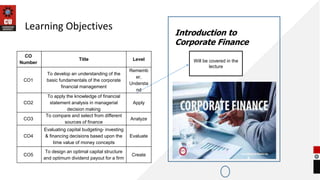

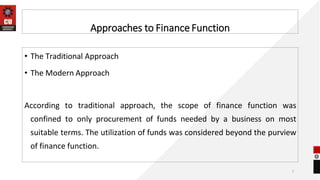

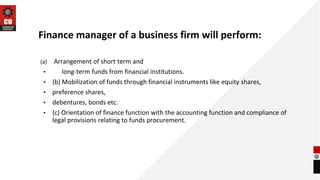

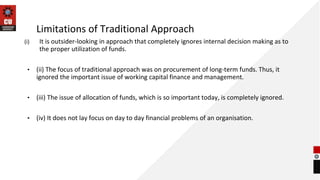

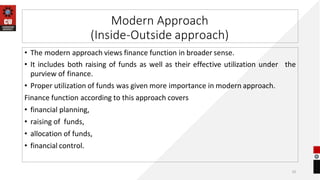

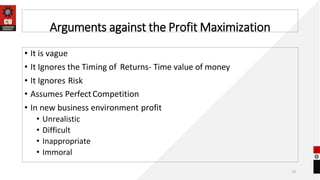

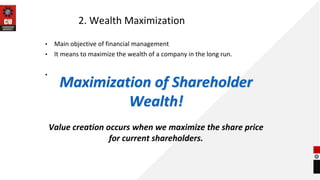

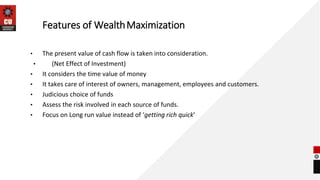

This document provides an introduction to corporate finance. It begins with learning objectives that focus on developing an understanding of corporate financial management fundamentals, applying financial statement analysis, comparing financing sources, and evaluating capital budgeting decisions. It then defines finance, discusses the traditional and modern approaches to the finance function, and outlines the objectives of financial management including profit maximization and wealth/shareholder maximization. Key differences between profit maximization and wealth maximization are also highlighted.