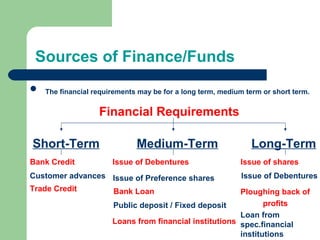

The document defines financial management and discusses its scope and functions. Under the traditional approach, the scope of finance is restricted to procuring funds, while the modern approach covers both acquiring and allocating funds efficiently. The key functions of financial management are investment decisions, financing decisions, and dividend decisions. Investment decisions involve capital budgeting and working capital management. Financing decisions determine the optimal debt-equity ratio. Dividend decisions balance paying dividends to shareholders with retaining profits for reinvestment.