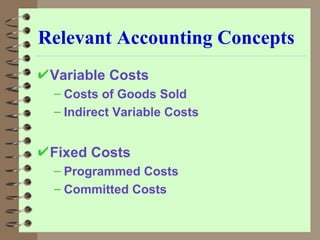

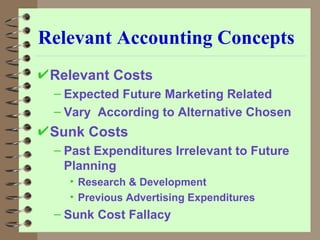

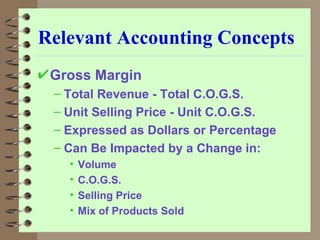

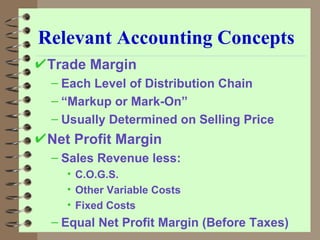

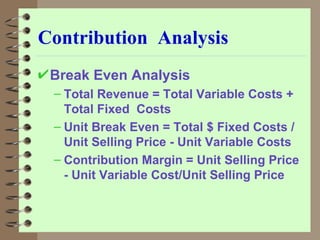

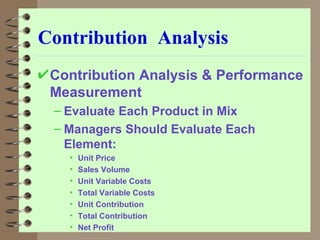

The document discusses key financial concepts relevant to marketing management including variable costs, fixed costs, contribution margin, break-even analysis, and pro-forma income statements. It explains how to use contribution analysis to evaluate alternative marketing strategies and product mixes. It also covers concepts like gross margin, net profit margin, liquidity, working capital, and operating leverage.