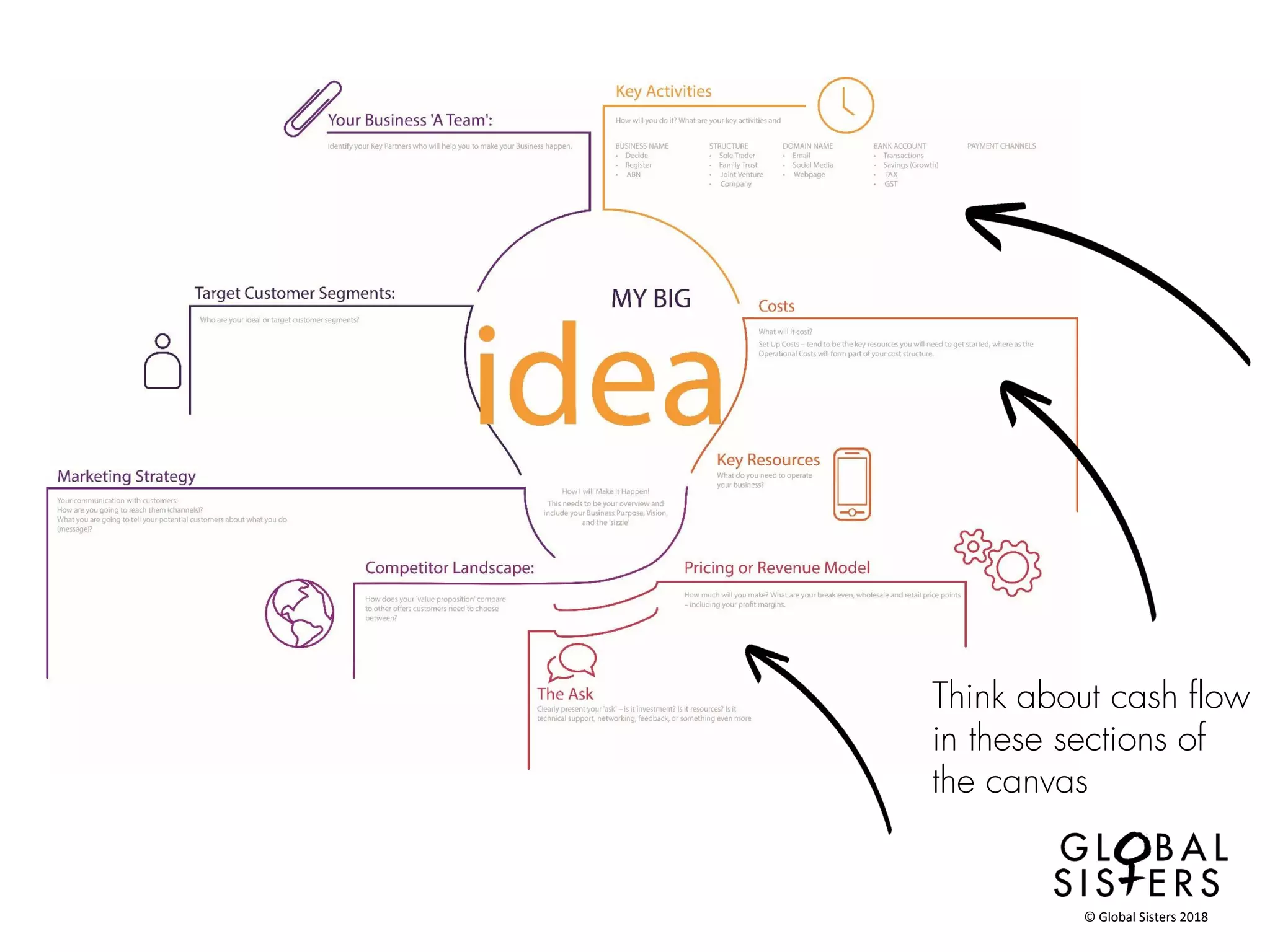

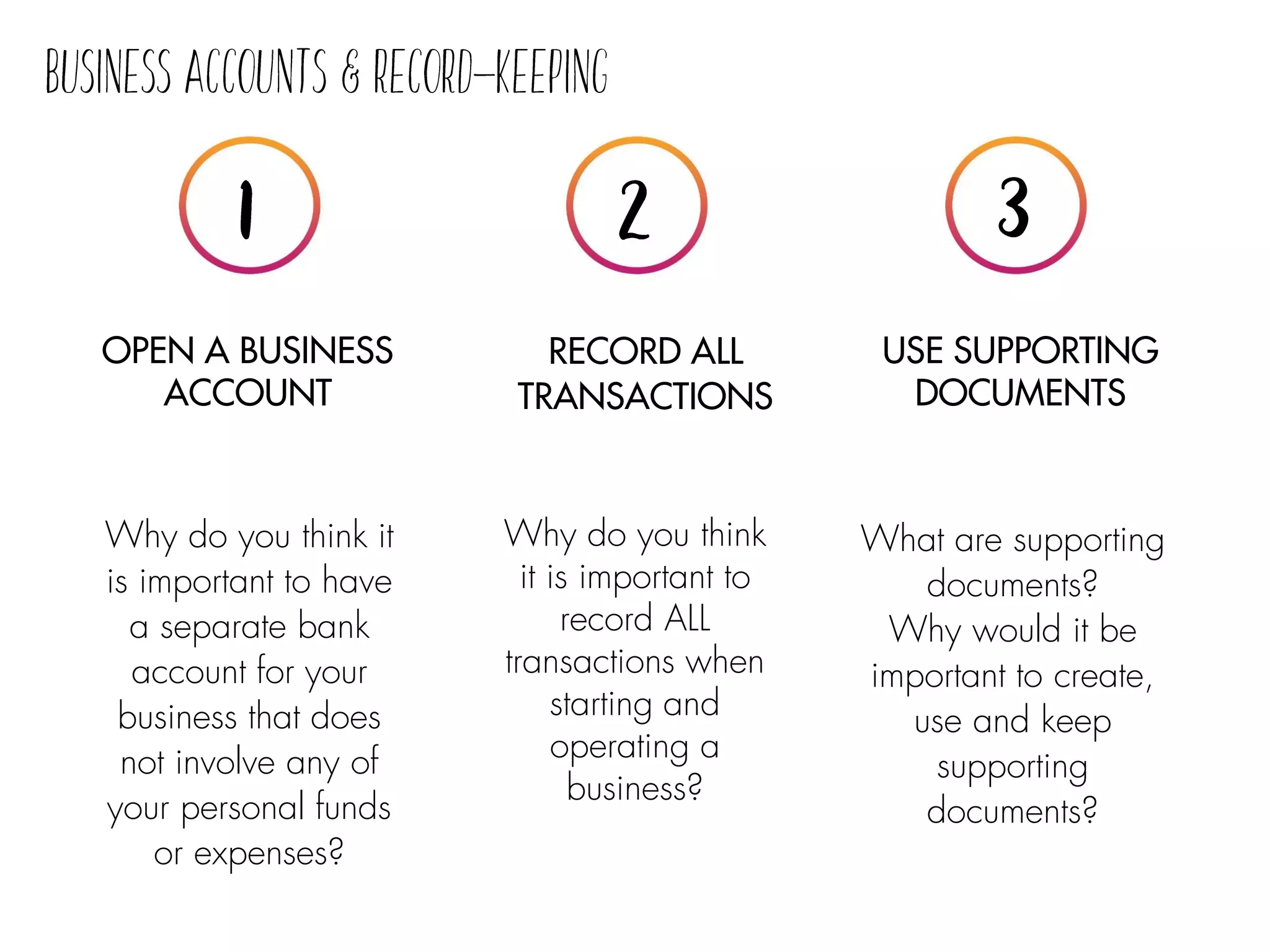

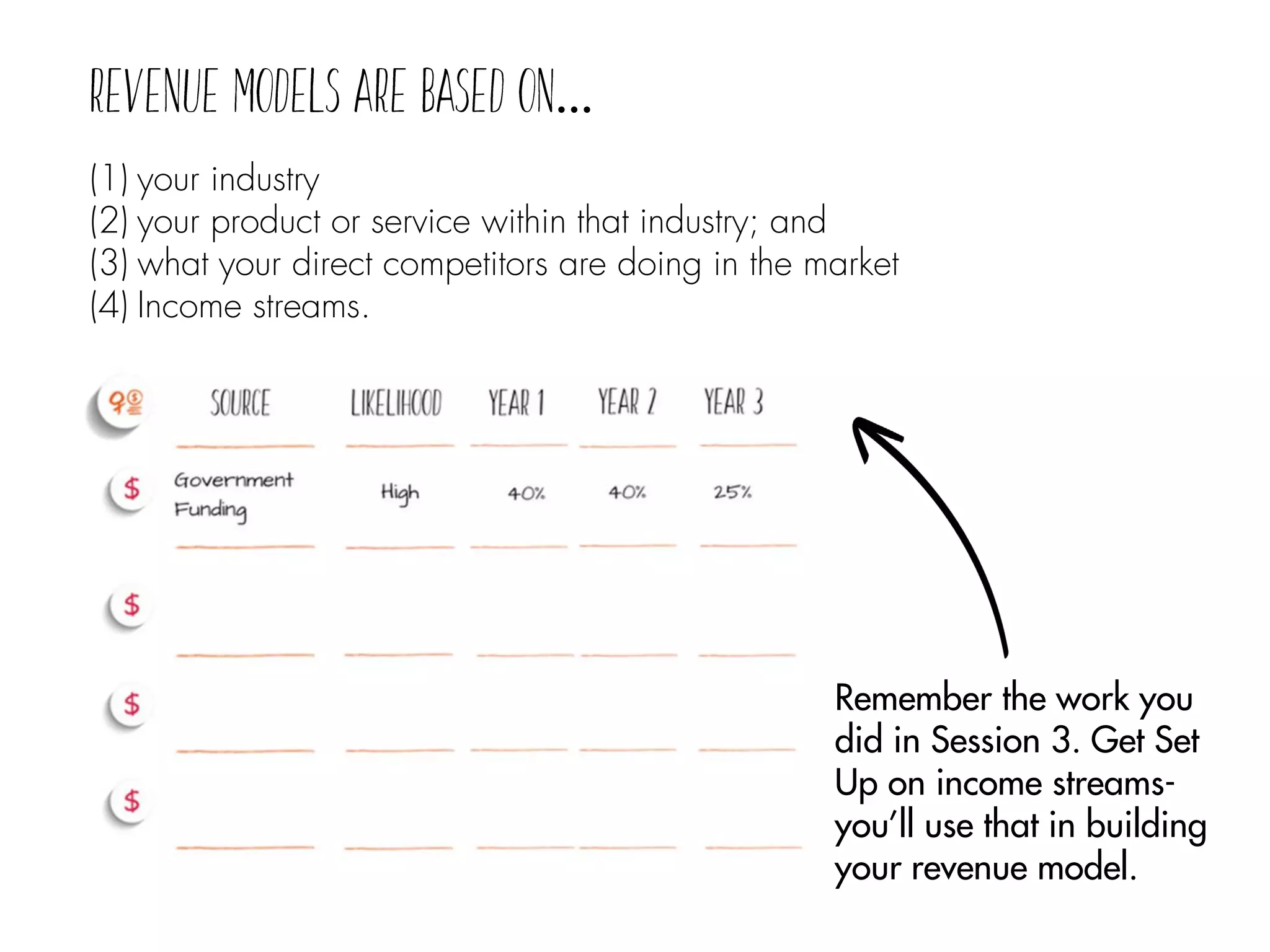

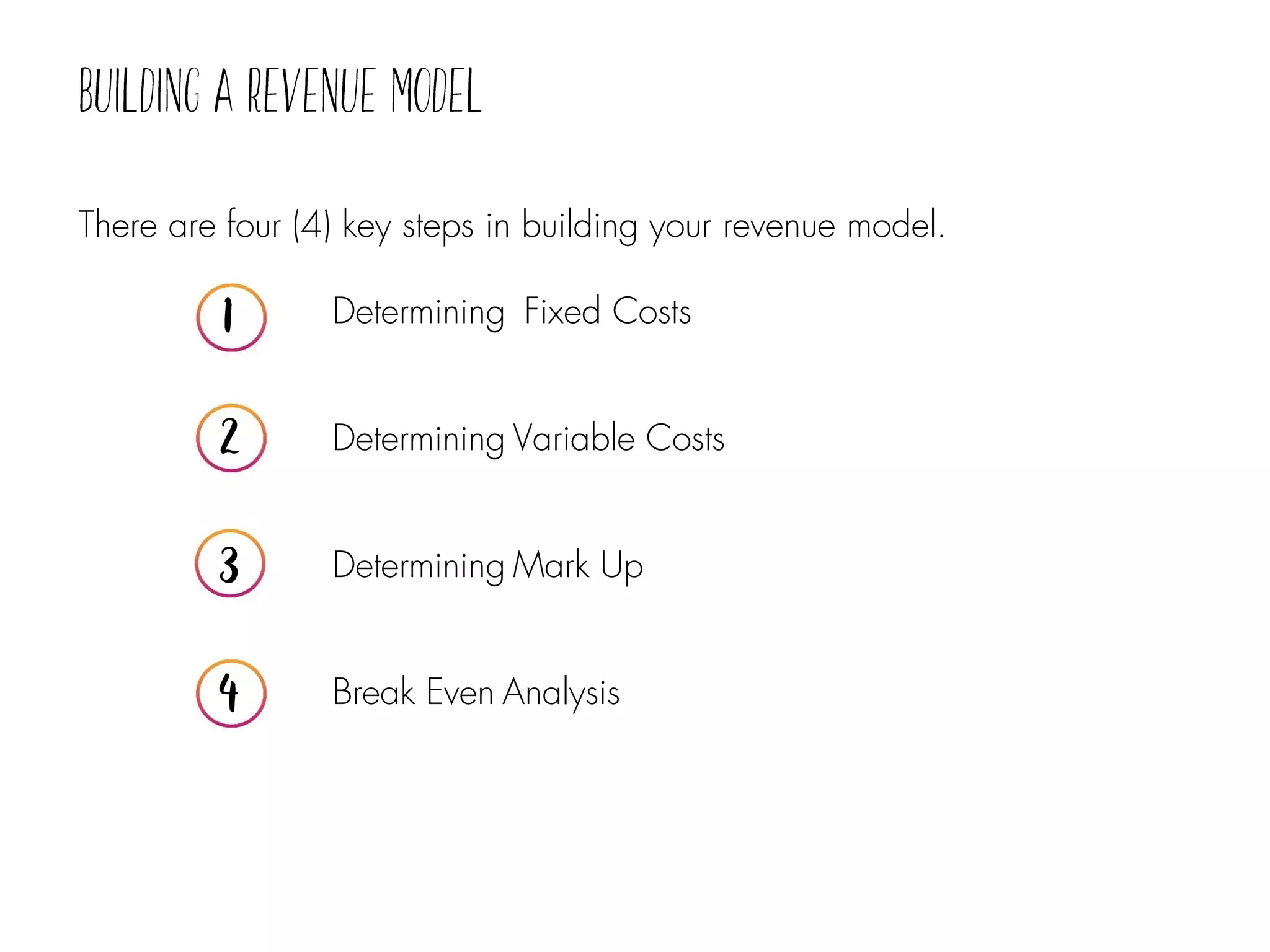

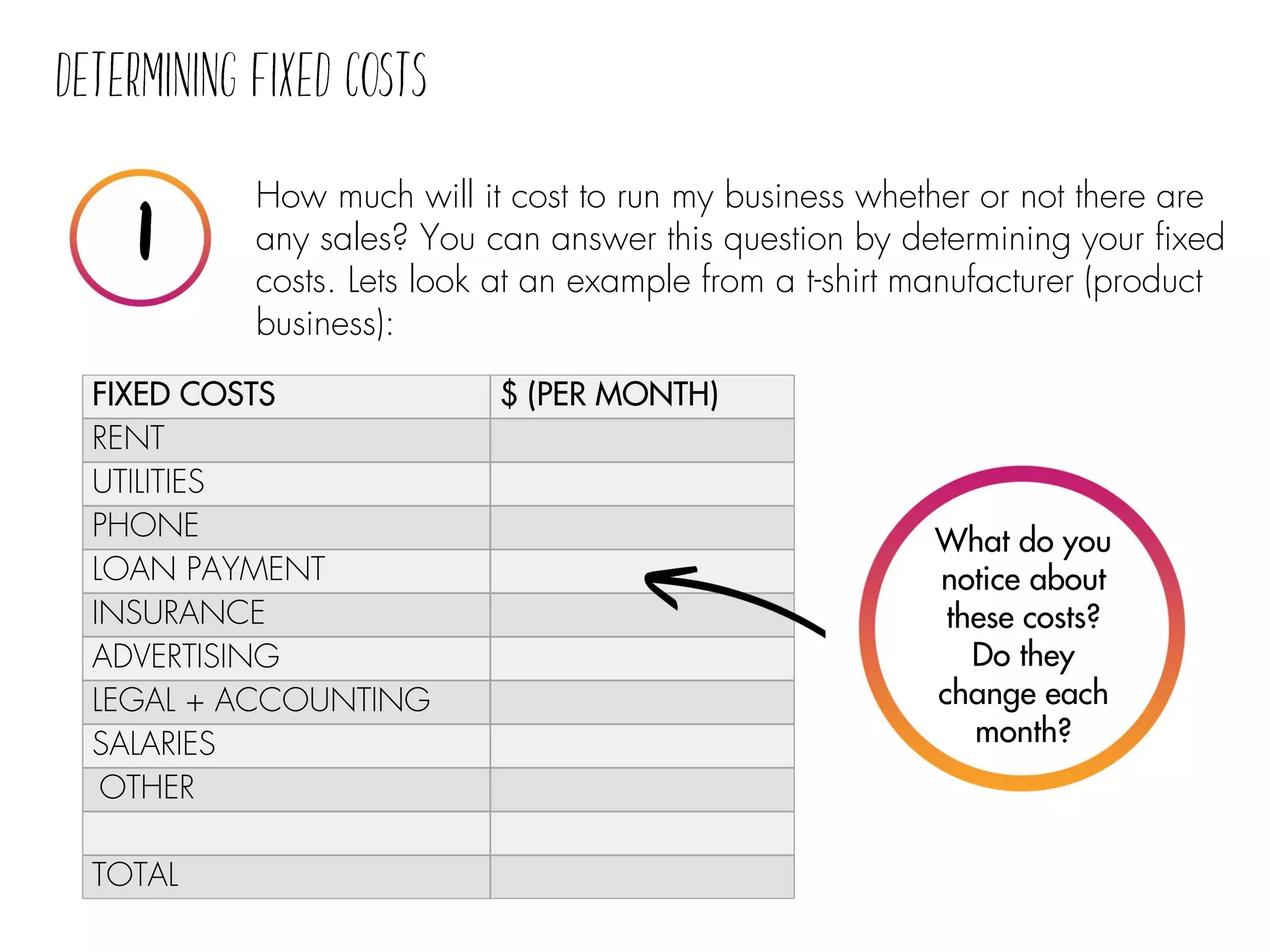

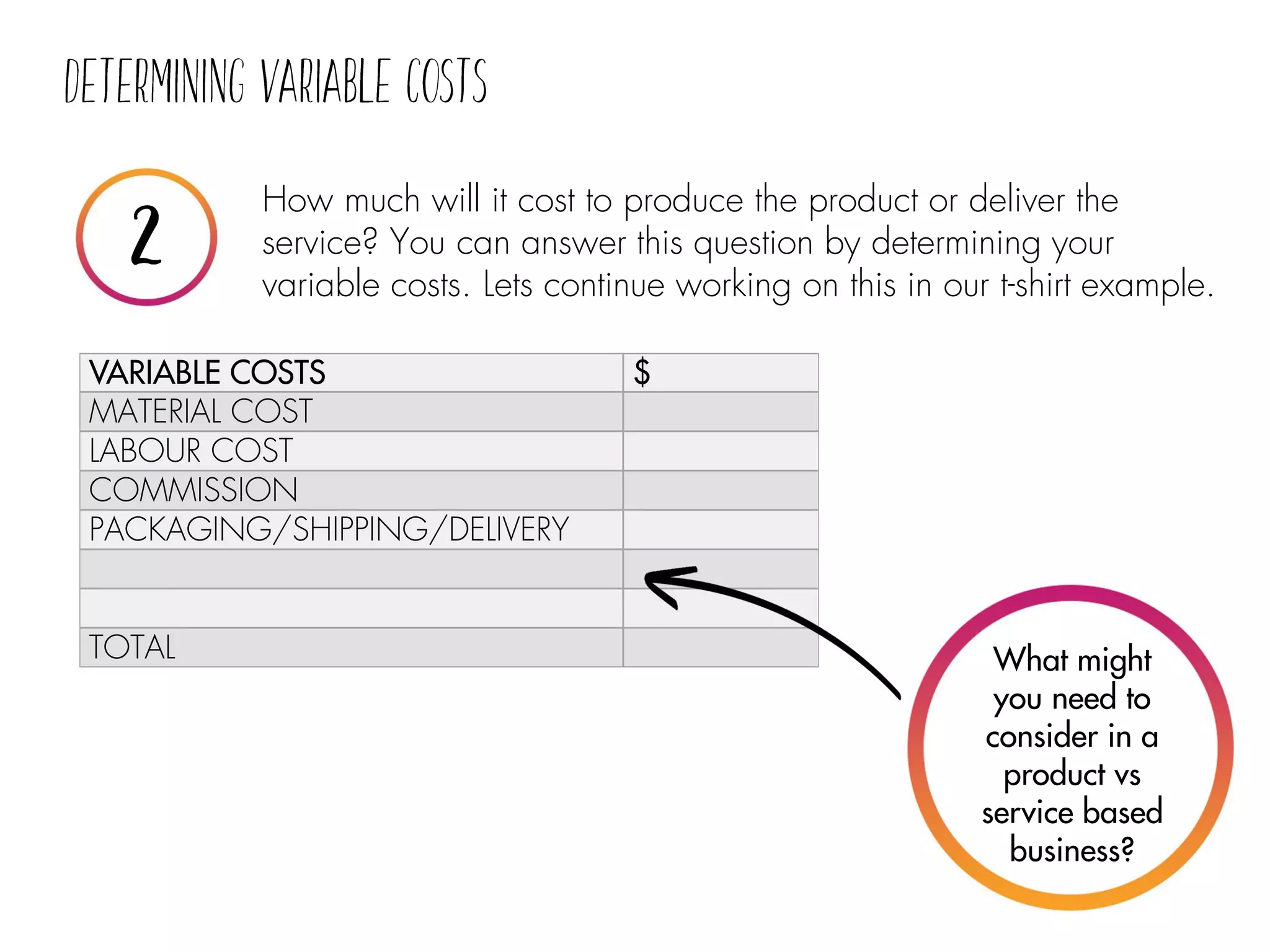

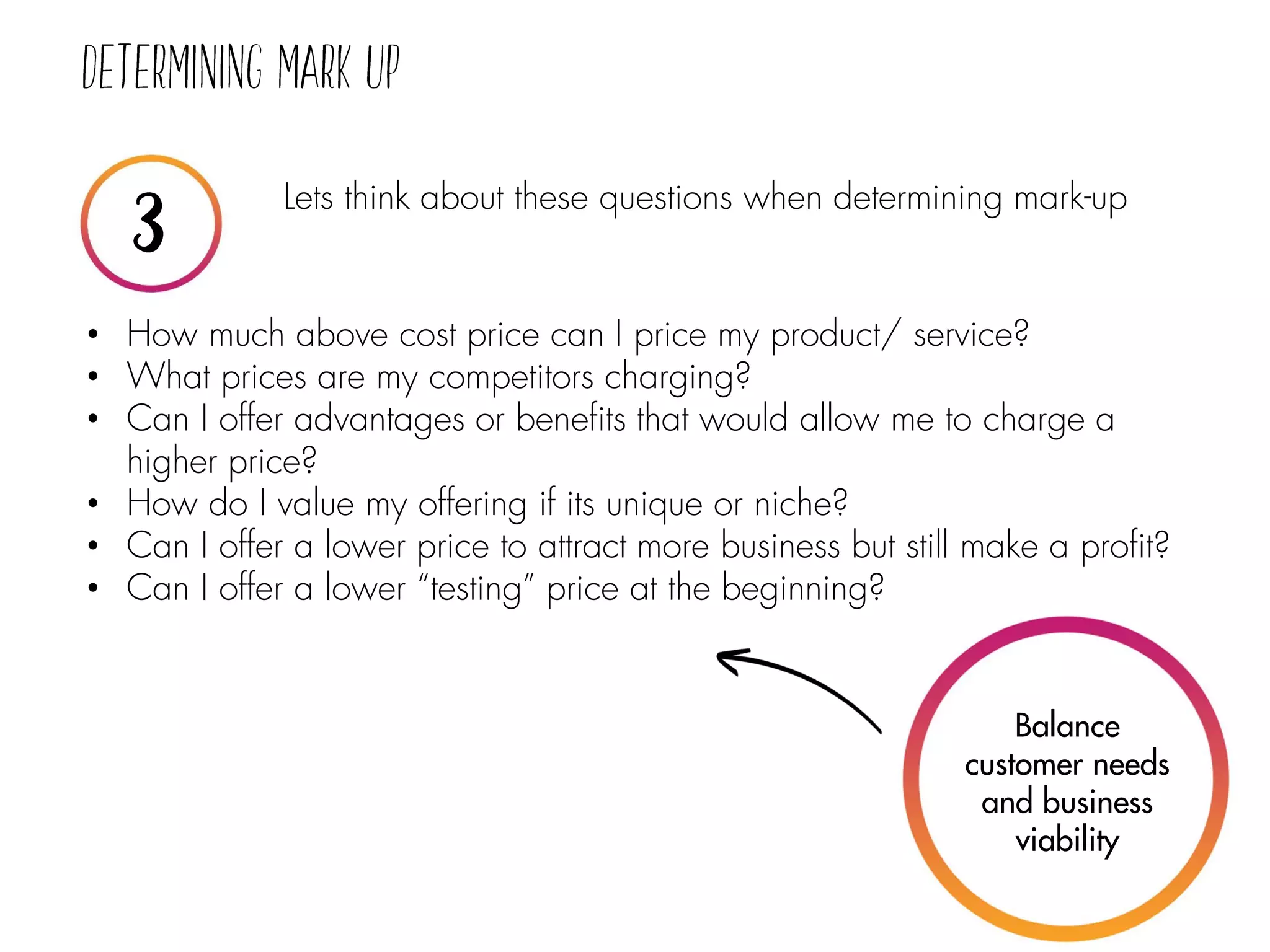

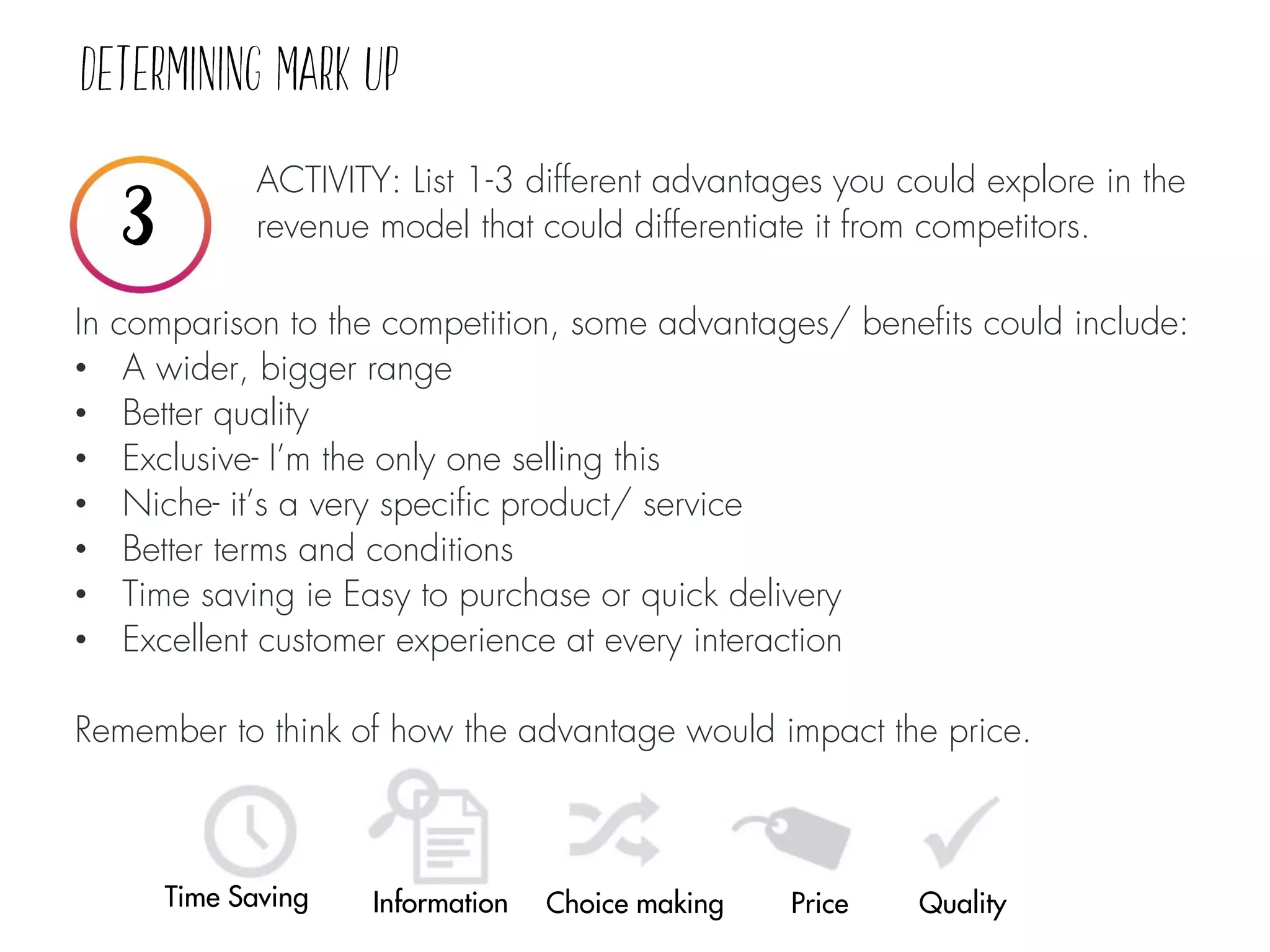

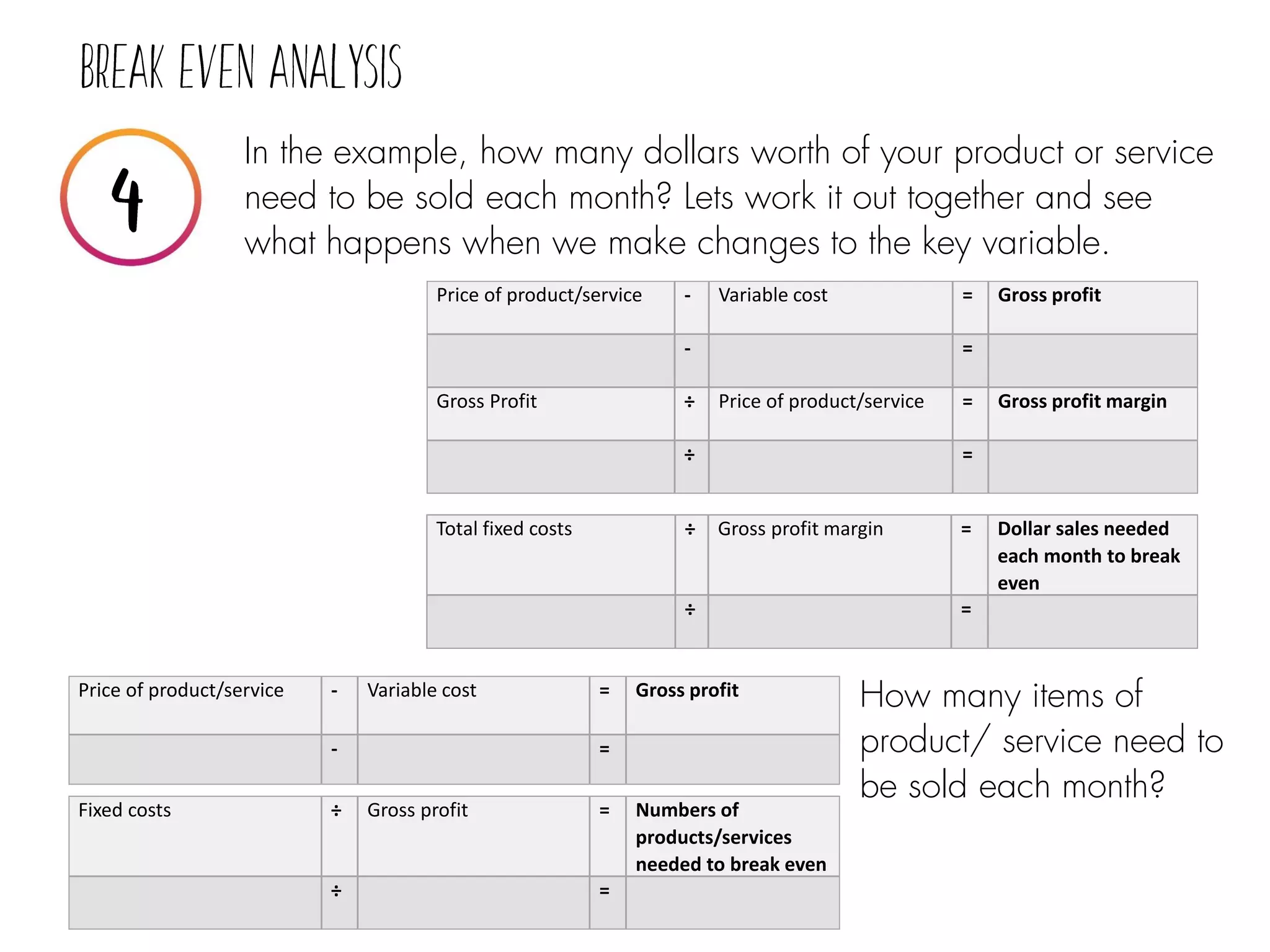

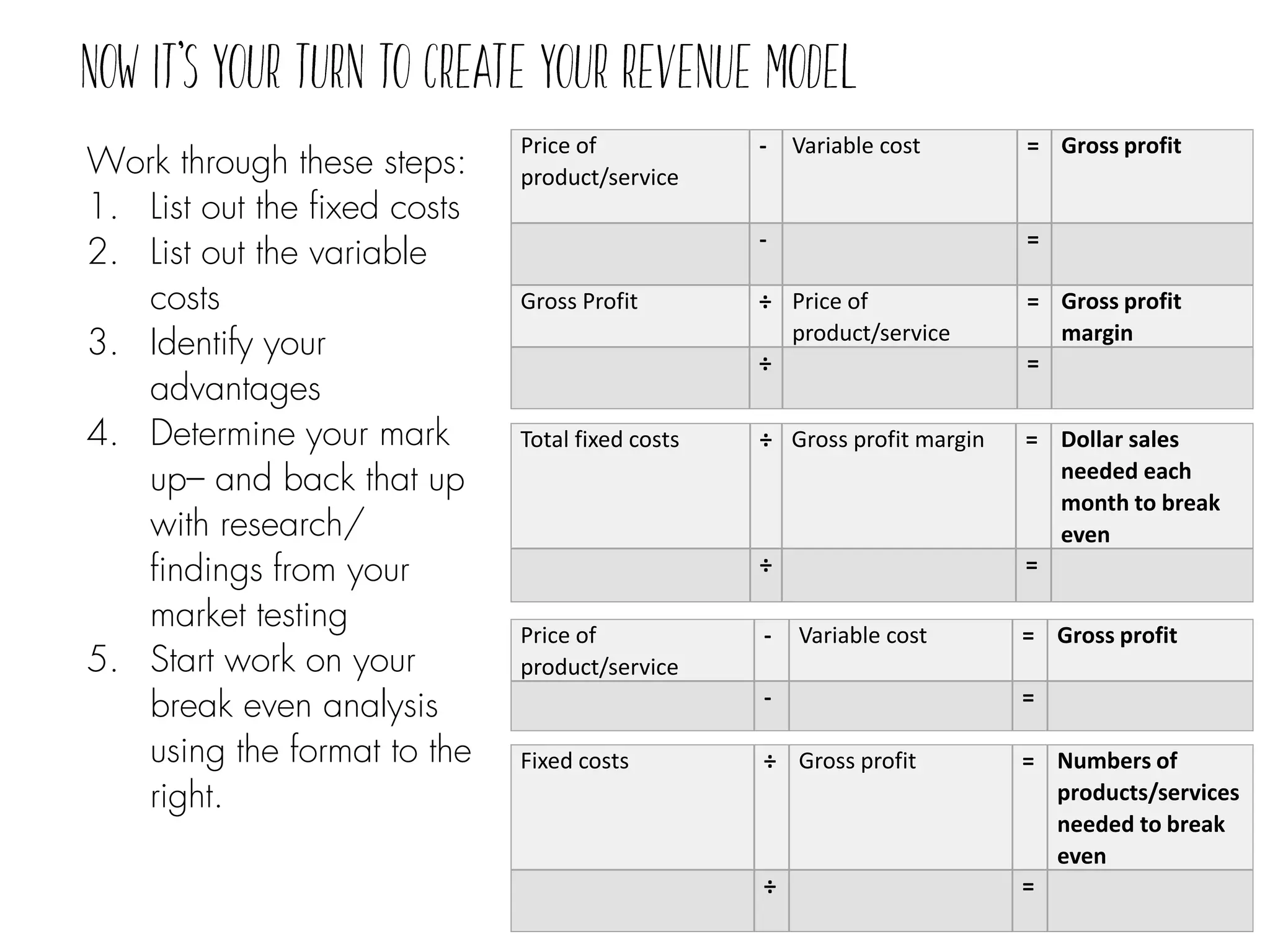

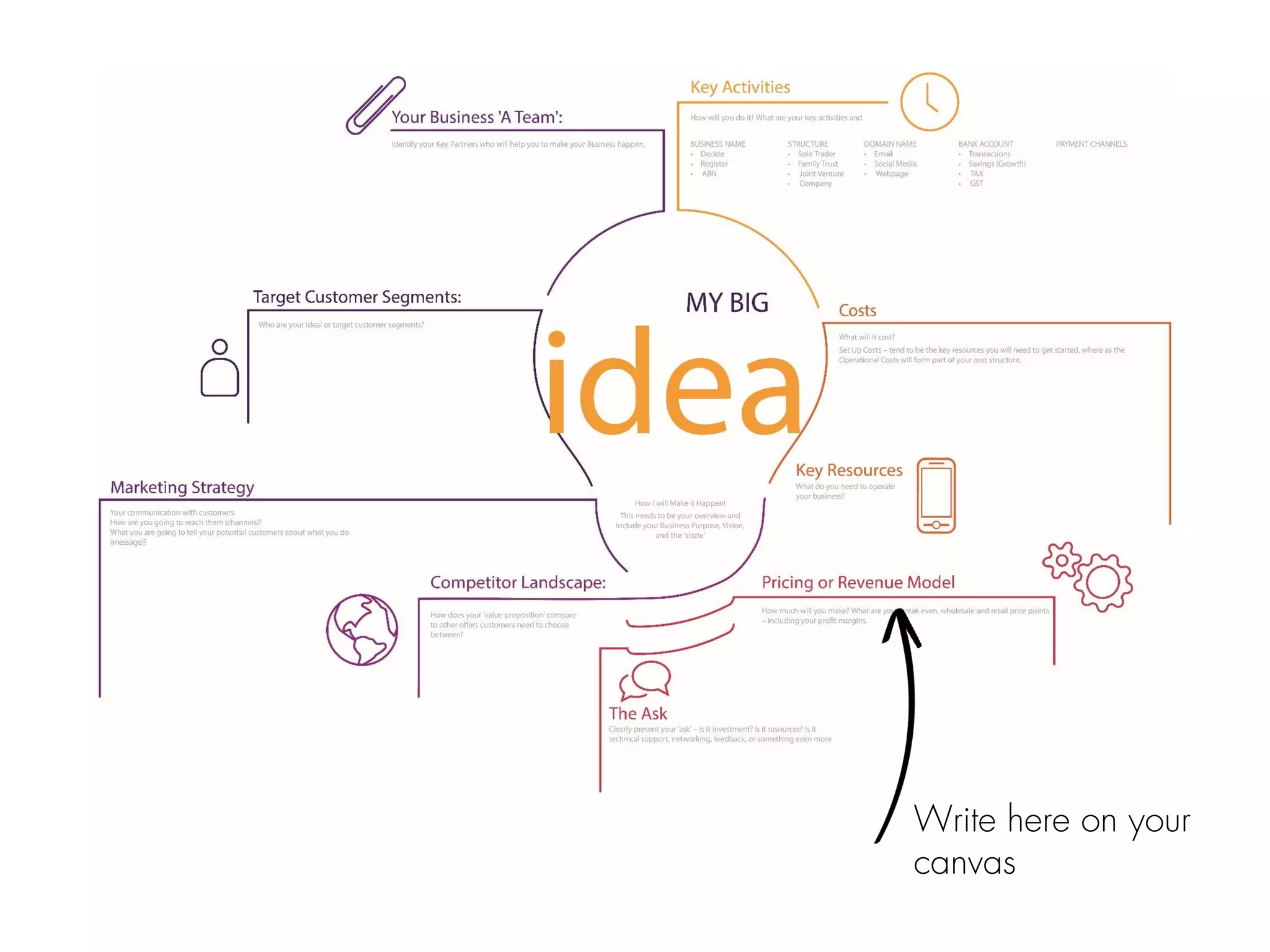

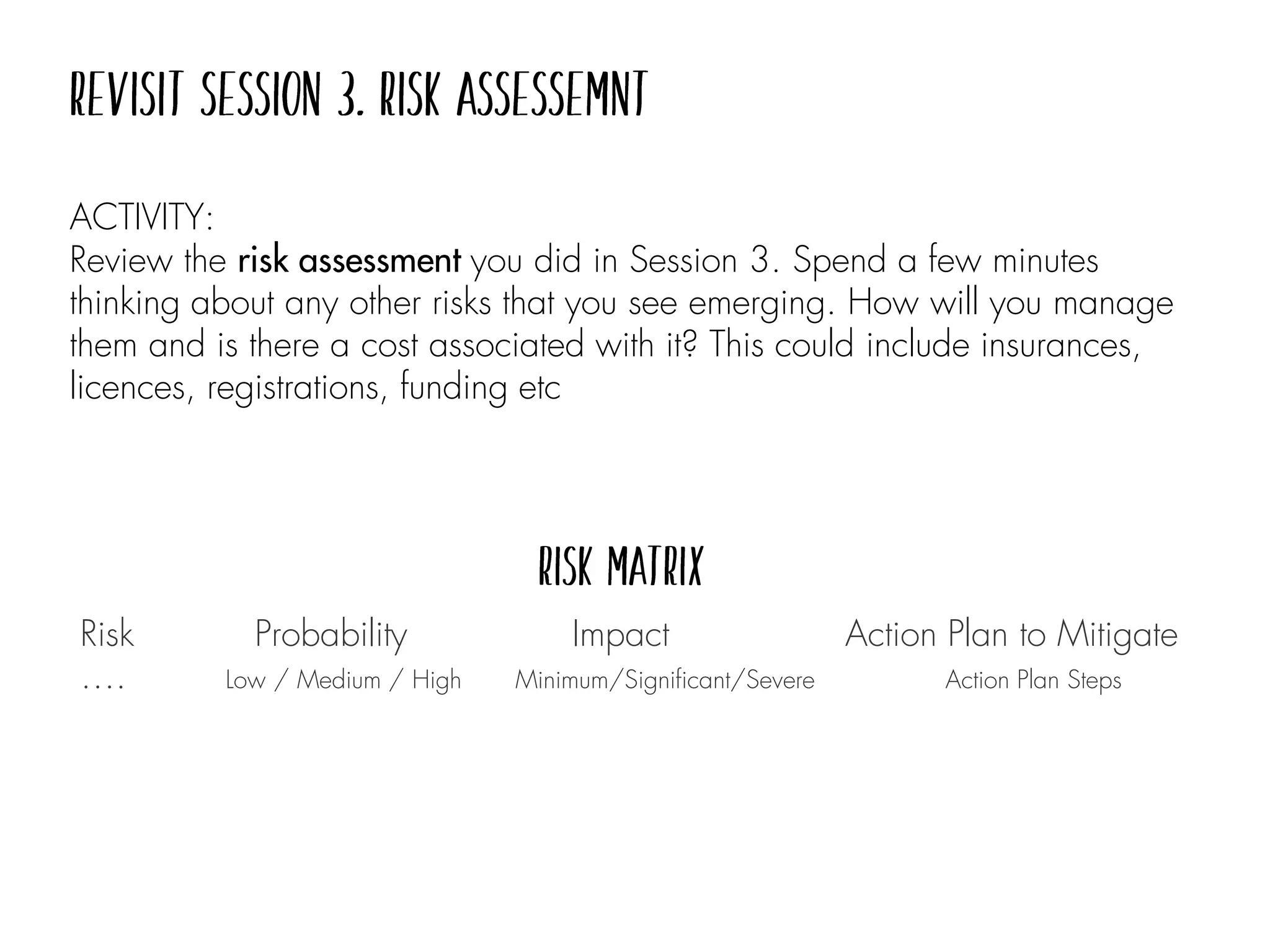

The document focuses on managing cash flow in a business by understanding income, expenses, and fixed versus variable costs, while also addressing emotional attitudes towards money. It emphasizes the creation of a revenue model through analysis of costs, pricing strategies, and customer needs, and encourages separating personal and business finances for better tracking. Additional activities are provided to help identify money habits and risks connected with managing business finances.