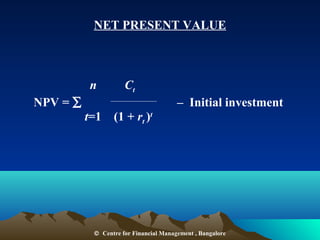

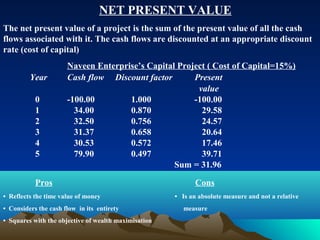

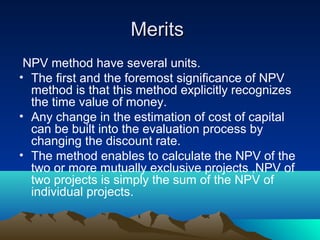

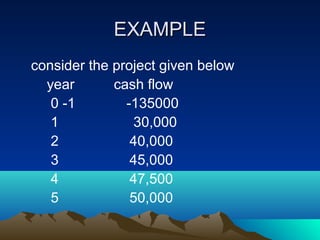

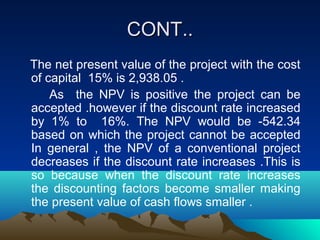

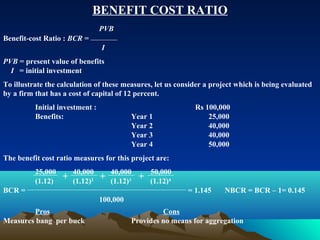

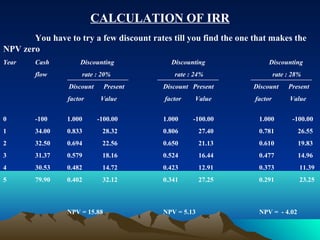

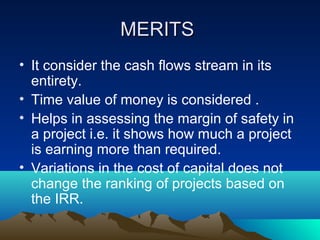

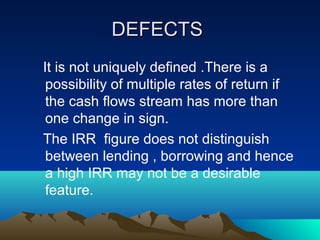

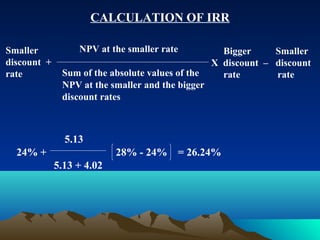

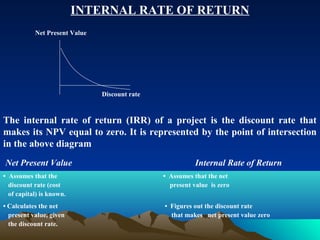

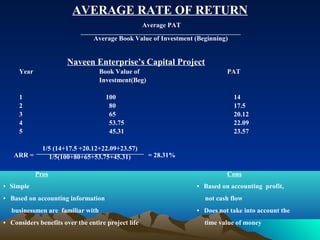

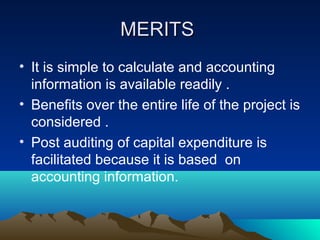

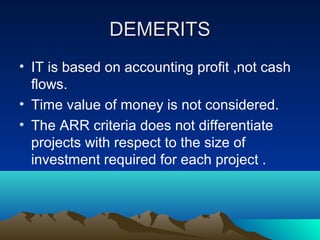

This document discusses various evaluation techniques for assessing investment projects. It describes discounted criteria such as net present value (NPV), internal rate of return (IRR), and benefit-cost ratio (BCR), as well as non-discounted criteria like average rate of return (ARR) and payback period. NPV is defined as the sum of the present values of future cash flows from a project, and the decision rule is to accept projects with a positive NPV. IRR is the discount rate that makes the NPV equal to zero. BCR measures the present value of returns relative to the initial investment. The document also discusses the merits, defects, and calculations of each technique.