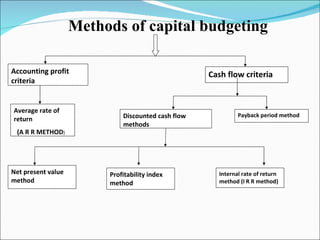

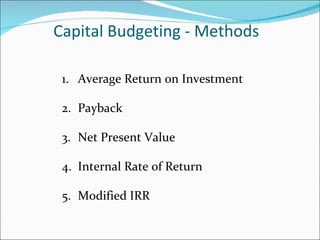

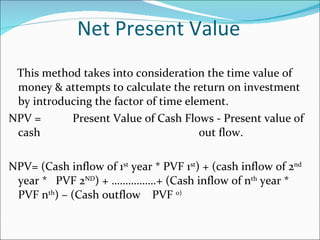

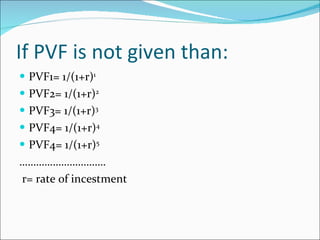

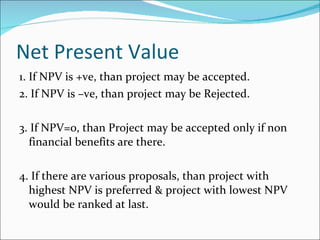

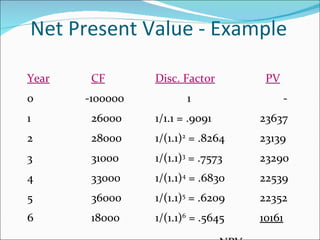

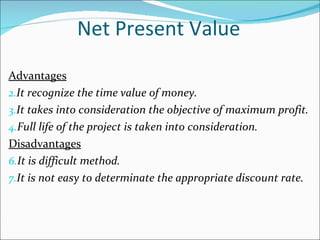

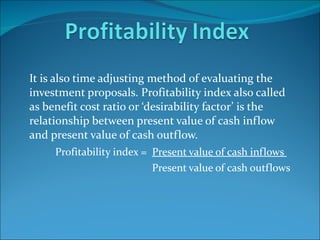

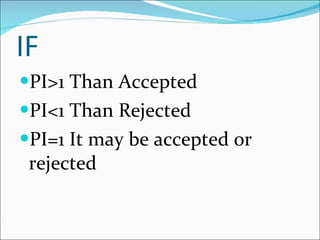

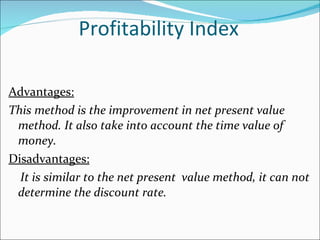

The document discusses various capital budgeting methods used to evaluate investment projects. It describes the net present value (NPV) and profitability index (PI) methods. For NPV, a project is accepted if NPV is positive and rejected if negative. PI is the ratio of present value of cash inflows to outflows; a project is accepted if PI is greater than 1 and rejected if less than 1. An example NPV calculation is shown. The document also lists advantages and disadvantages of the NPV method.