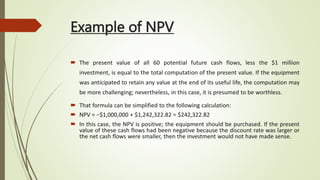

This document discusses various capital budgeting techniques used to evaluate investment projects. It begins by defining capital budgeting and explaining that there are discounted and non-discounted methods. Some of the key methods discussed include net present value (NPV), internal rate of return (IRR), payback period, and profitability index (PI). Formulas for calculating each method are provided along with examples to illustrate how they are applied. The document compares the various techniques and discusses their advantages and limitations.