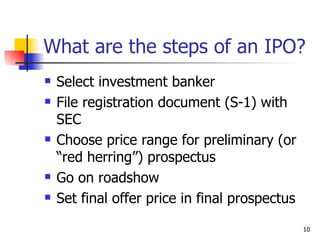

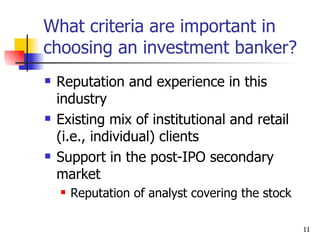

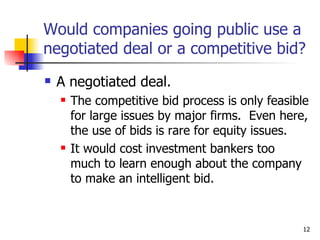

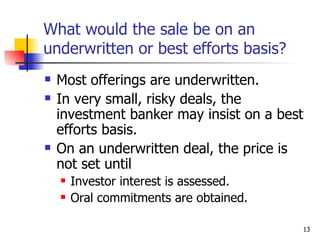

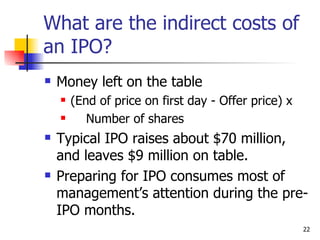

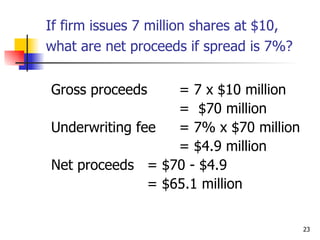

The document provides an overview of key topics related to initial public offerings (IPOs) and investment banking. It discusses the IPO process, including selecting an investment banker, filing with the SEC, determining pricing, and conducting a roadshow. It also covers costs of IPOs, long-term returns, and alternatives to public offerings like private placements, rights offerings, and going private transactions.