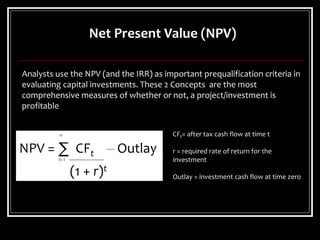

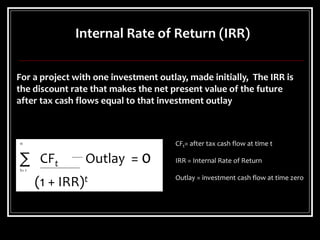

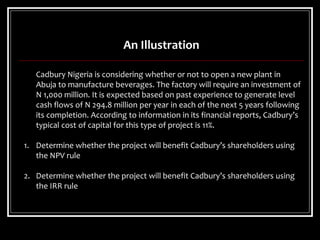

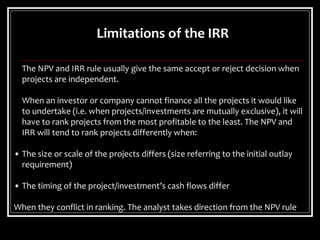

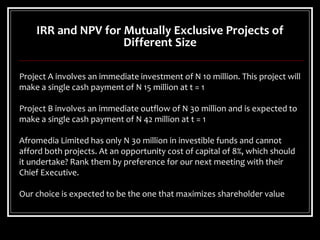

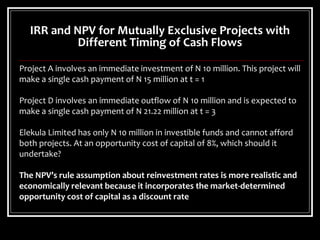

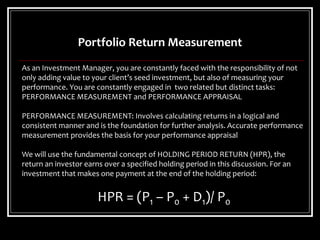

This document discusses key concepts in discounted cash flow analysis including net present value (NPV) and internal rate of return (IRR). It provides examples of how to calculate NPV and IRR for investment projects and explains how to use NPV and IRR to evaluate whether projects will benefit shareholders. It also discusses limitations of IRR for ranking mutually exclusive projects and introduces the concept of portfolio return measurement using holding period return and money-weighted rate of return.