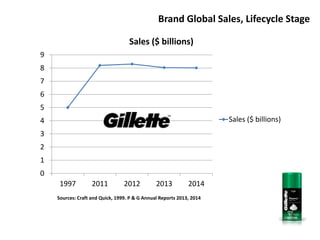

- Gillette's marriage with P&G is one-sided, with Gillette receiving fewer benefits than P&G. Gillette needs to rethink its strategy to grow its shrinking market share.

- Maintaining its brand image through sports sponsorships works well, but Gillette must also use social media marketing to design new products.

- Increasing its presence in the women's market using P&G's expertise can help Gillette grow, but it needs to focus on developing less complex products.