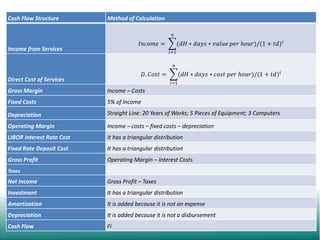

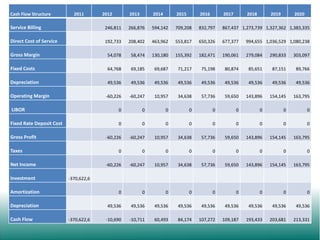

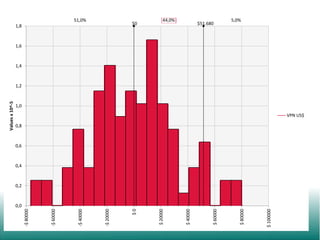

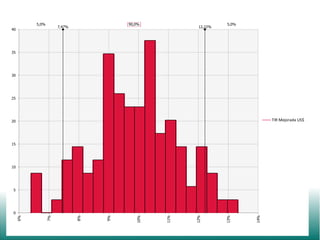

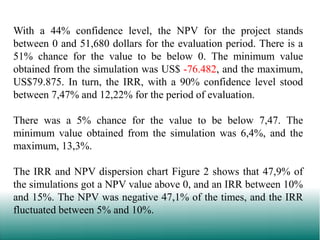

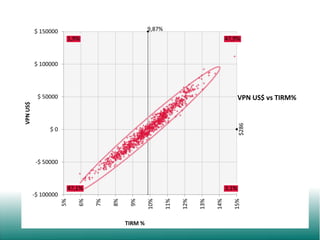

This document presents a risk assessment of an investment project to build a financial complex and business center at Tecnológico de Antioquia University. A Monte Carlo simulation was used to model the net present value and internal rate of return based on the variability of estimated cash flows. The simulation found a 44% chance that the NPV is between $0-51,680 and a 51% chance it is below $0, with an IRR between 7.47%-12.22%. While the financial assessment is positive, the project's main benefit is providing students, teachers and entrepreneurs experience with financial transactions, negotiations and simulations.