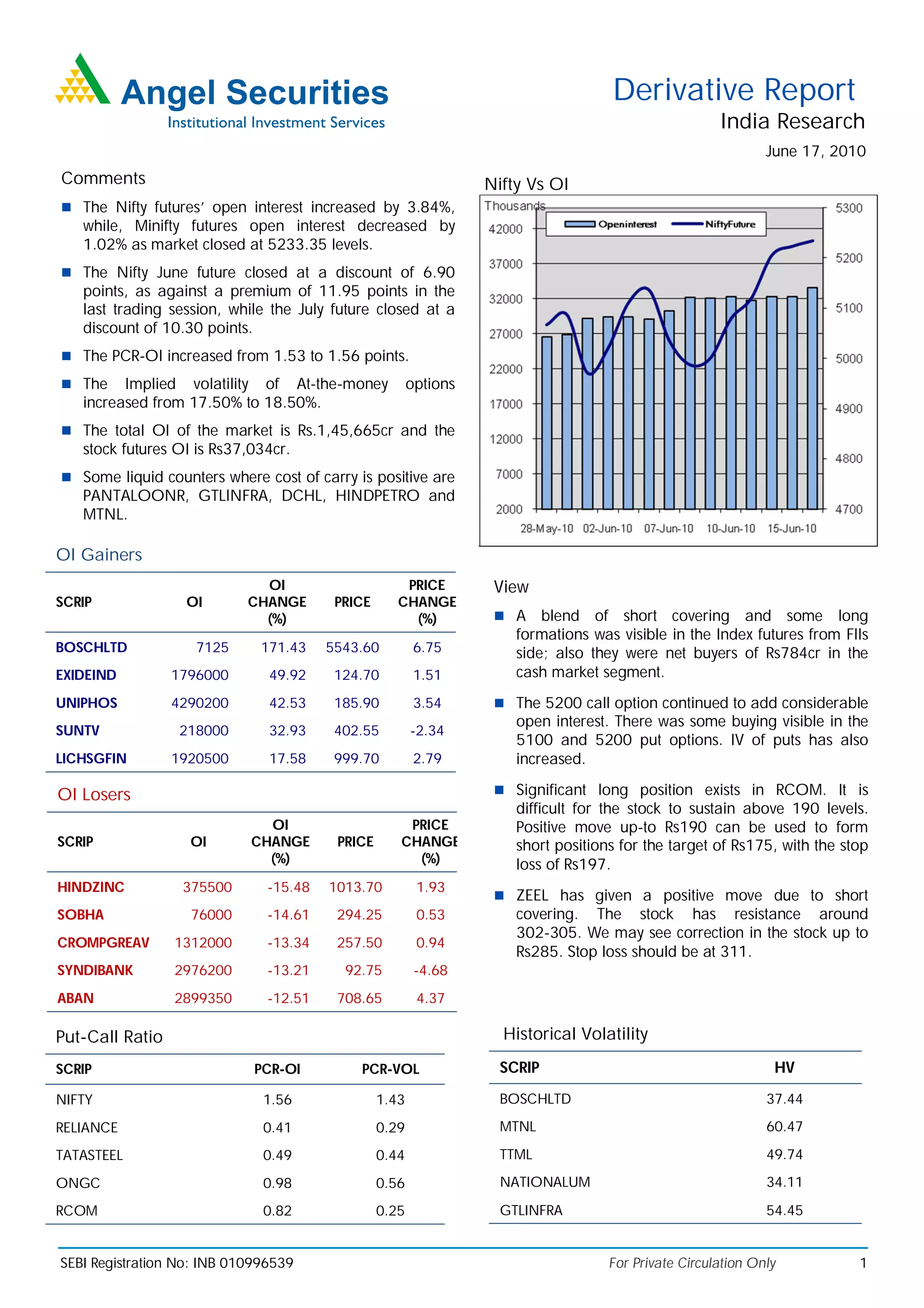

The document provides a summary of derivative market activity in India for June 17, 2010. It notes that open interest in Nifty futures increased while Minifut futures decreased. Several stocks saw increases or decreases in open interest. Put-call ratios and implied volatility also changed. Analysis of specific stocks like RCOM and ZEEL is also provided.