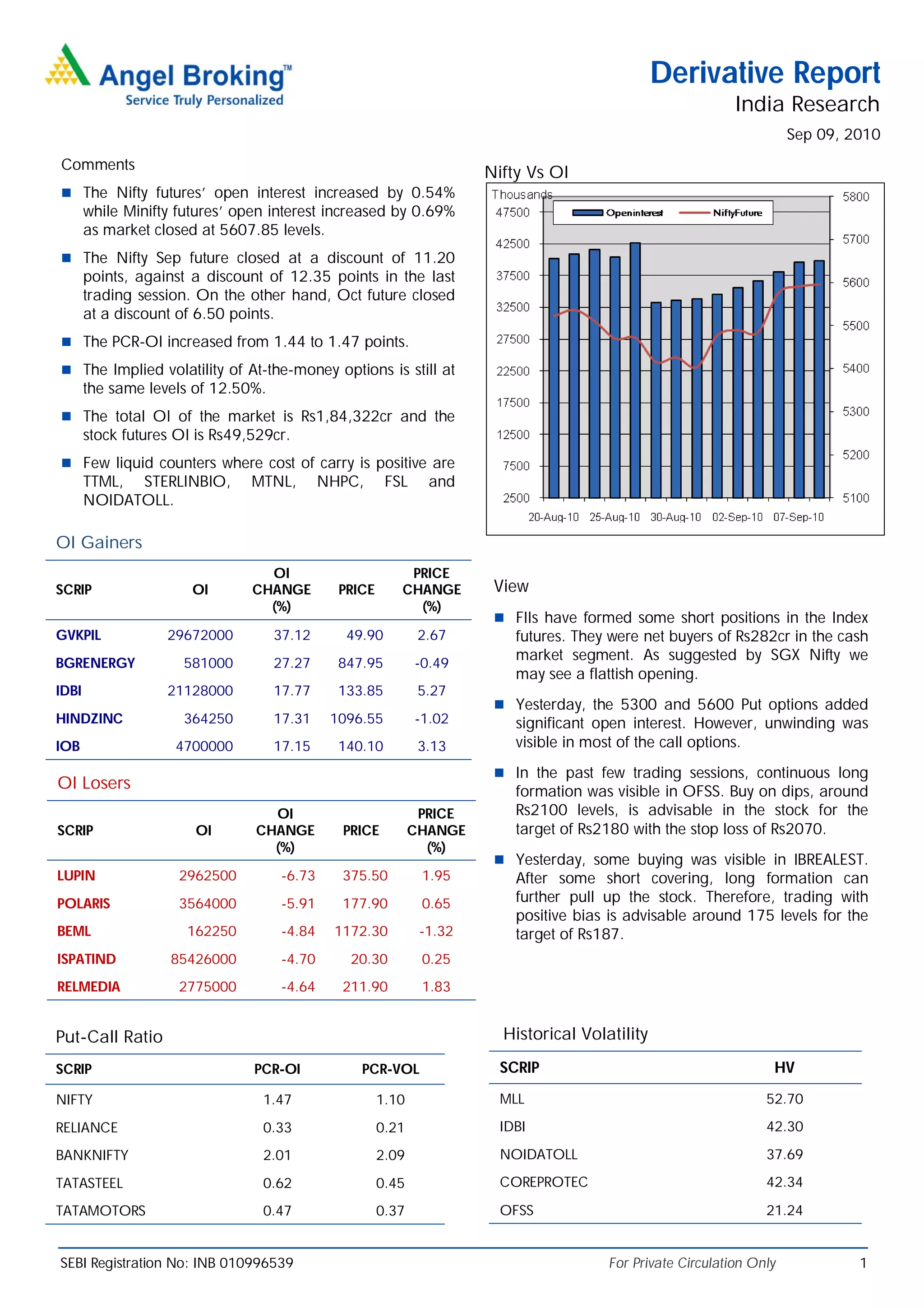

The document provides a summary of derivative market activity in India as of September 09, 2010. Open interest in Nifty futures increased slightly while open interest in Mini Nifty futures rose by 0.69%. The Nifty September future closed at a discount of 11.20 points. Put-call ratio for Nifty increased to 1.47. Total open interest in the market was Rs. 1,84,322 crore with stock futures open interest at Rs. 49,529 crore. Few stocks saw positive cost of carry including TTML, STERLINBIO, MTNL, NHPC, FSL and NOIDATOLL.