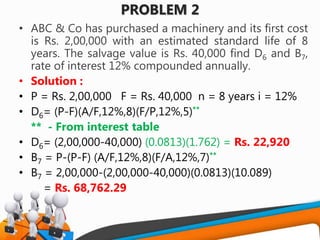

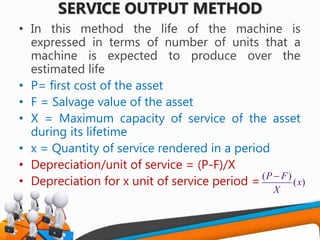

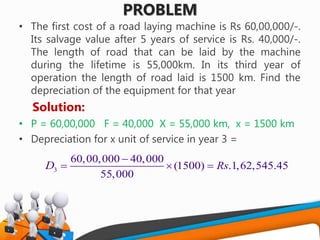

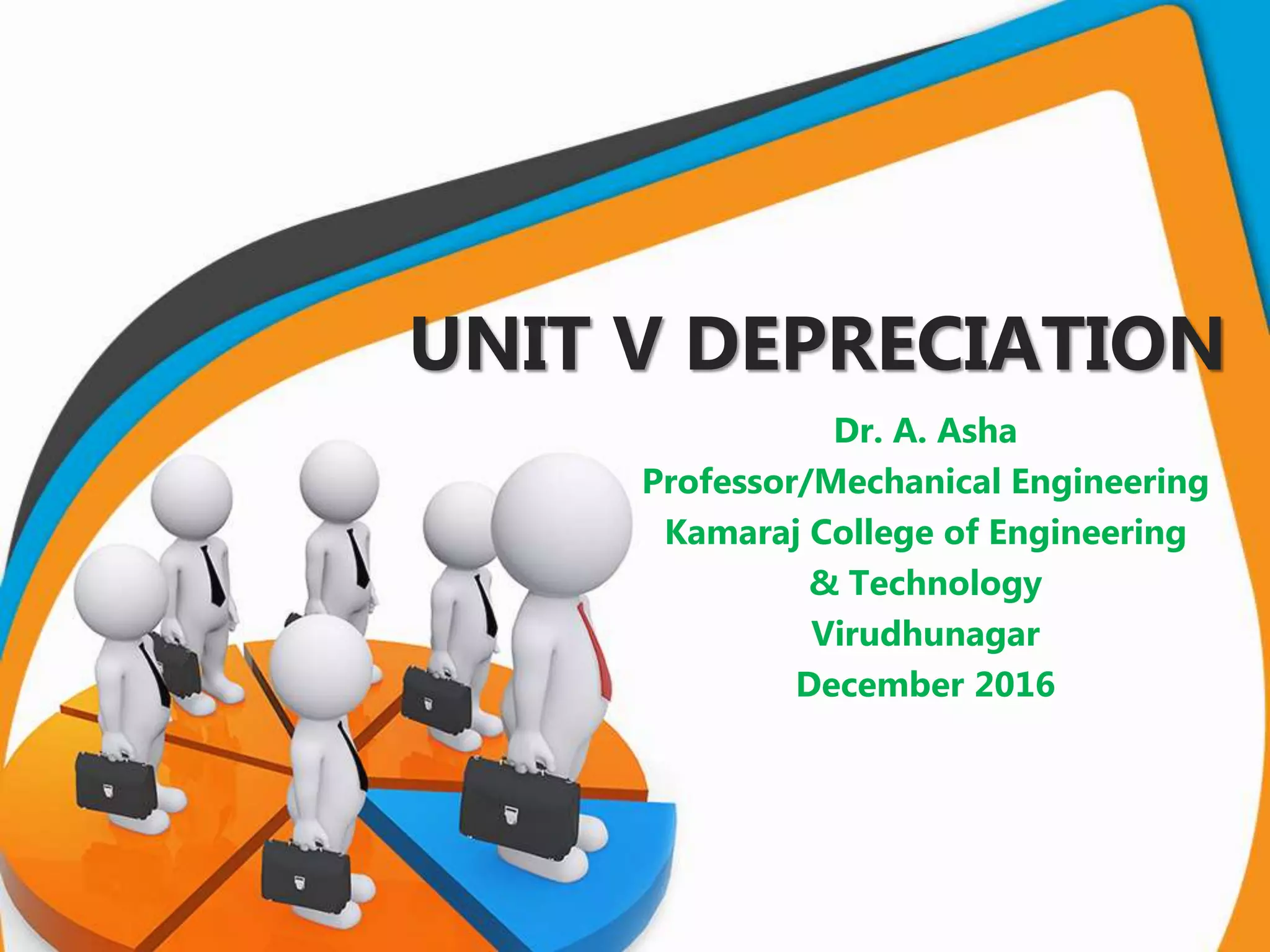

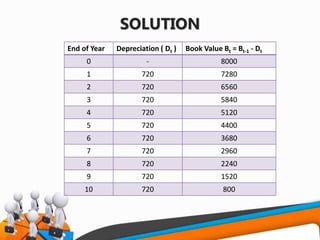

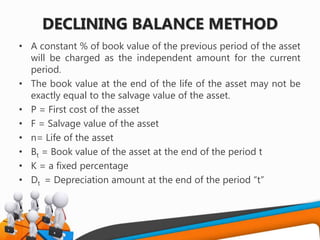

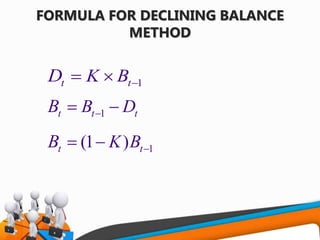

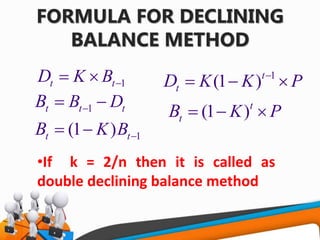

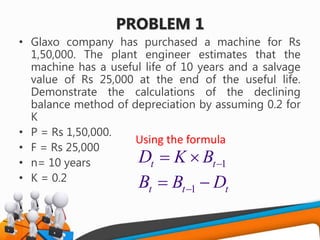

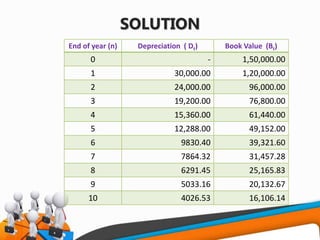

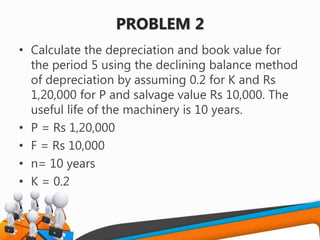

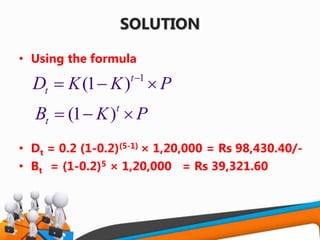

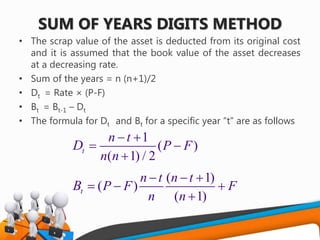

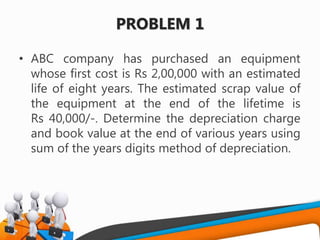

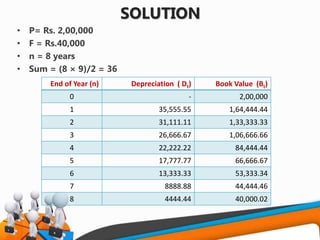

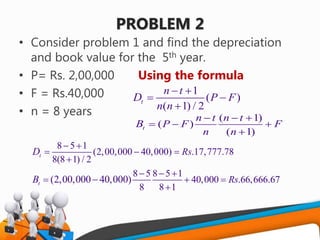

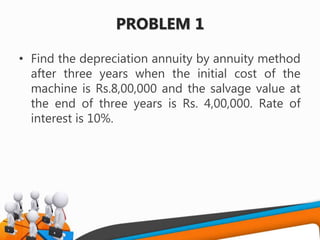

This document discusses various methods of depreciation including straight line, declining balance, sum of years digits, sinking fund, and service output methods. It provides definitions and formulas for calculating depreciation and book value under each method. Examples are given to demonstrate how to use the formulas to calculate depreciation and book value for different time periods and asset information. Causes of depreciation and evaluation of public alternatives are also briefly covered.

![STRAIGHT LINE MEHTOD OF

DEPRECIATION

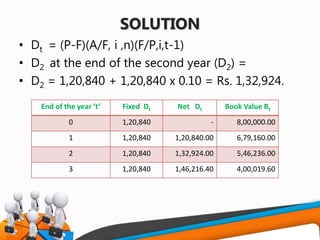

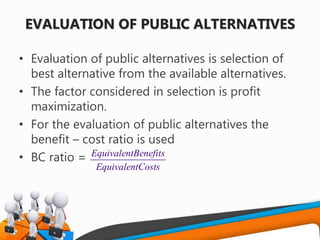

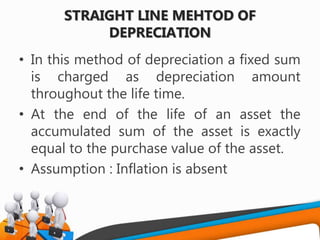

• P = First cost of the asset

• F = Salvage value of the asset

• n = Life of the asset

• Bt = Book value of the asset at the end of the period ti

• Dt = Depreciation amount for the time period t

1 [ ]t i t

P F

B B D P t

n

[ ]

t

P F

D

n

](https://image.slidesharecdn.com/f82cdf94-8f74-4145-905d-f5a85c2401ea-161230103429/85/UNIT-V-DEPRECIATION-6-320.jpg)

![SOLUTION

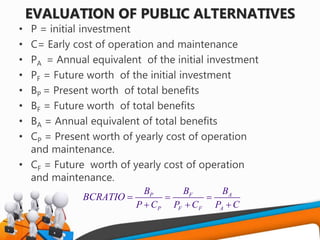

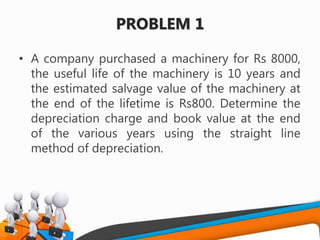

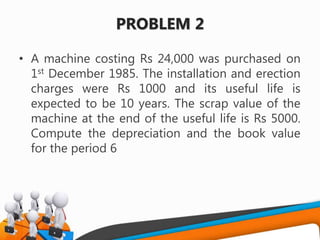

• P = Rs 24,000 + Rs 1000 = 25000

• F = Rs 5000/-

• n = 10 years

• Dt = (P-F)/n = (25000-5000)/10 = 2000

•

• Bt = 25,000 – 6 × (25000-5000)/10

• Bt = Rs. 13,000/-

1 [ ]t i t

P F

B B D P t

n

](https://image.slidesharecdn.com/f82cdf94-8f74-4145-905d-f5a85c2401ea-161230103429/85/UNIT-V-DEPRECIATION-11-320.jpg)

![FORMULA USED

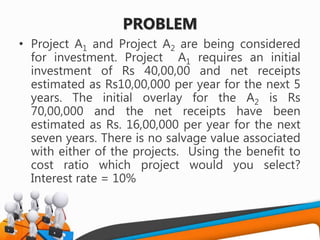

• P= first cost of the asset

• F= salvage value of the asset

• n= life of the asset

• i = Rate of return compounded annually

• A = Annual equivalent amount

• Bt = Book value of the asset at the end of the period ‘t’

• Dt = Depreciation amount at the end of the period ‘t’.

• The loss of value of the asset (P-F) is made available in the form of

cumulative depreciation amount

• A = (P-F)[A/F, i, n]

• The fixed sum depreciated at the end of every time period earns an interest

at the rate of i% compounded annually

• Dt = (P-F)(A/F, i ,n)(F/P,i,t-1)

• Bt = P-(P-F)(A/F, i, n)(F/P,i,t-1)](https://image.slidesharecdn.com/f82cdf94-8f74-4145-905d-f5a85c2401ea-161230103429/85/UNIT-V-DEPRECIATION-24-320.jpg)

![SOLUTION

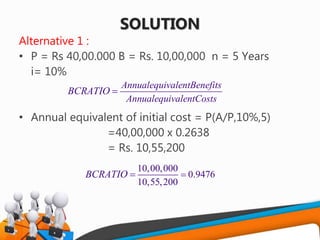

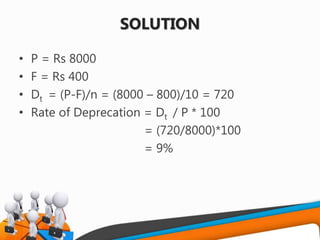

• P = Rs. 8,00,000

• F = Rs. 4,00,000

• n = 3 years

• i = 10%

• A = (P-F)[A/F, i, n]

• A = (8,00,000-4,00,000) [A/F,10%,3] value from interest

table is substituted

• A = (8,00,000-4,00,000) x 0.3021 = Rs. 1,20,840

• Dt = (P-F)(A/F, i ,n)(F/P,i,t-1)

• Bt = P-(P-F)(A/F, i, n)(F/P,i,t)](https://image.slidesharecdn.com/f82cdf94-8f74-4145-905d-f5a85c2401ea-161230103429/85/UNIT-V-DEPRECIATION-26-320.jpg)