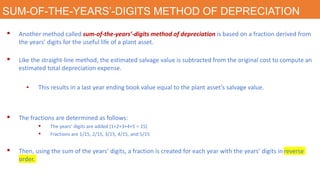

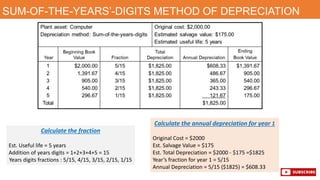

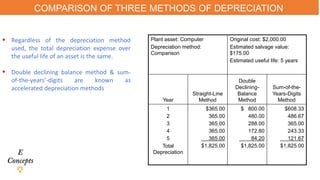

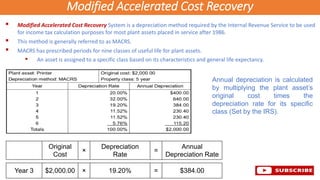

The document discusses various methods of asset depreciation, explaining their purposes, calculations, and applications in business accounting. It covers five primary depreciation methods: straight-line, declining-balance, sum-of-the-years'-digits, production-unit, and the modified accelerated cost recovery system (MACRS), along with detailed examples for each. The total depreciation expense remains the same across methods, but the timing and amount of depreciation vary based on the chosen approach.