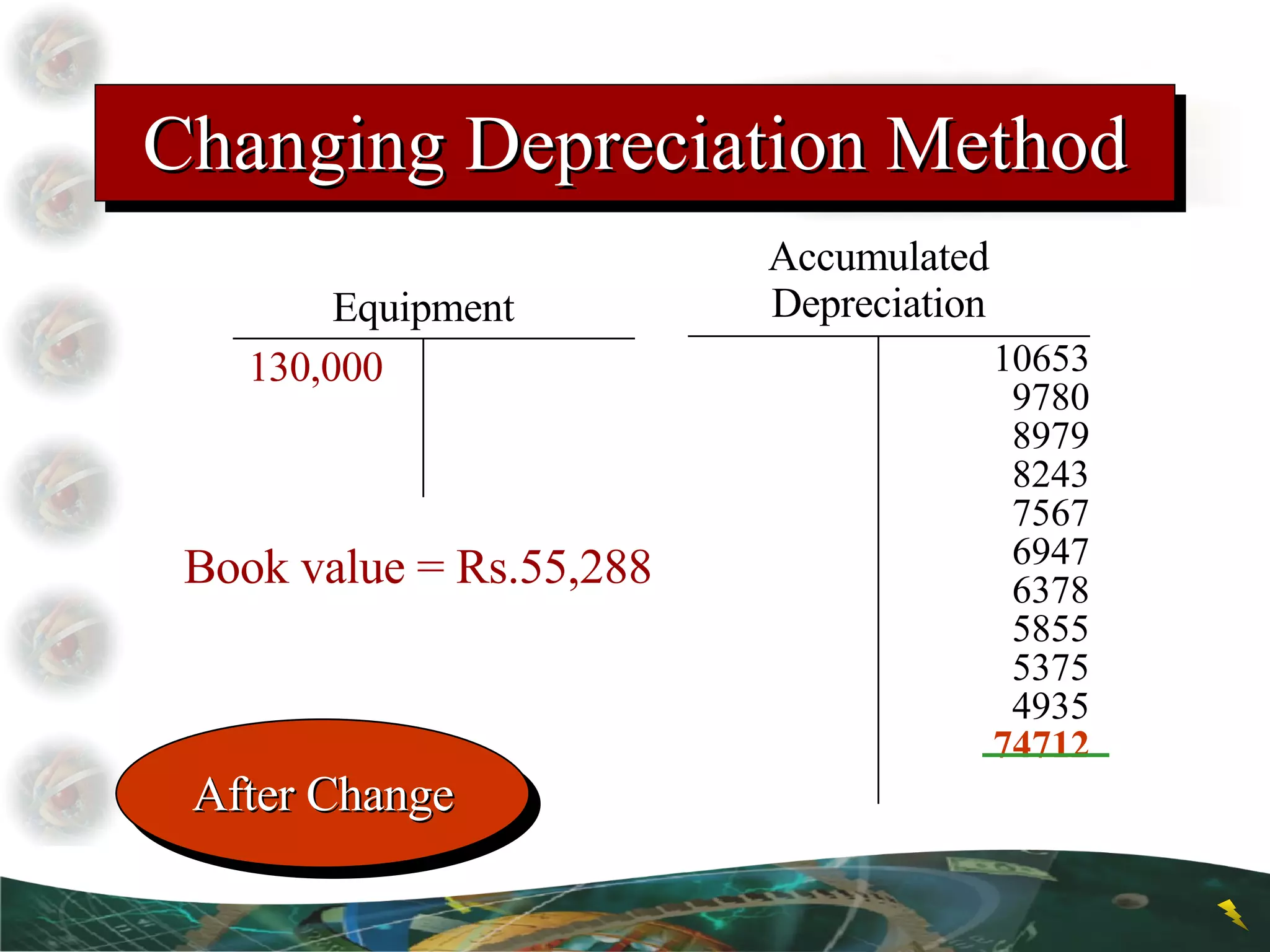

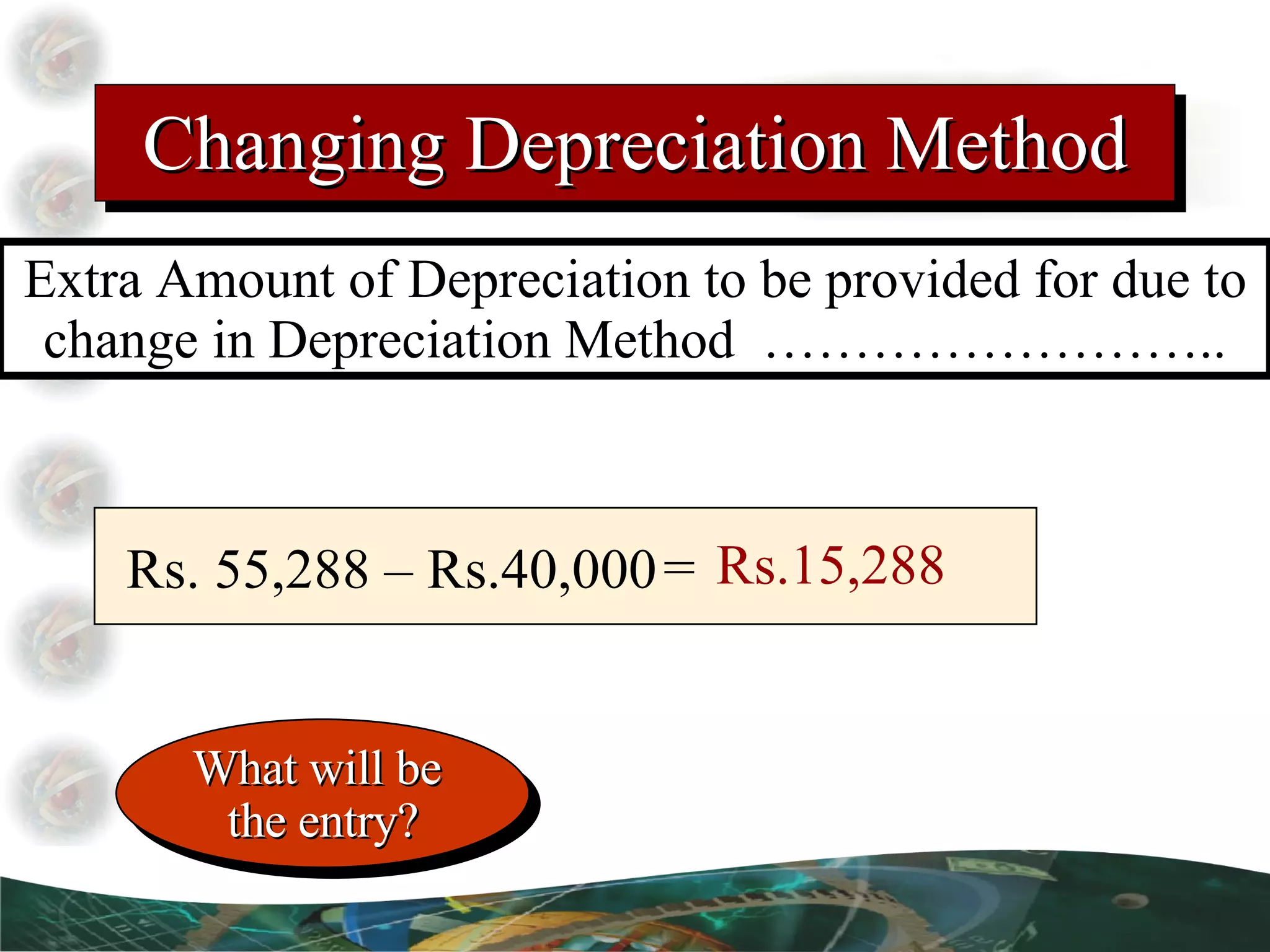

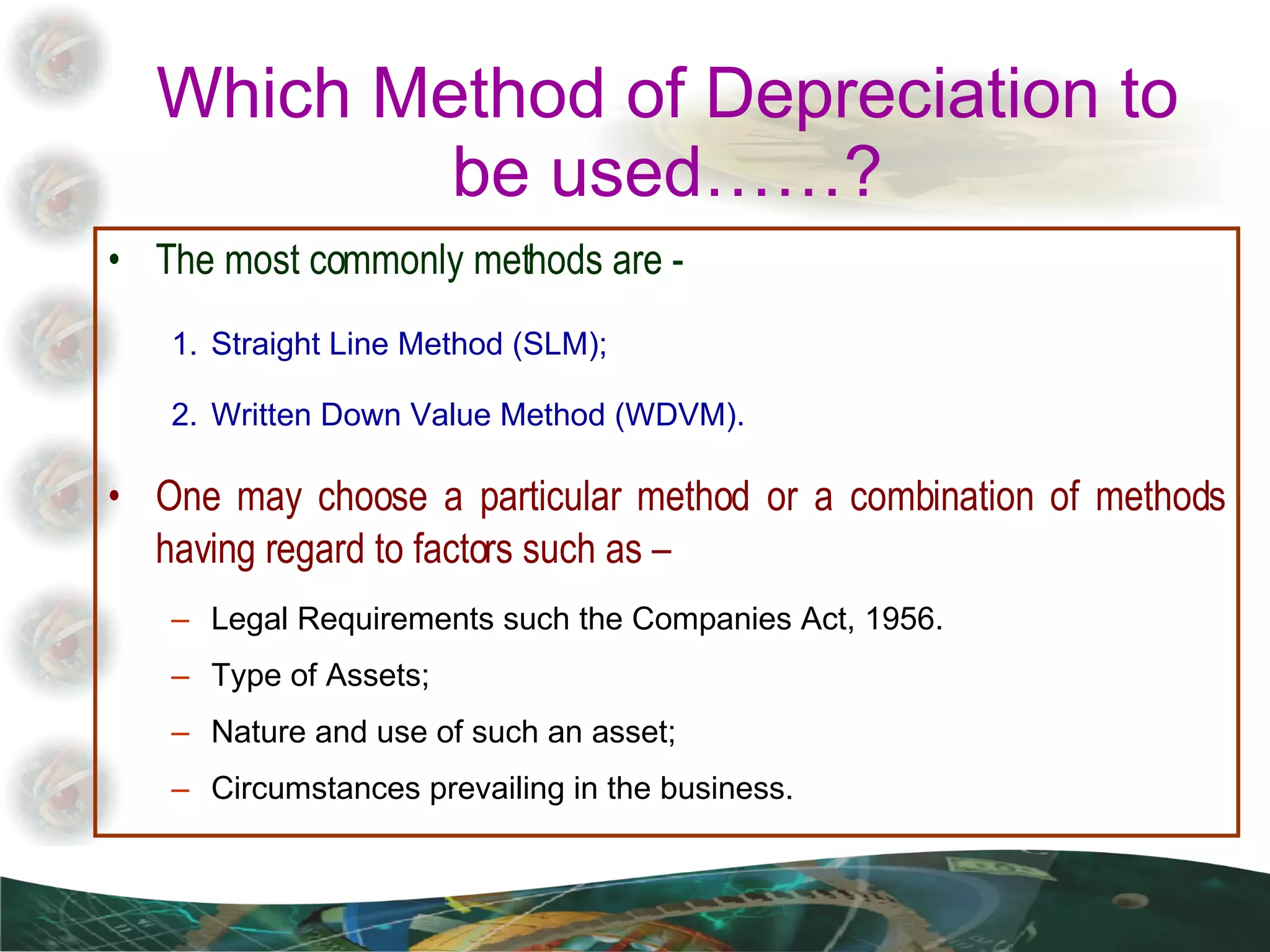

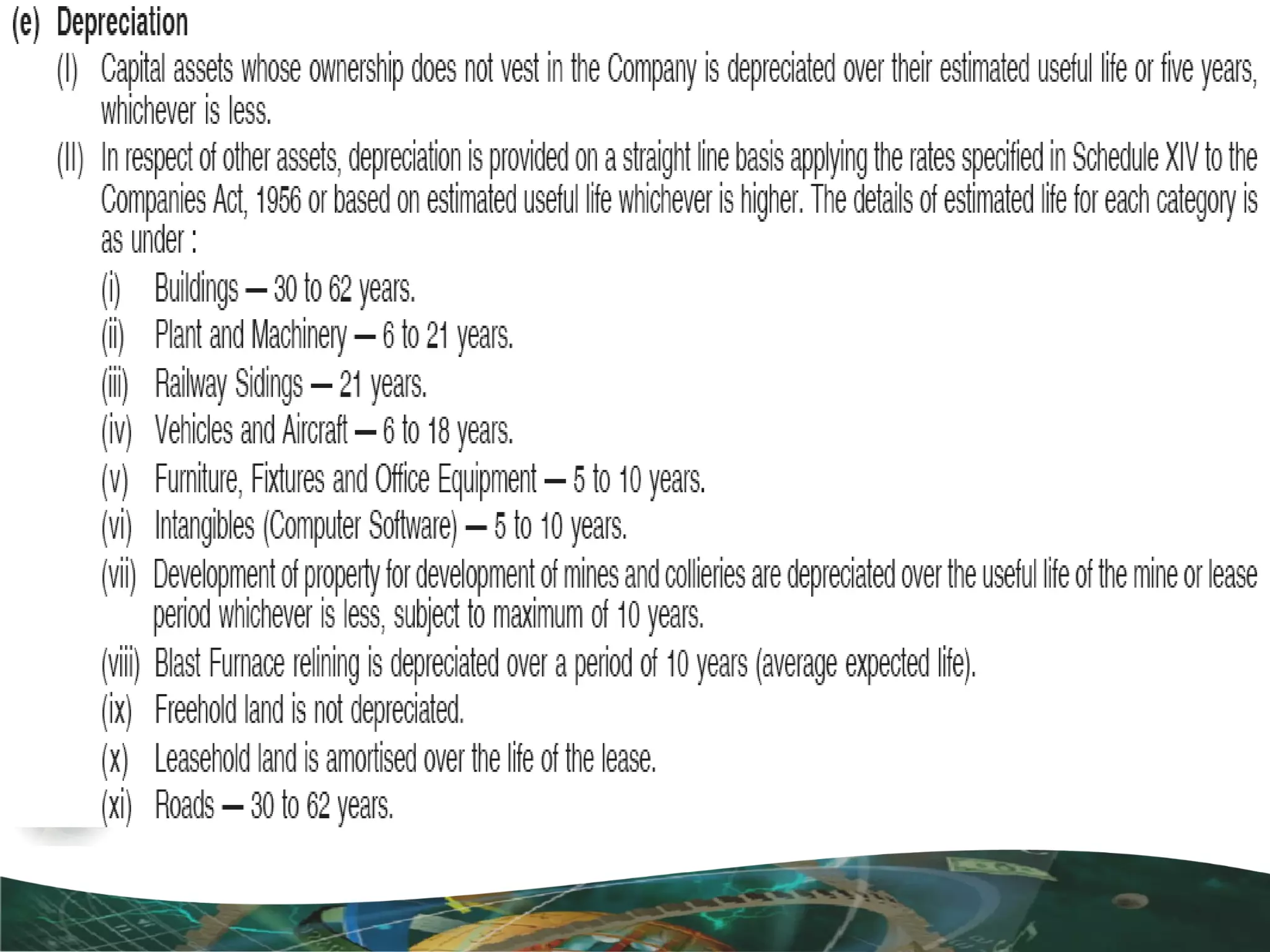

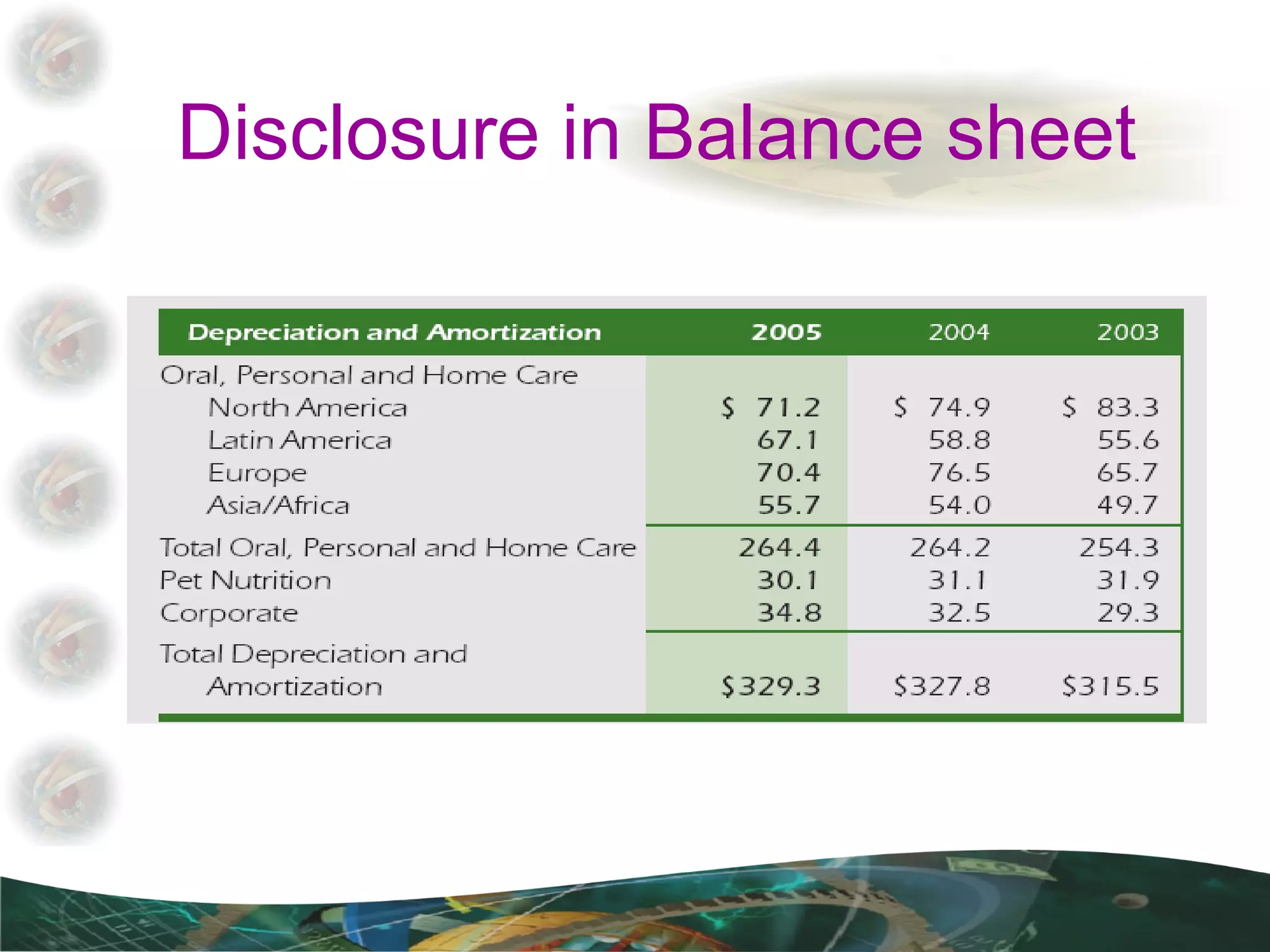

The document discusses accounting principles related to depreciation of assets. It covers calculating depreciation expense using different methods, revising estimates of useful life and residual value, changing the depreciation method, and revaluing assets. Disclosure requirements for depreciation policies and amounts in financial statements are also reviewed under Indian, US, and international accounting standards.