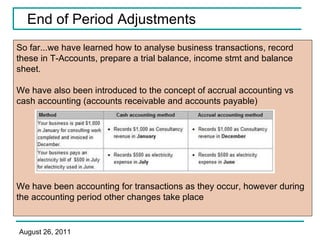

The document discusses key accounting concepts including adjusting entries, the matching principle, prepaid expenses, depreciation, and current and non-current assets. It provides examples of how to record adjusting entries for prepaid insurance and depreciation. It also explains the differences between cash and accrual accounting and how depreciation matches the cost of a non-current asset to the periods that benefit from its use.