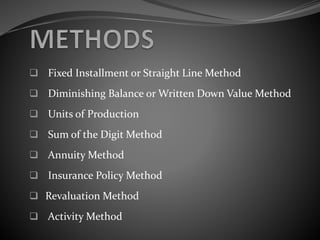

Depreciation is the permanent and gradual decline in the value of fixed assets over time due to wear and tear, effluxion of time, or obsolescence. It is a process of allocating the cost of a fixed asset over its useful life and is based on factors like the asset's cost, estimated useful life, and estimated residual value. Depreciation is calculated using methods like the straight-line method, diminishing balance method, or units of production method and is important for determining accurate profits, financial position, and asset values.