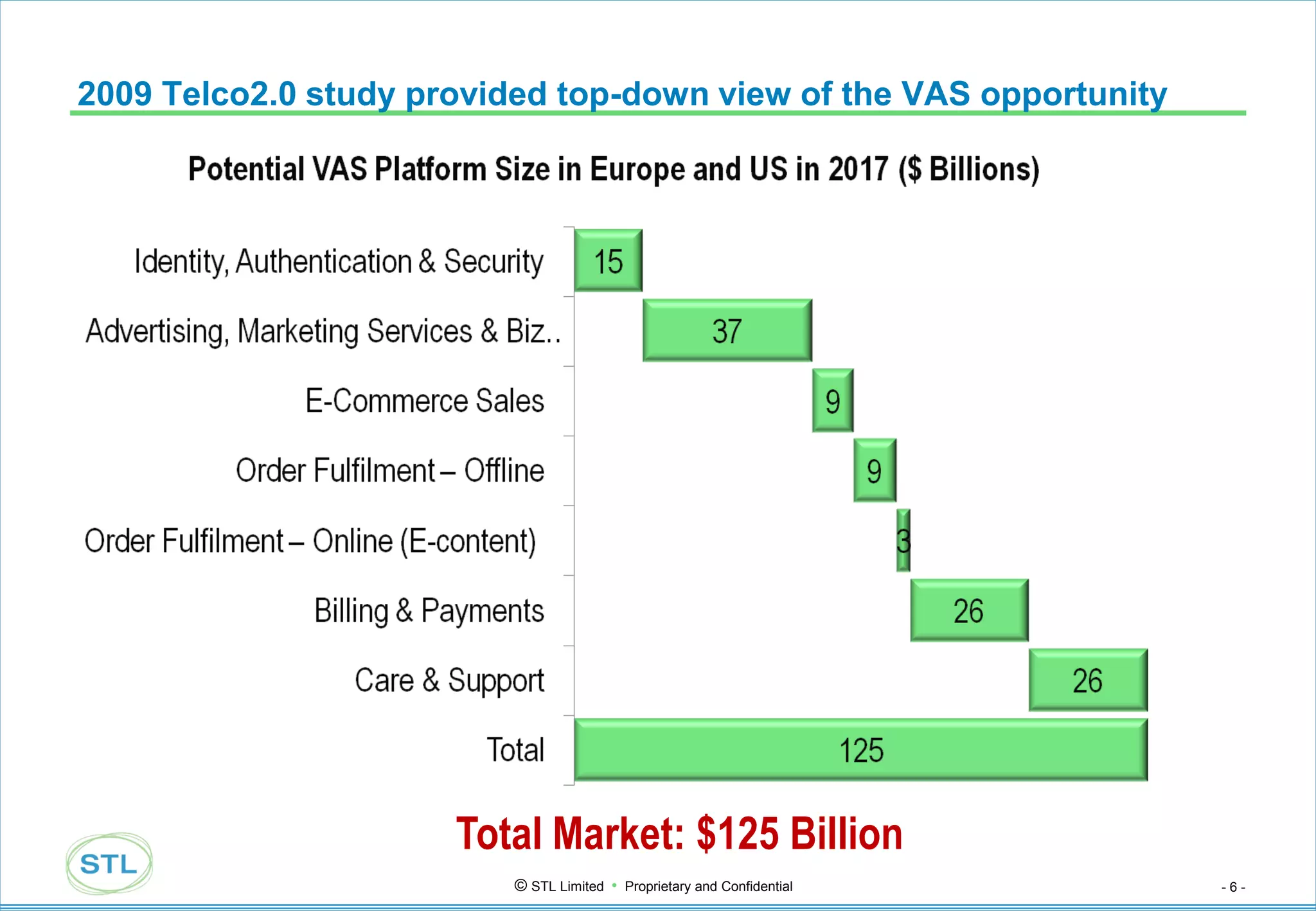

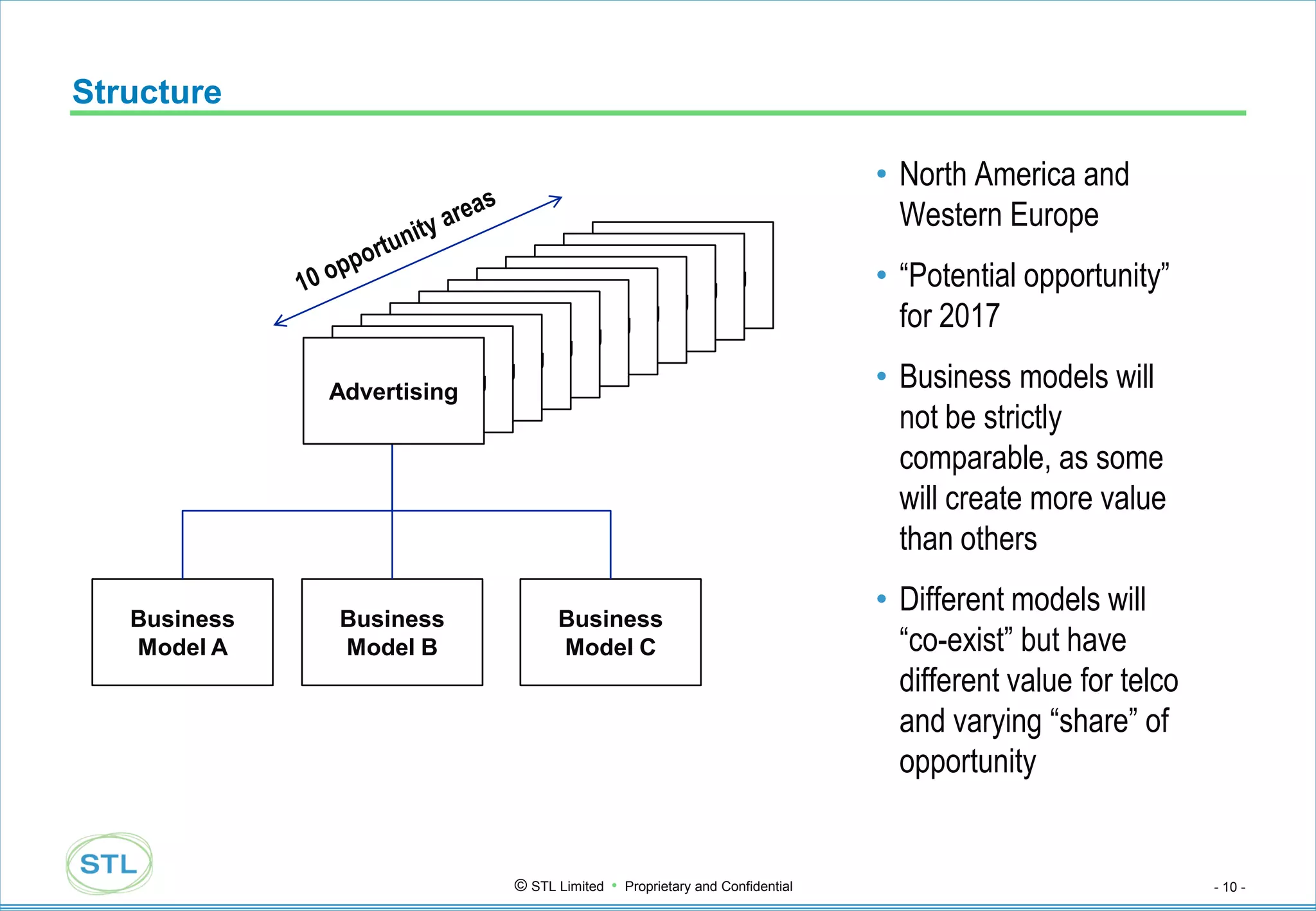

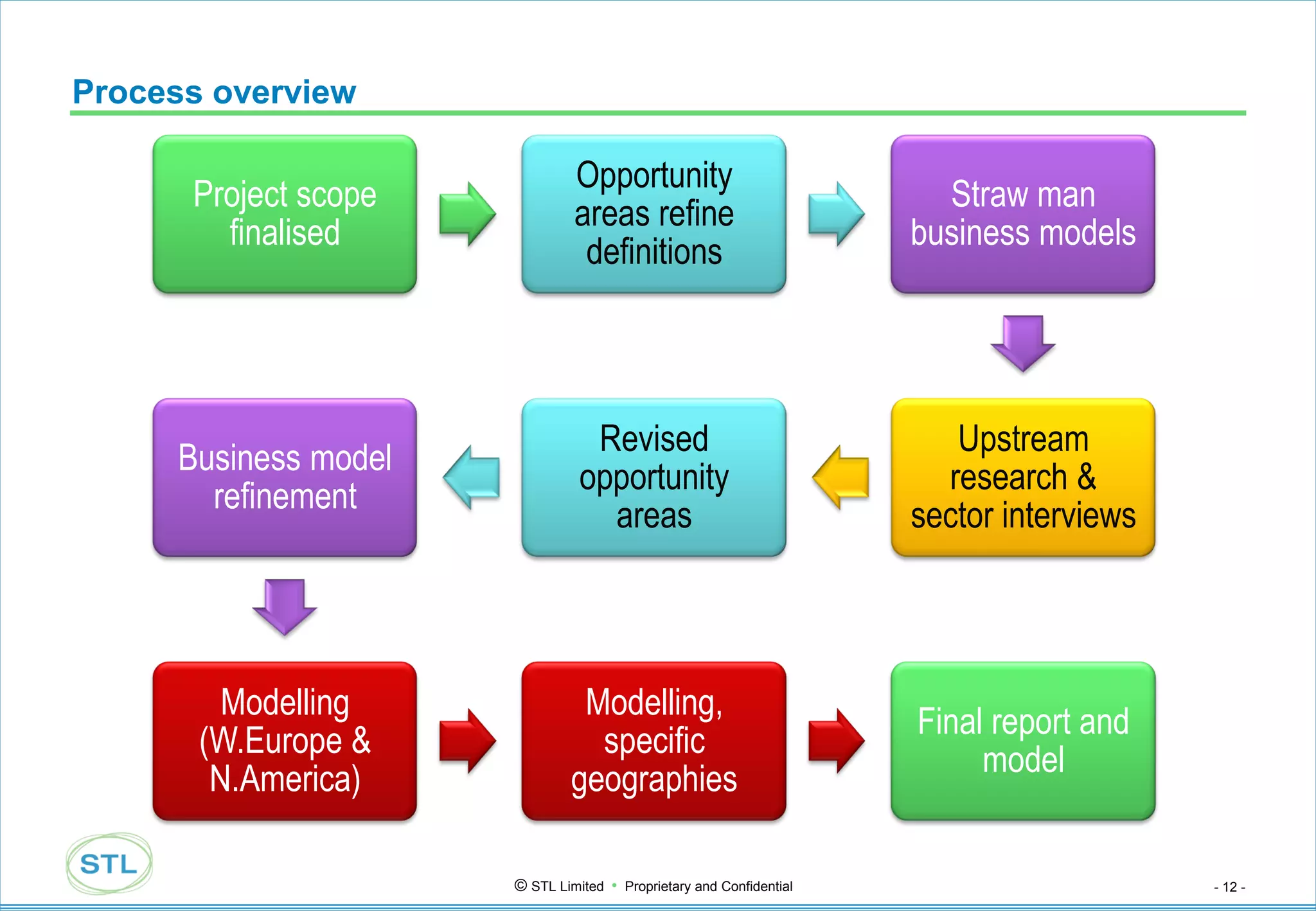

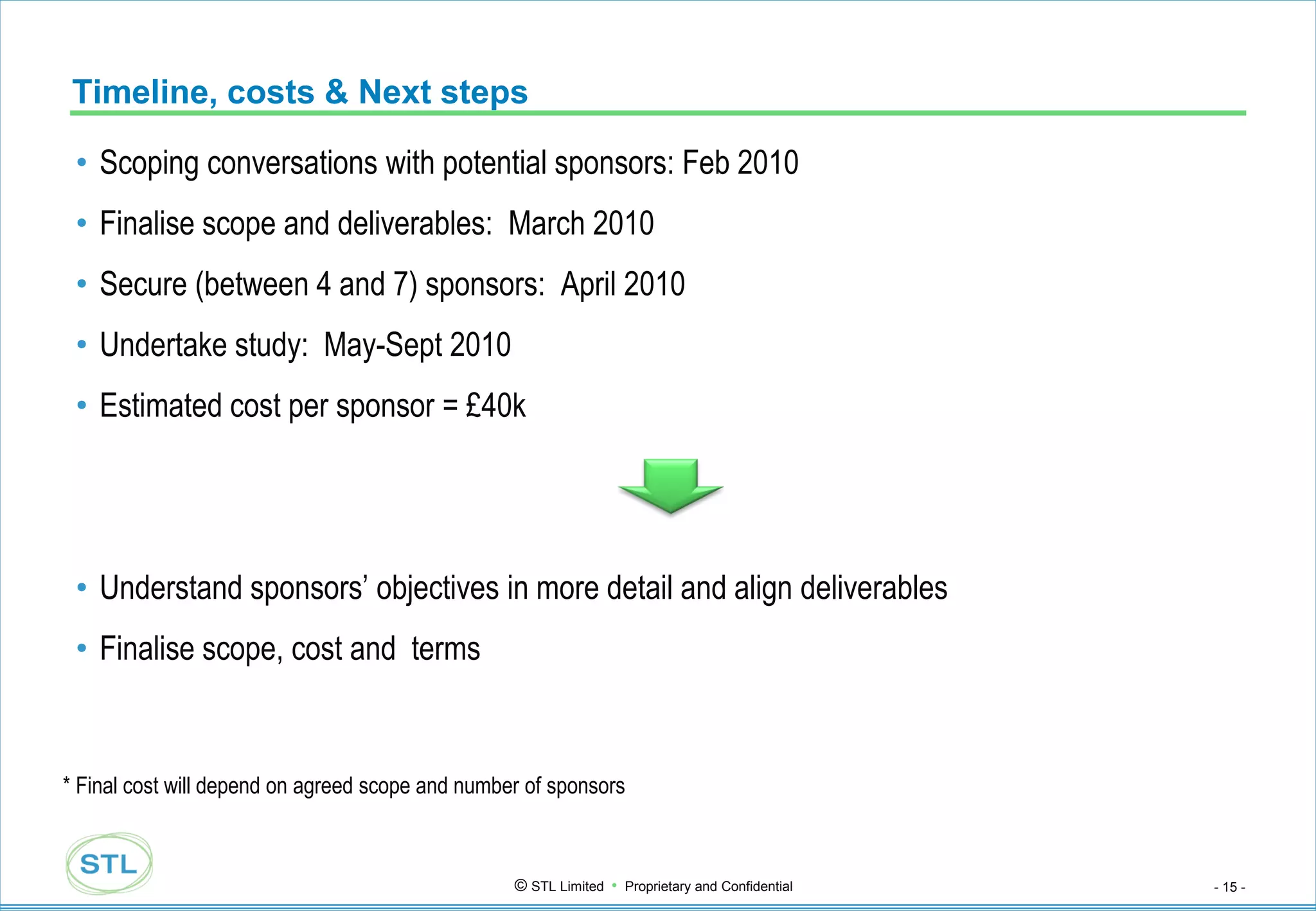

This document proposes a syndicated study to provide a bottom-up analysis of the $125 billion telecom value-added services opportunity identified in an earlier top-down study. The new study would model specific opportunity areas like advertising and customer care across geographies and business models to generate detailed forecasts sponsors could use for business cases and partner discussions. Multiple sponsors would share costs. The timeline calls for scoping in early 2010, finalizing the scope in March, securing sponsors in April, conducting the study from May to September, and delivering reports tailored for each sponsor.