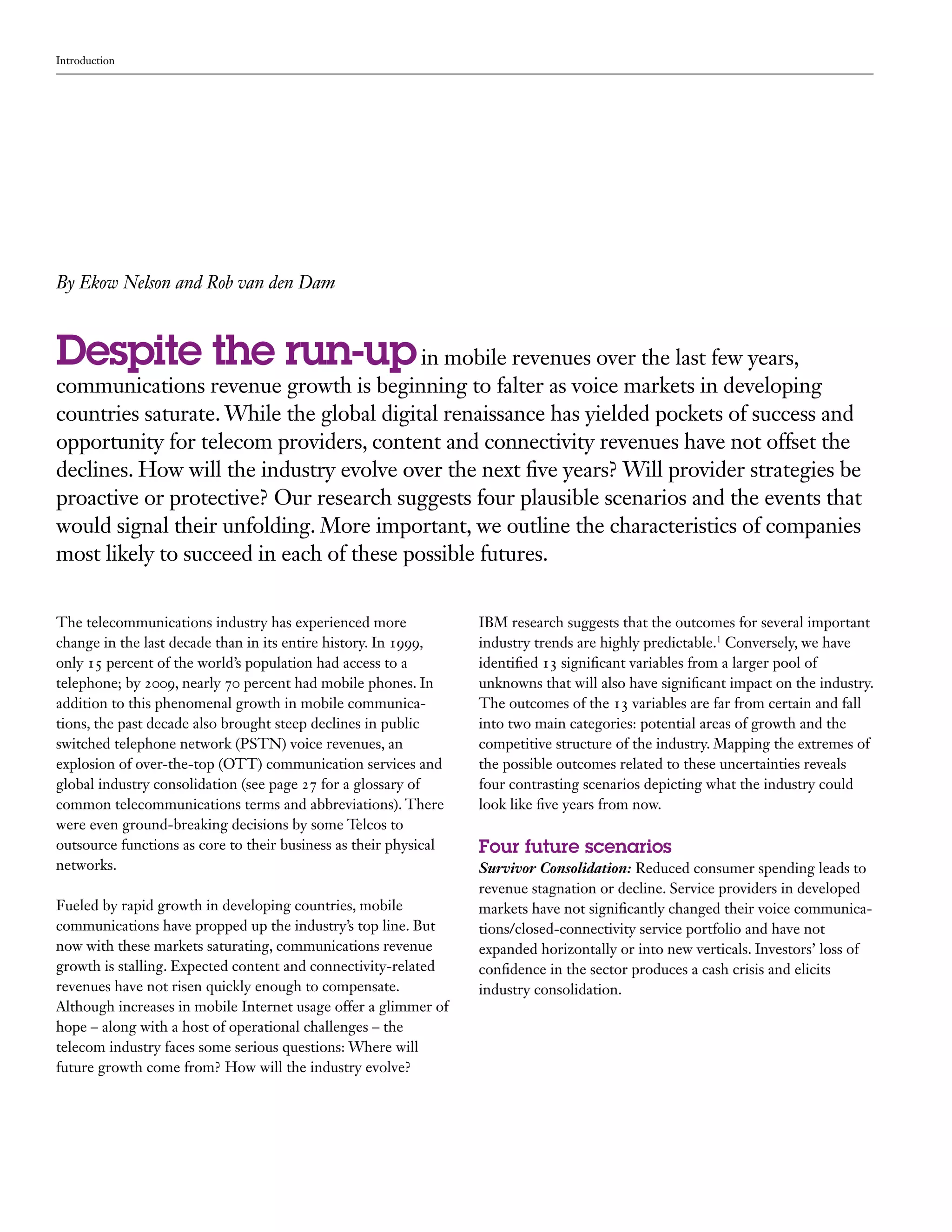

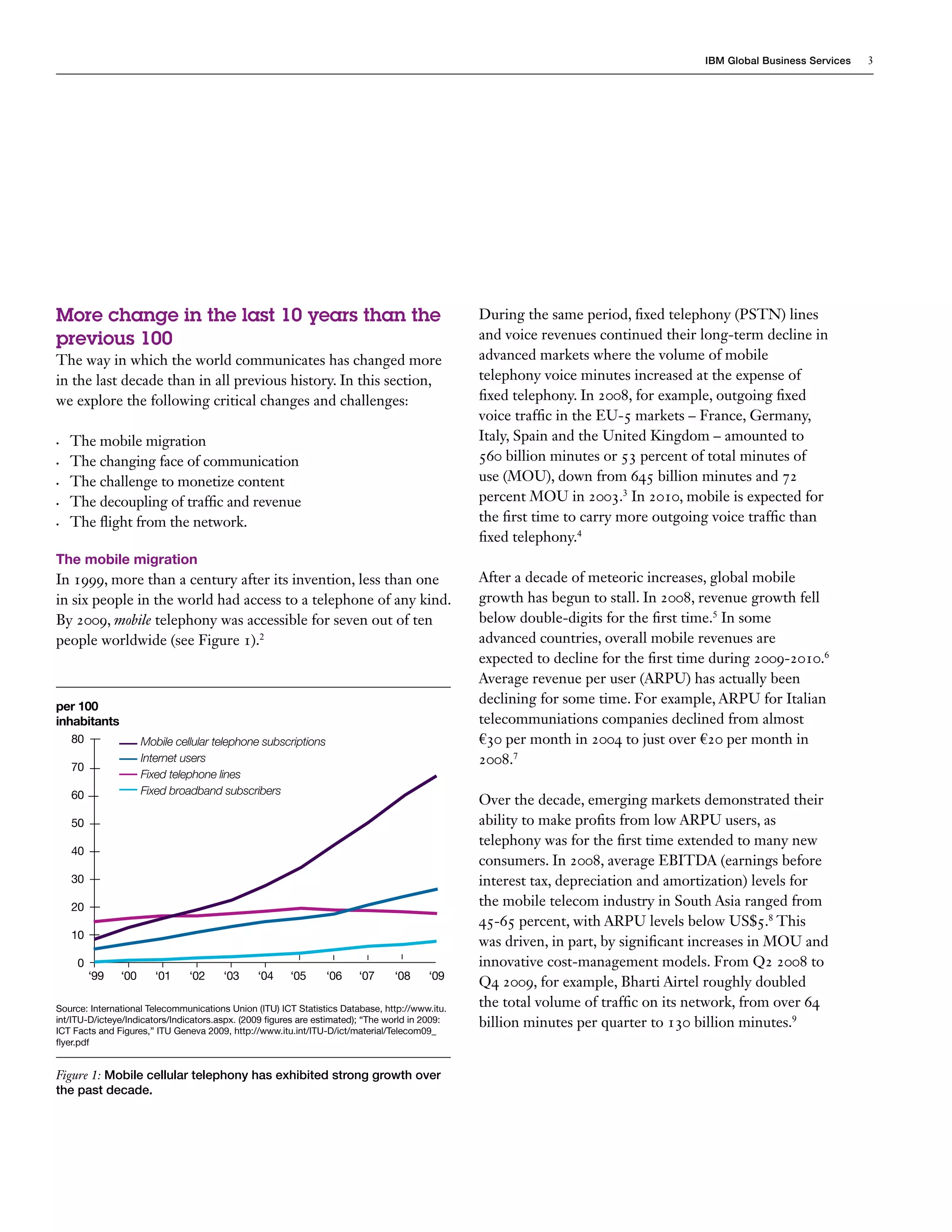

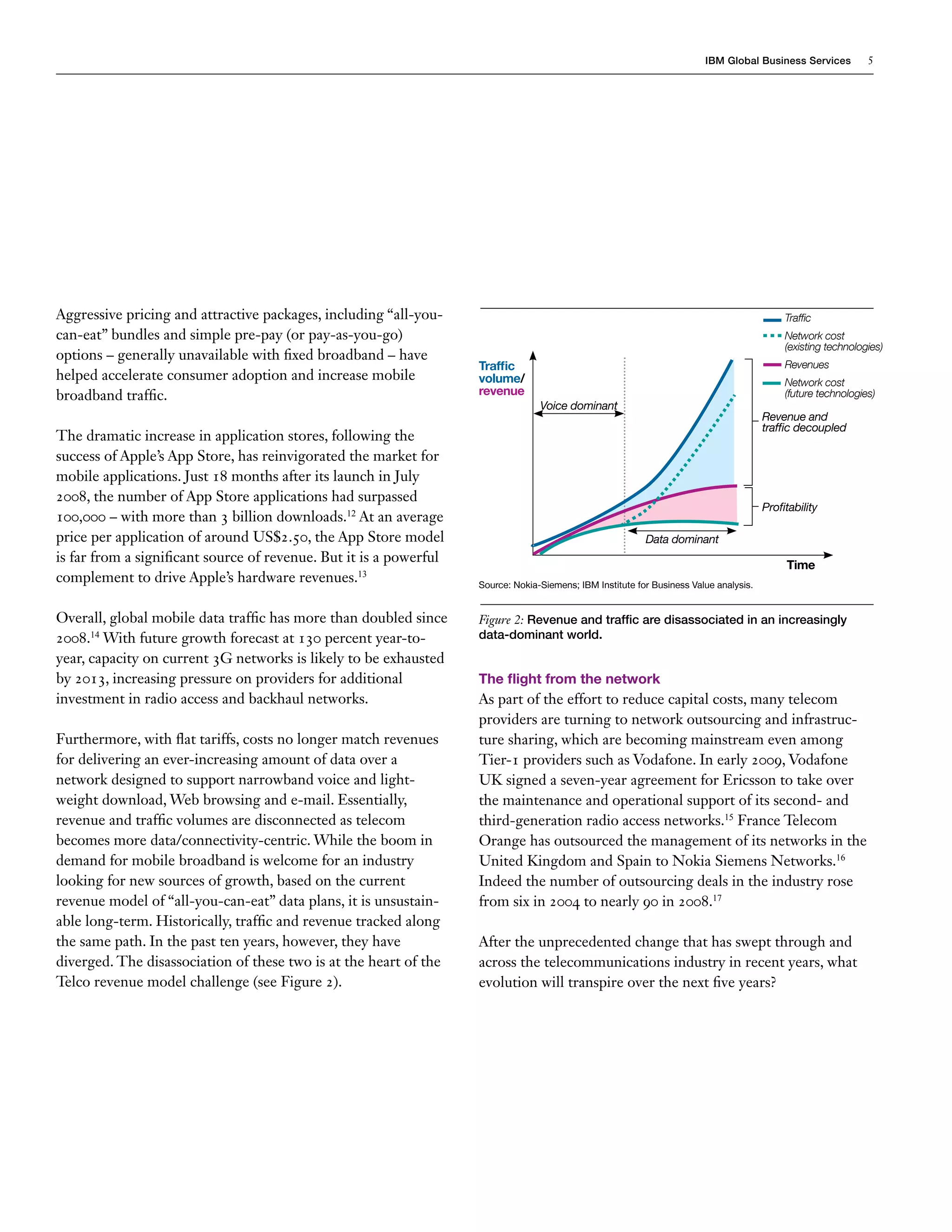

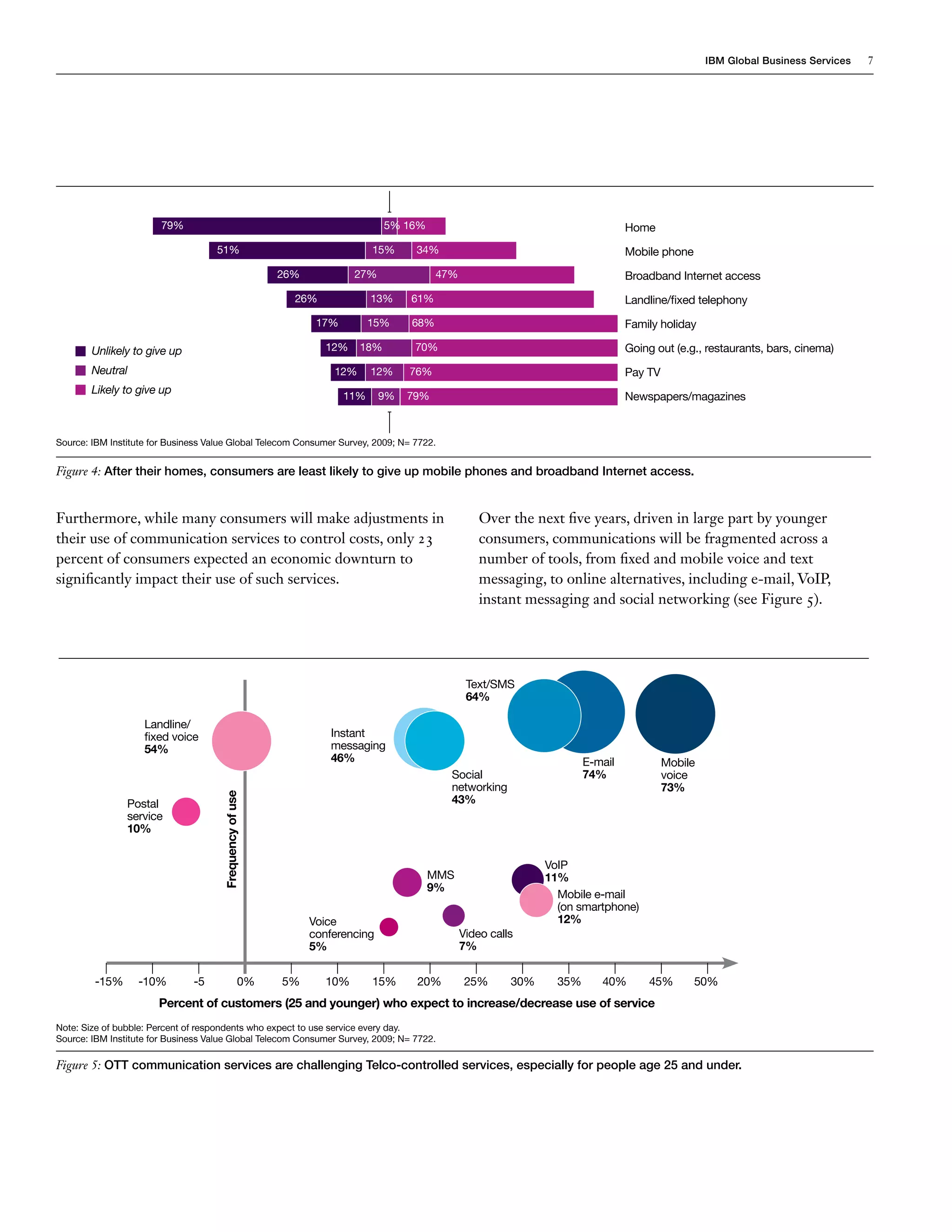

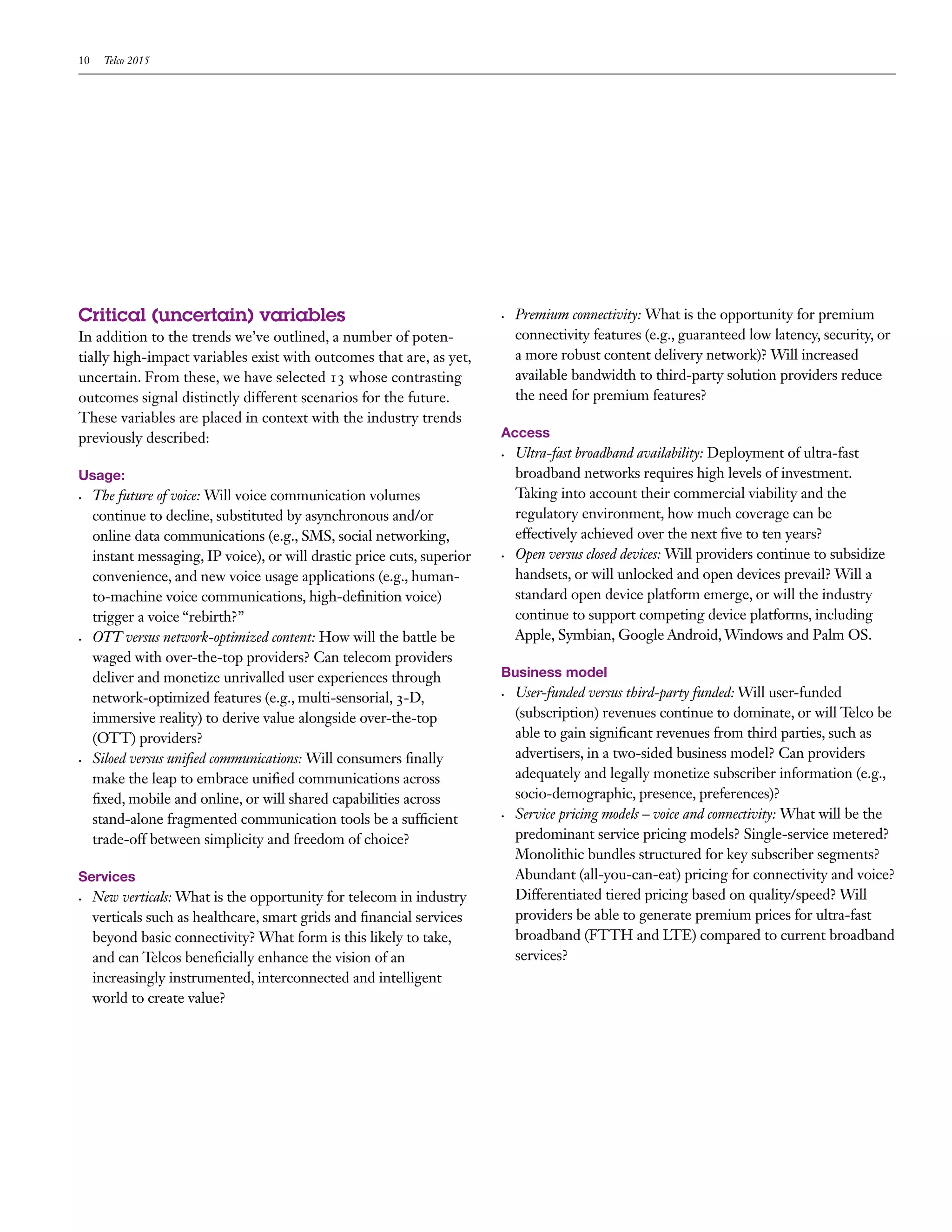

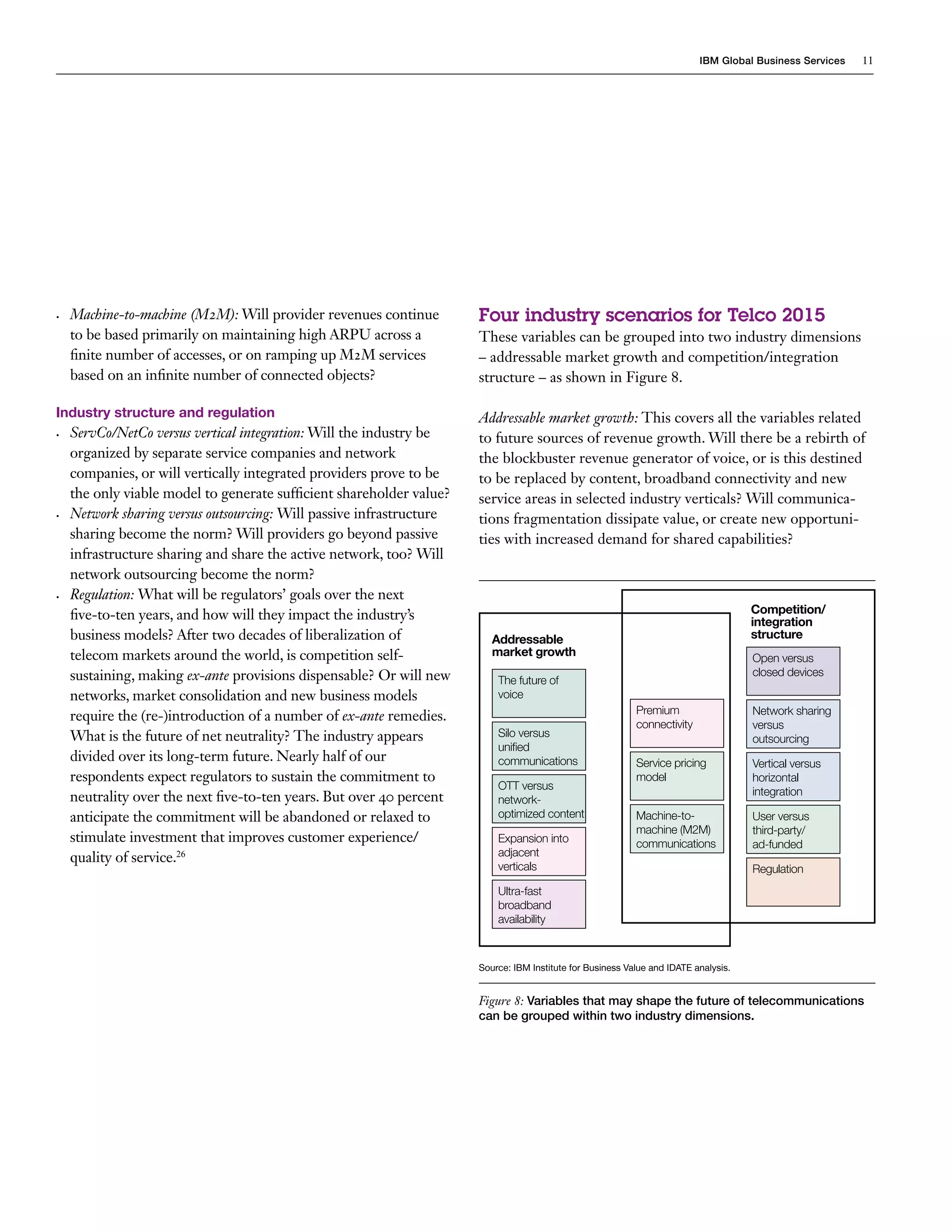

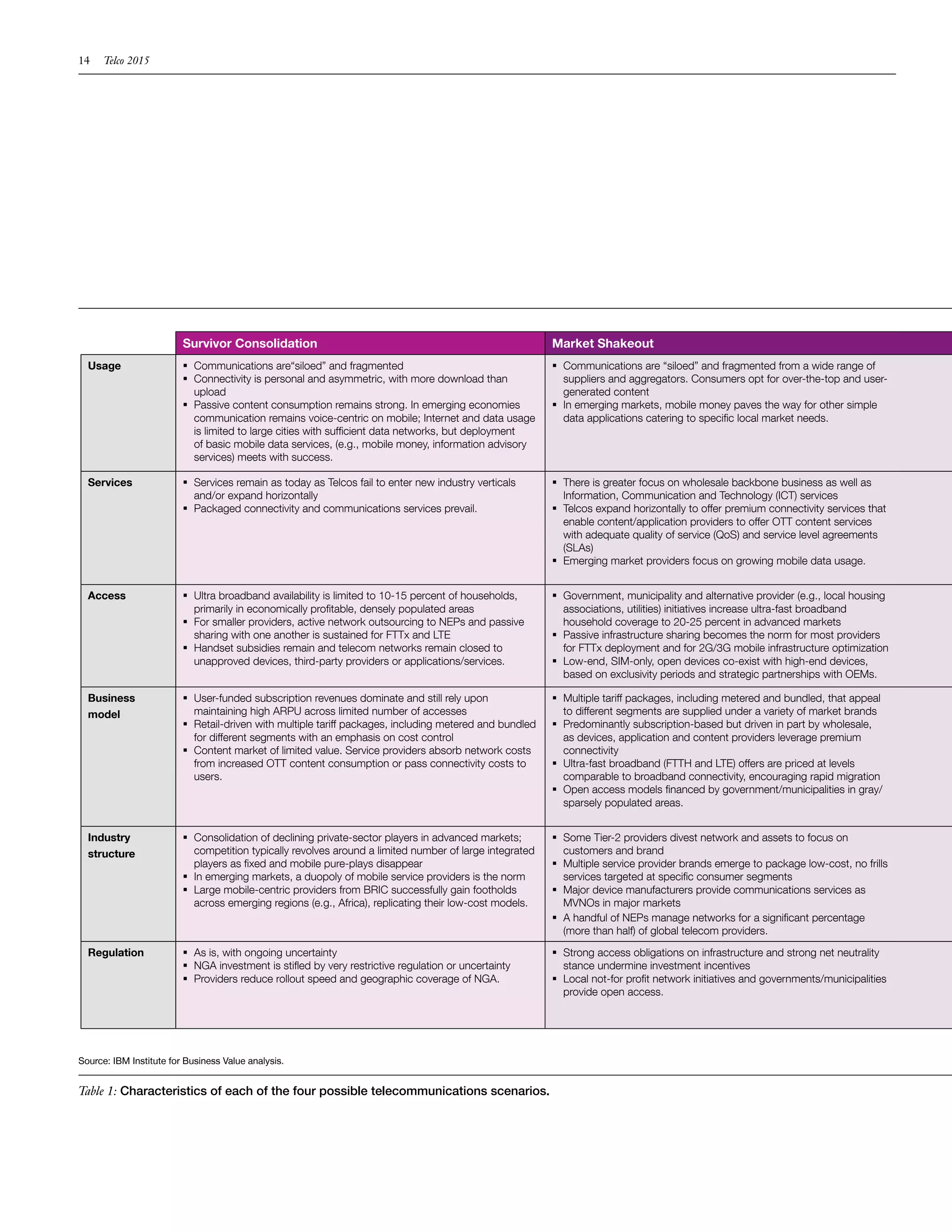

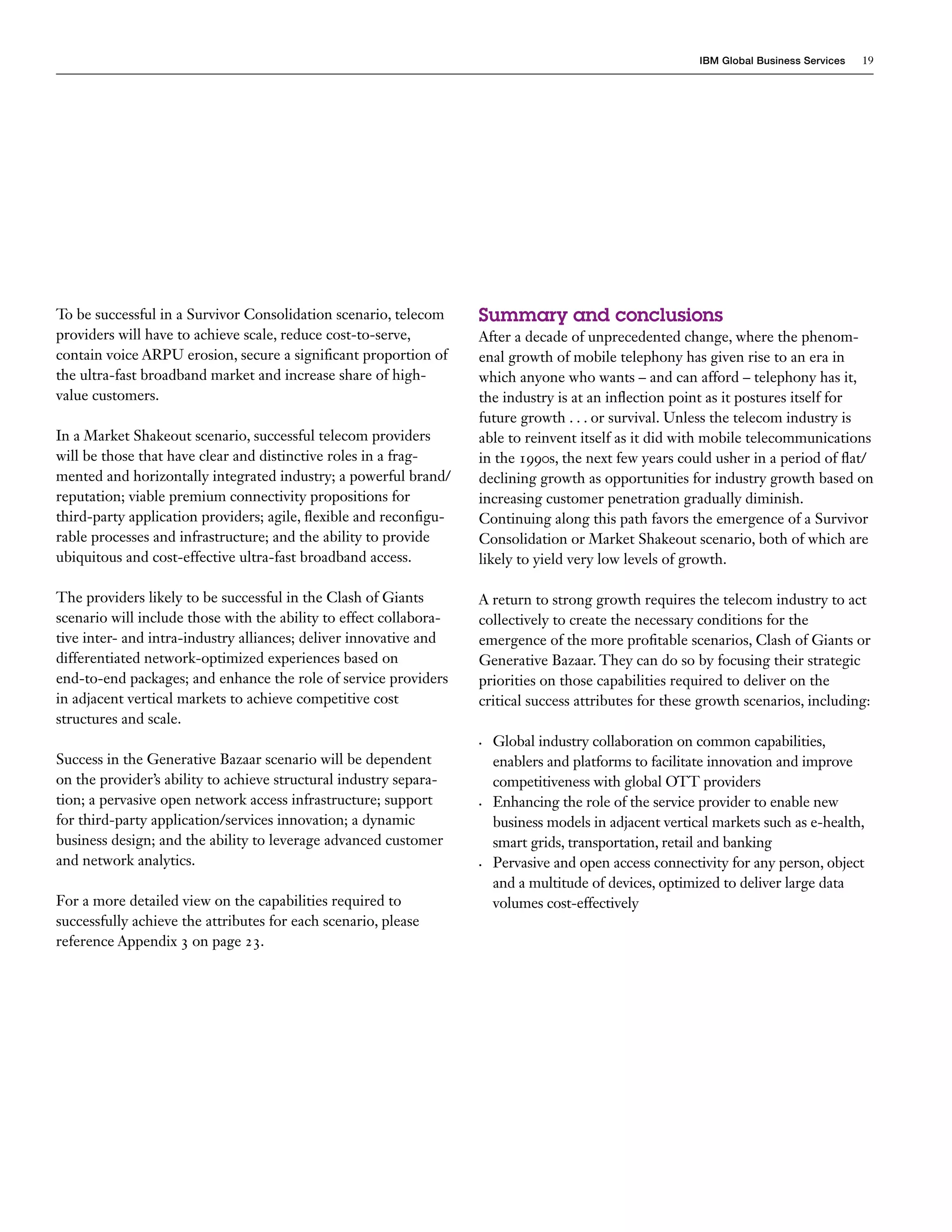

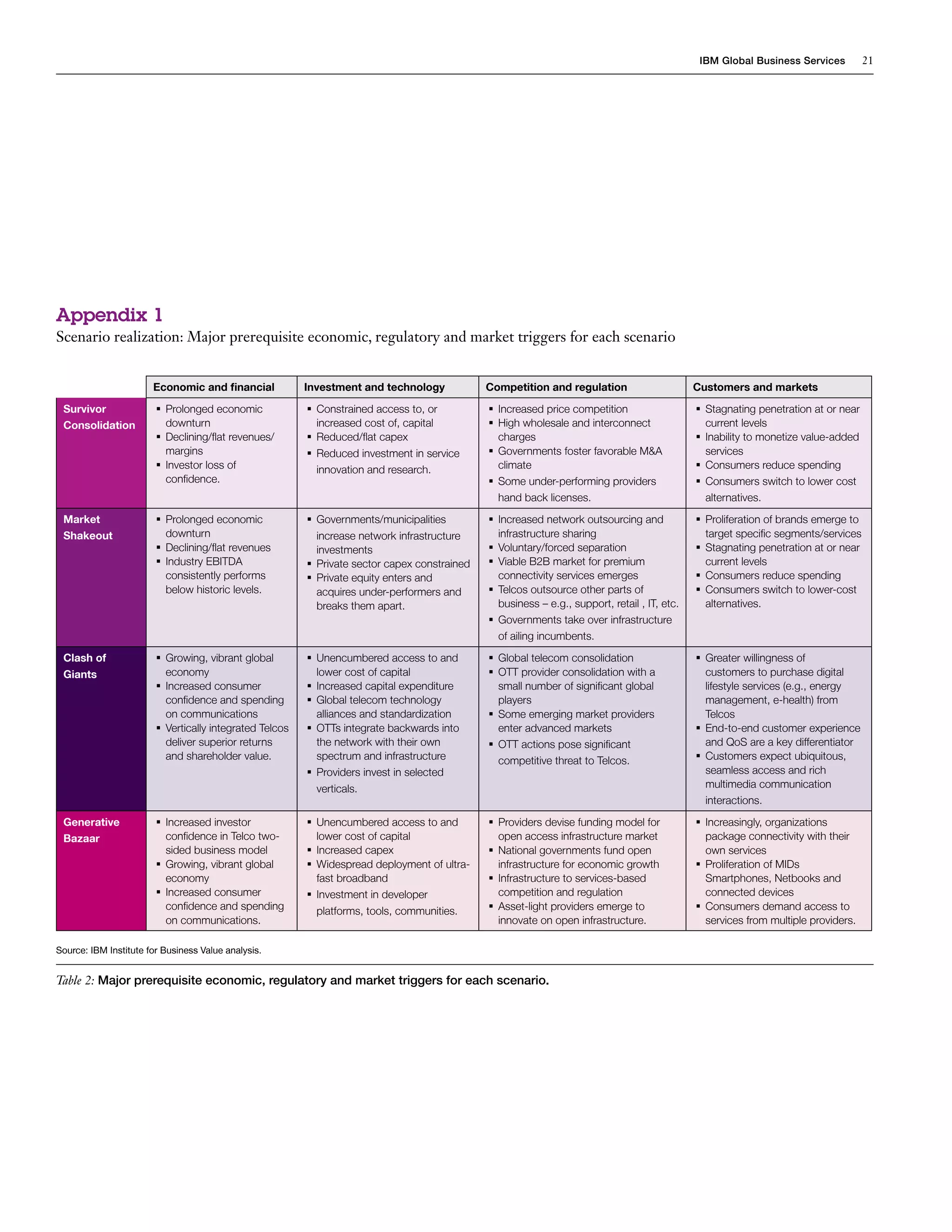

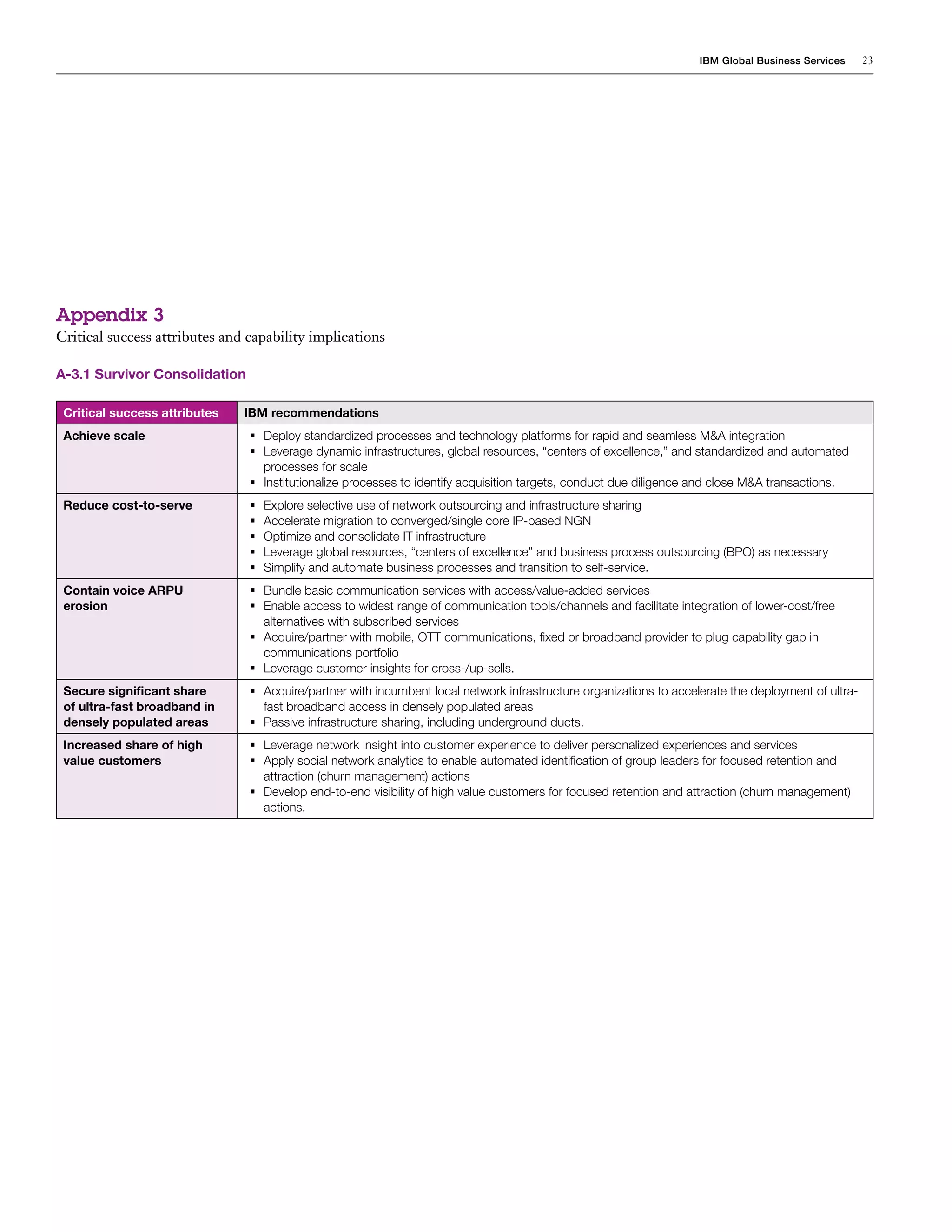

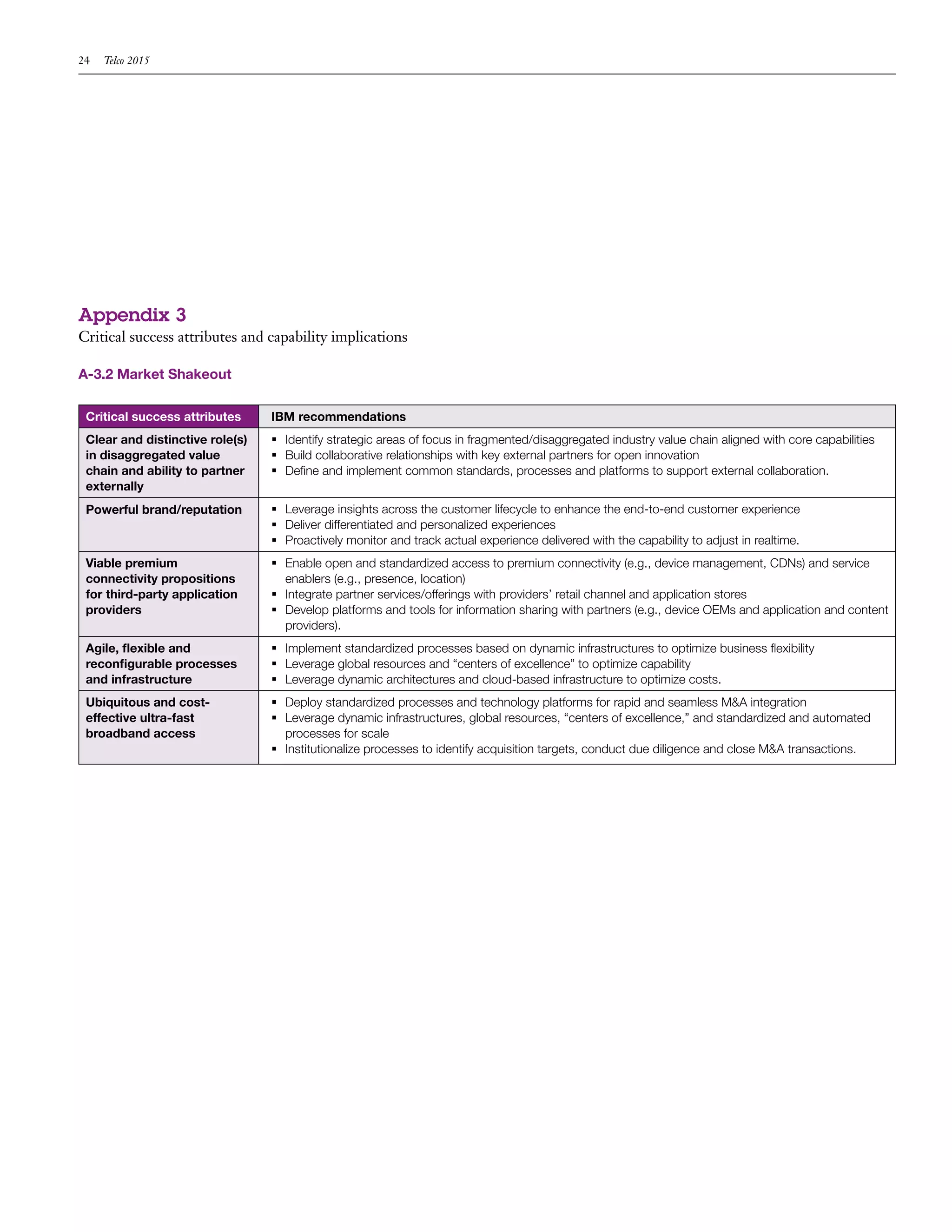

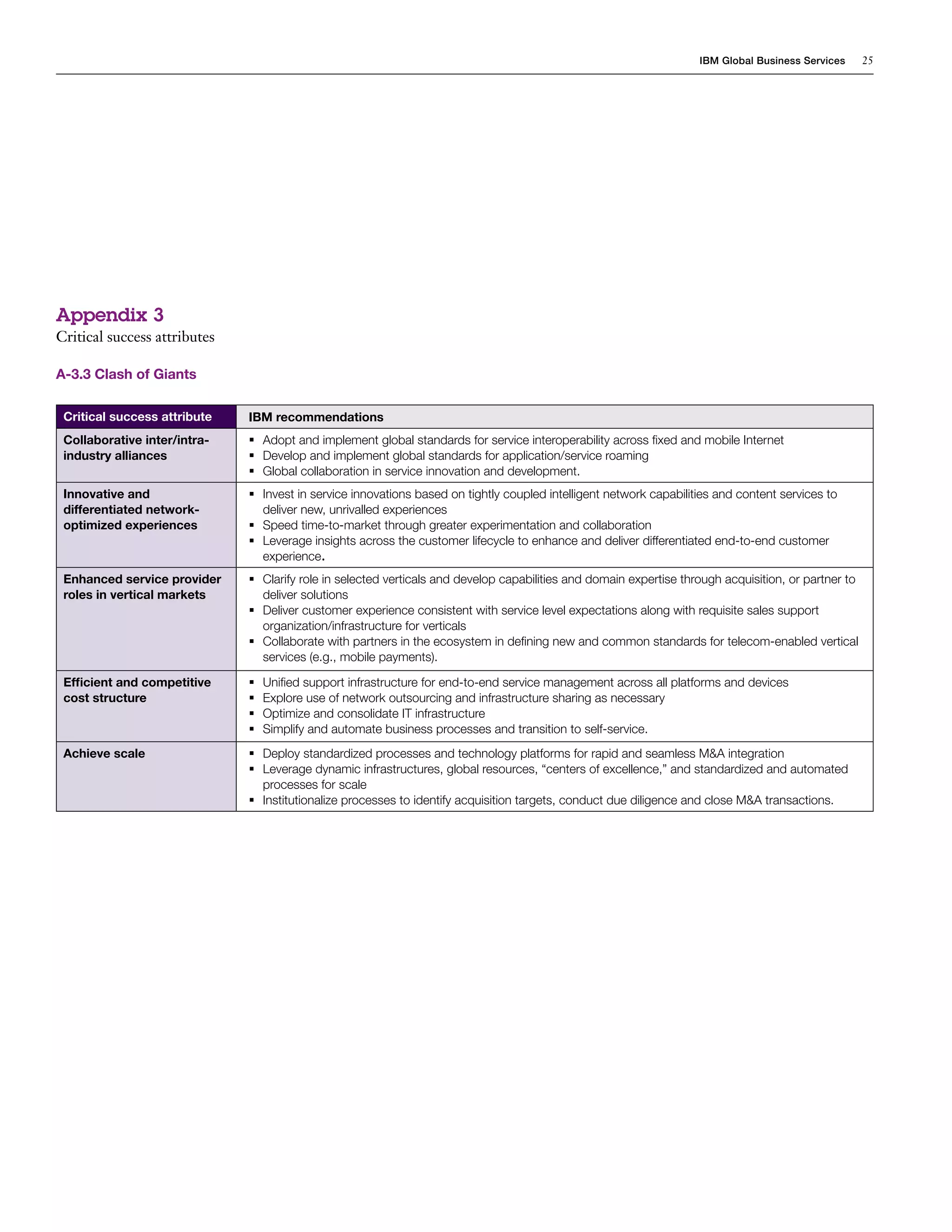

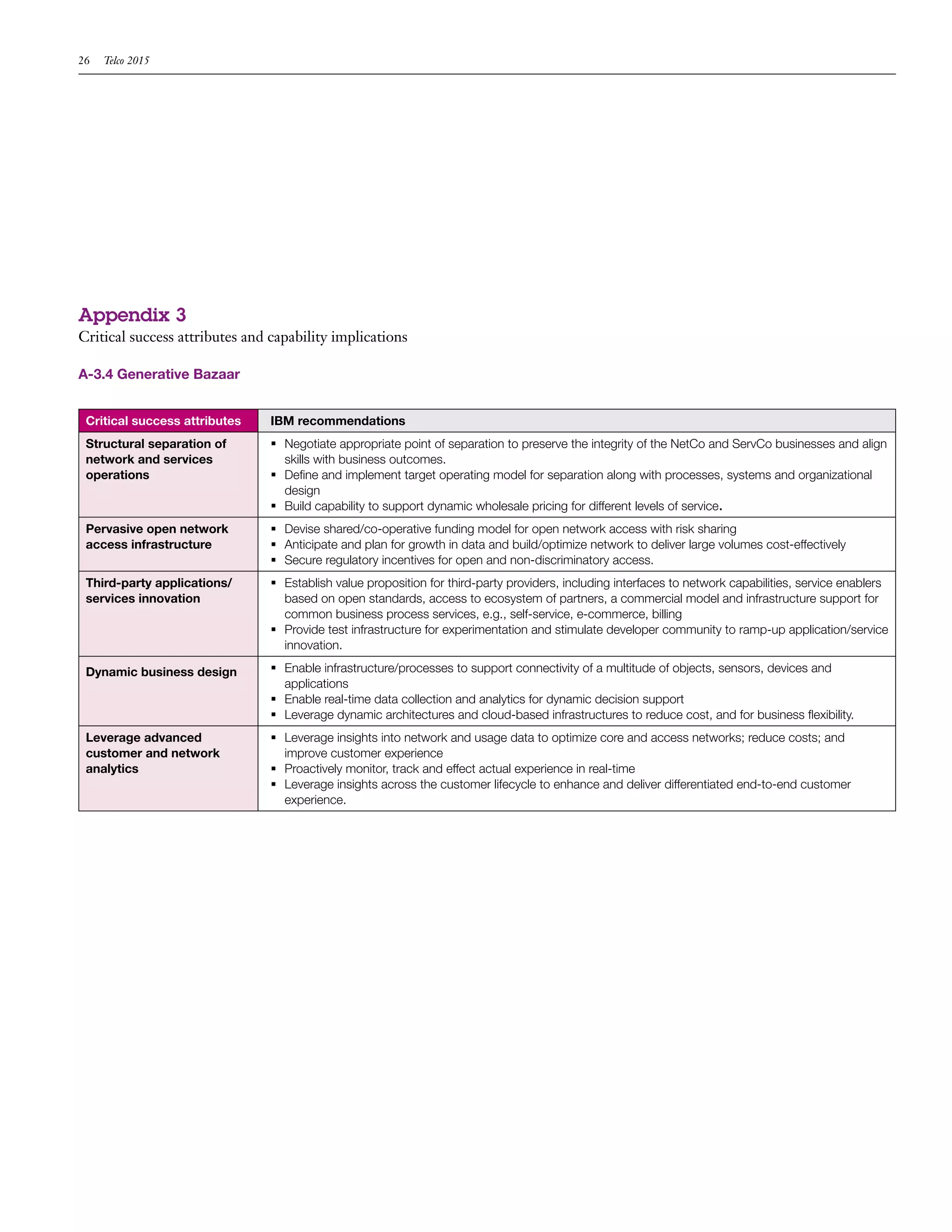

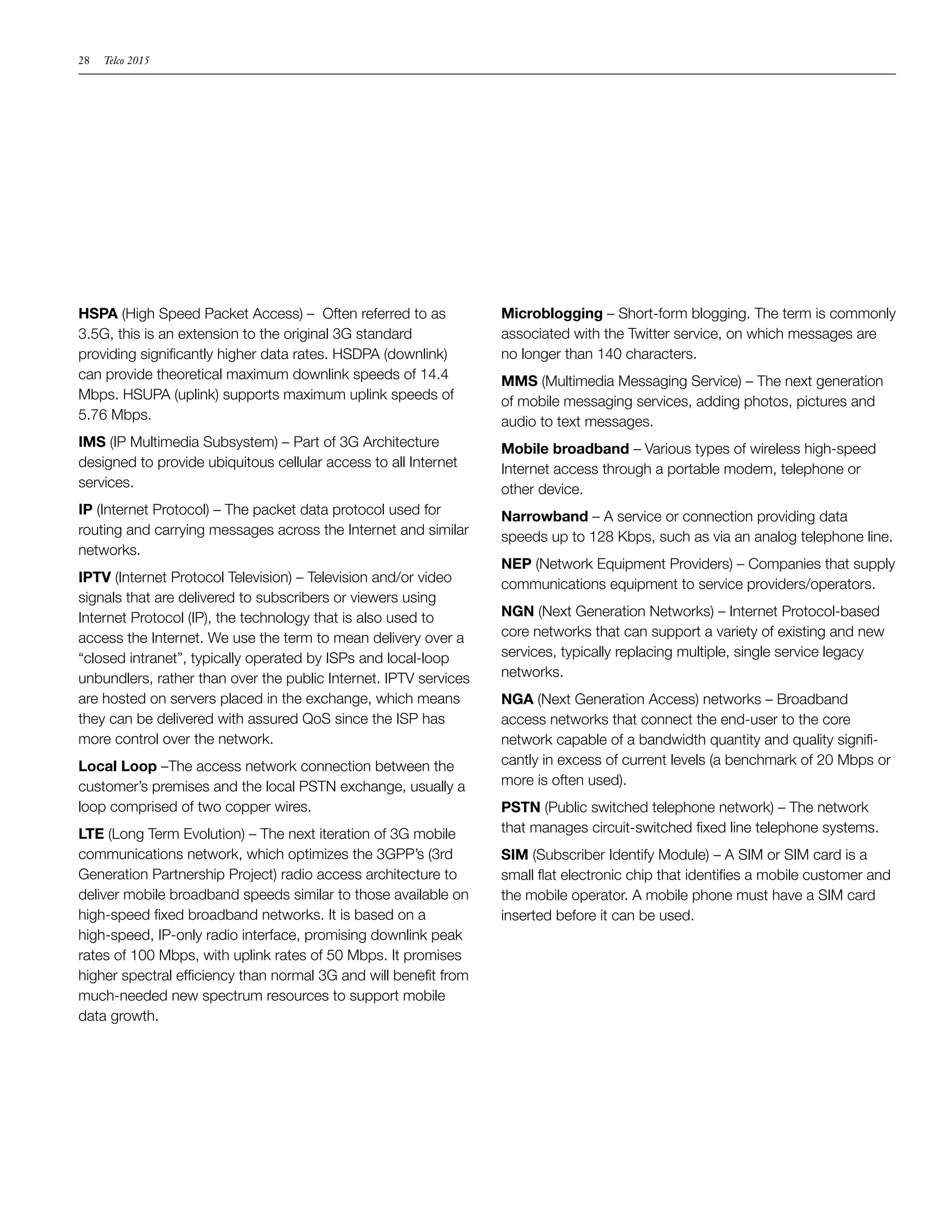

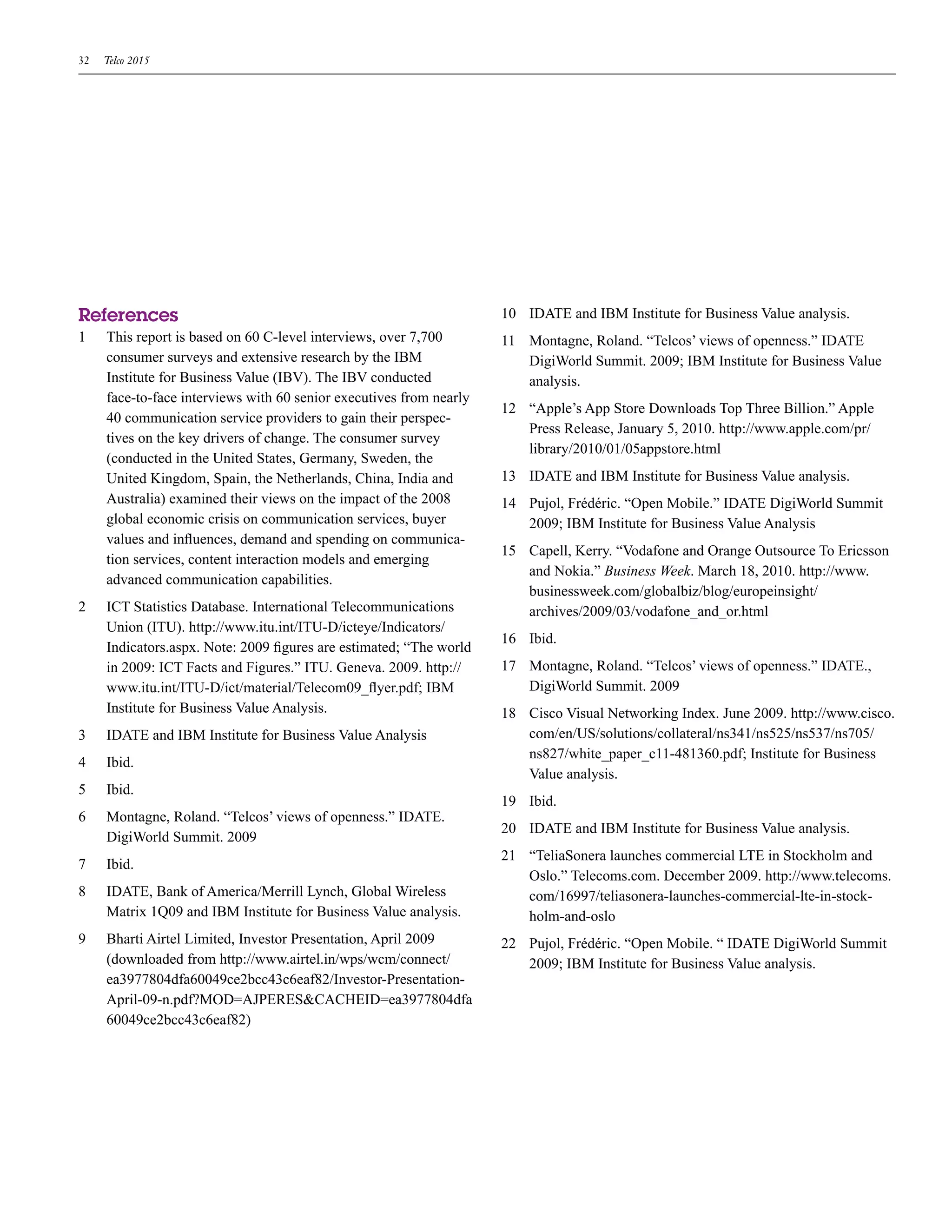

The IBM Global Business Services report analyzes the telecommunications industry, highlighting a stagnation in revenue growth due to market saturation in developing countries and the decline of traditional voice services. It presents four future scenarios for the industry's evolution over the next five years, ranging from consolidation and market fragmentation to more dynamic and profitable models driven by cooperation between providers. The report underscores the need for innovation and adaptation to overcome challenges and leverage opportunities in a changing communications landscape.