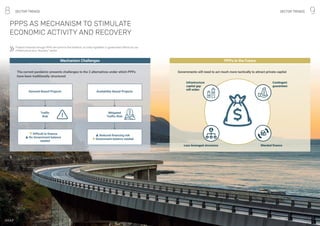

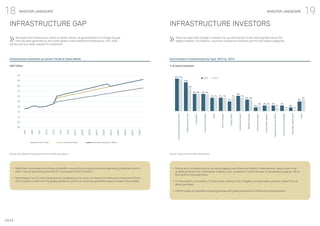

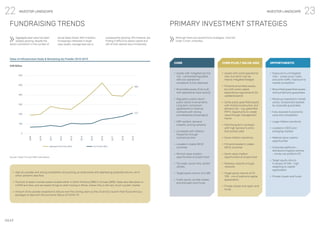

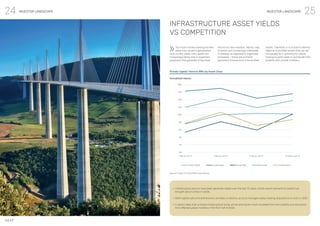

The document analyzes the current state and future trends in the global infrastructure sector post-COVID-19, highlighting a shift towards investments in digital and social infrastructure alongside traditional sectors like energy and transport. It notes a growing investor appetite, particularly from pension funds, amidst challenges such as high asset prices and declining deal flow. Future projections suggest significant public expenditure on infrastructure as governments aim to address gaps caused by underinvestment, with opportunities emerging in diverse areas, including telecommunications and renewable energy.