Embed presentation

Downloaded 105 times

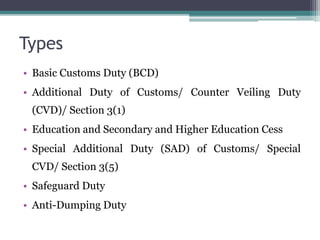

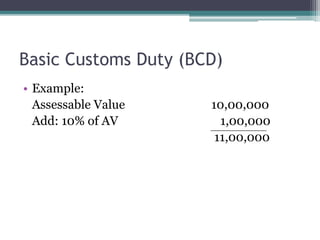

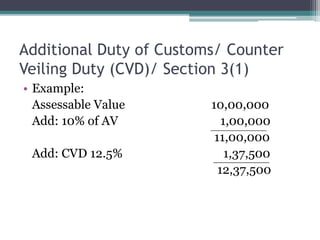

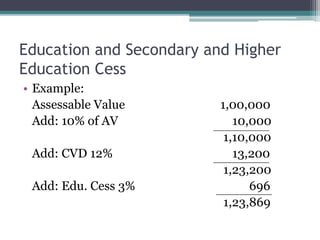

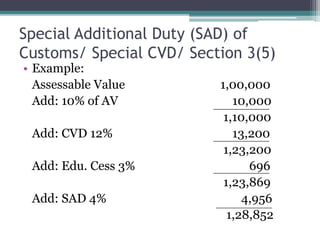

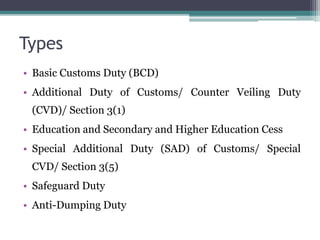

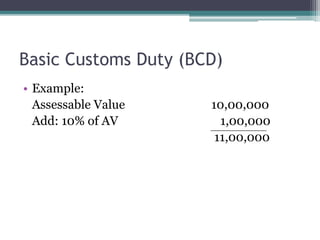

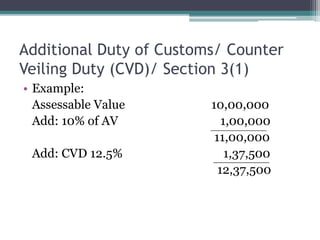

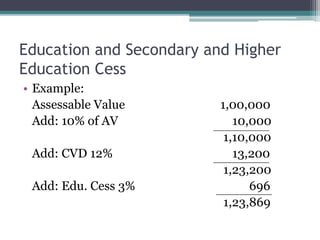

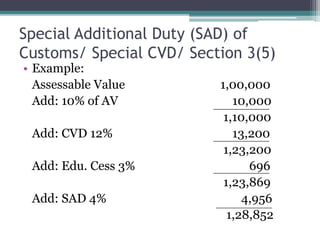

This document defines and explains customs duties in India. It states that customs duty is a tax imposed on imports and exports to raise government revenue and protect domestic industries. There are different types of customs duties including basic customs duty, additional duty, education and secondary education cess, and special additional duty. The document provides examples of how each duty is calculated and applied to the assessable value of imported goods.