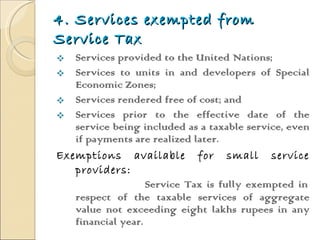

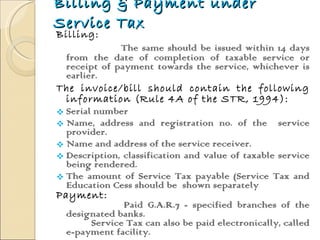

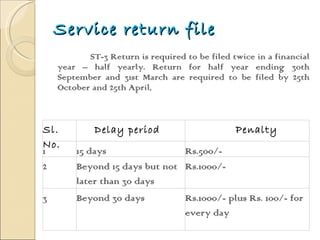

Service tax is a tax levied on service providers in India at a rate of 10.3% which includes a 10% service tax amount and 3% education cess on the service tax amount. Businesses providing taxable services exceeding Rs. 7 lakhs annually must register within 30 days by submitting Form ST-1 along with required documents. Certain services such as those provided to the UN or in special economic zones are exempted from service tax. Service providers with aggregate taxable services not exceeding Rs. 8 lakhs annually are also fully exempted. Invoice/bills for taxable services must be issued within 14 days and contain specified details, and service tax must be paid through specified banks using challan GAR

![Registration under Service Tax law Exceeding Rs. 7 lakhs, Time period to obtain registration : within 30 days of commencement of business – both new and existing company Procedure for Registration under Service Tax: Form ST-1 (in duplicate) A copy of PAN card, proof of address of business premise(s), constitution of the business [proprietorship, firm, company, trust, institute etc.] Registration certificate - within a period of seven days Failure of registration may attract a penalty up to Rs.1000/-](https://image.slidesharecdn.com/servicetaxpresentation-111011044840-phpapp01/85/Service-tax-presentation-5-320.jpg)