The document discusses various topics related to CENVAT (Central Value Added Tax), including:

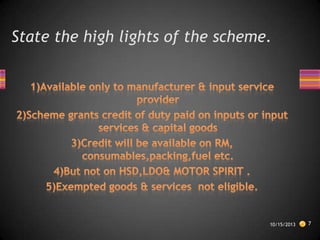

- CENVAT aims to levy tax only on value added at each stage.

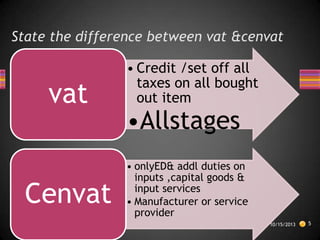

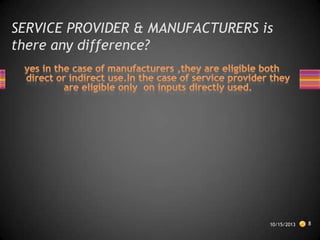

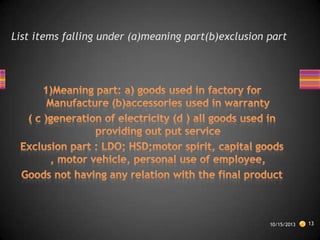

- VAT allows credit/set off of all taxes on all bought out items, while CENVAT only allows credit of excise duty and additional duties on inputs, capital goods, and input services for manufacturers and service providers.

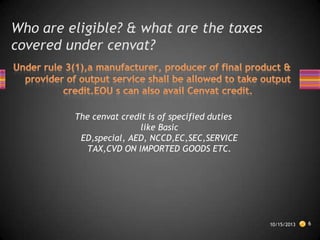

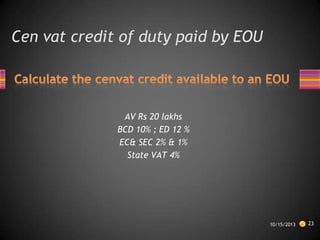

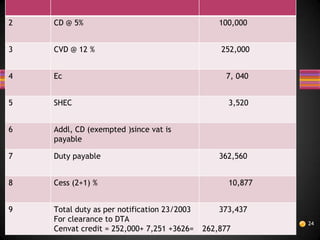

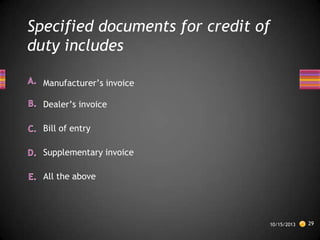

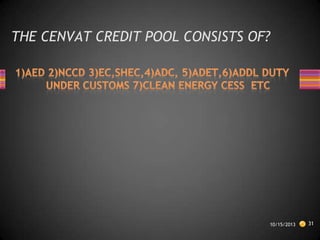

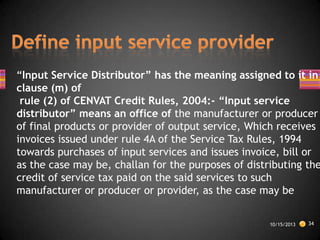

- Those eligible for CENVAT credit include manufacturers and service providers, and the credit covers taxes like basic excise duty, special additional duty, education cess, and service tax.