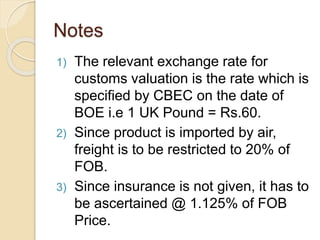

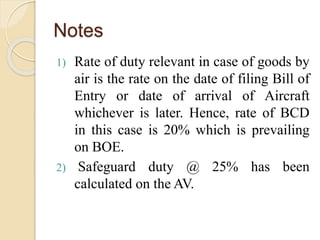

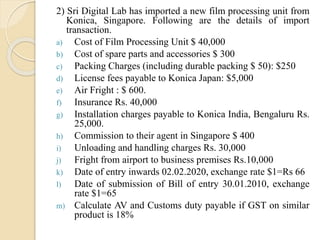

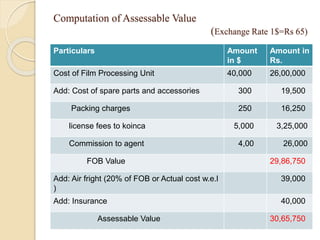

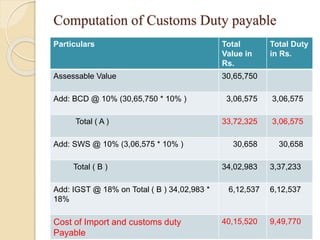

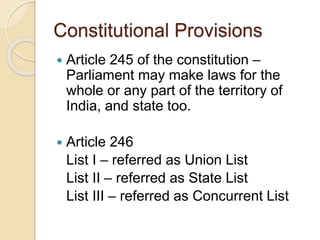

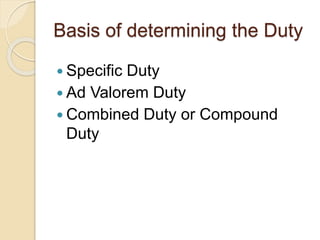

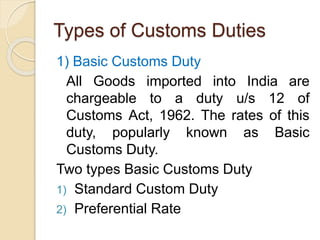

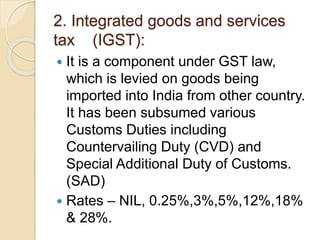

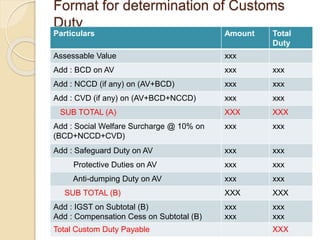

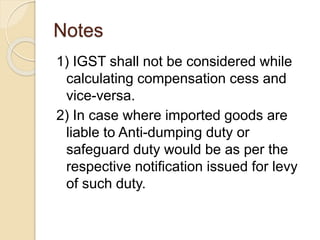

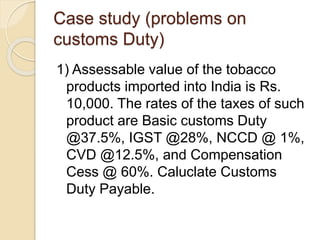

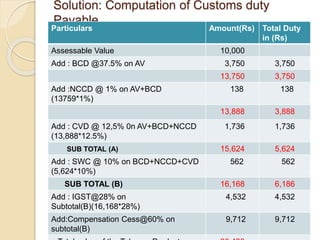

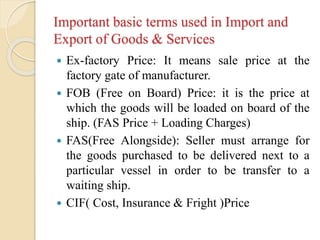

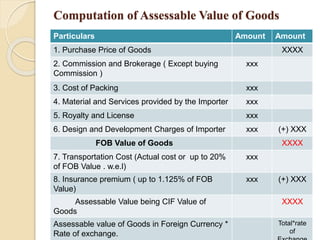

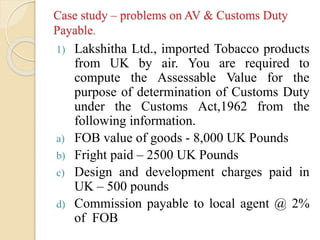

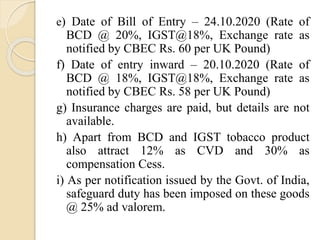

The document discusses customs duty in India, emphasizing its types, including basic customs duty, integrated goods and services tax (IGST), and various additional duties. It outlines the legal framework governing customs, methods for calculating duties, and provides detailed computations through case studies on different import scenarios. Key components such as assessable value, exemptions, and specific rates based on the goods imported are also elaborated.

![Particulars UK Pounds Amount in

Rs.

FOB Value 8,000 4,80,000

Add: Design and development charges 500 30,000

FOB value for customs 8,500 5,10,000

Add: Freight charges [restricted to 20% of

FOB 5,10,000 * 20% ]

1,02,000

Add: Insurance @ 1.125% on 5,10,000 5,738

Add: Commission payable to local Agent @

2% on 5,10,000

10,200

Assessable Value 6,27,938

Computation of Assessable Value

(Exchange Rate 1UKP = Rs

60 )](https://image.slidesharecdn.com/it-customsduty2021-230203171649-ceeef26e/85/Customs-duty-25-320.jpg)