1. The key amendments in the 2012 Finance Act related to service tax include increasing the service tax rate from 10% to 12% plus a 3% cess, bringing in a negative list approach where only specified services will be taxed, and introducing reverse charge mechanisms for certain services.

2. Under the negative list approach, only services specified in the negative list and exempted list will remain outside the scope of service tax. All other services will be taxable unless specifically exempted.

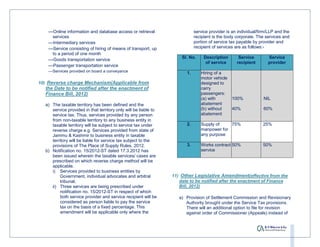

3. The reverse charge mechanism will apply to certain services provided by individuals/firms to corporate entities, as well as services provided by the government and arbitrators. The recipient of these services will now be liable to pay the service