Embed presentation

Downloaded 102 times

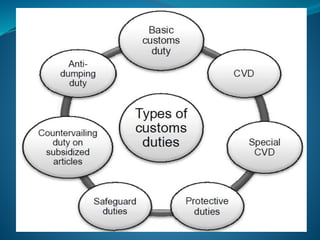

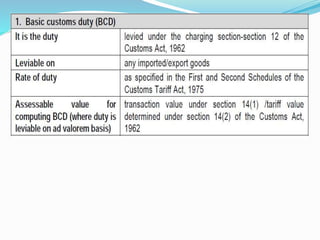

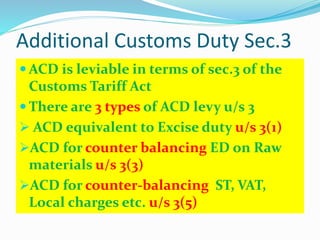

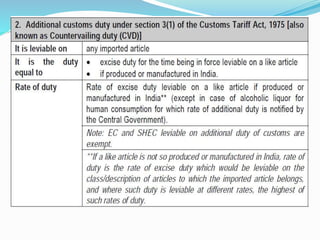

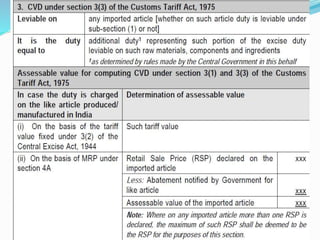

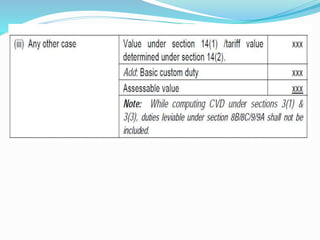

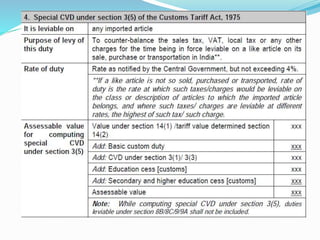

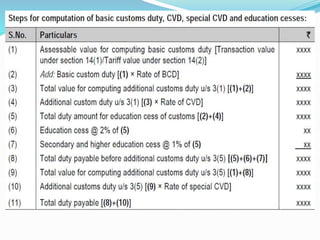

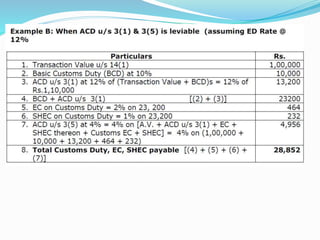

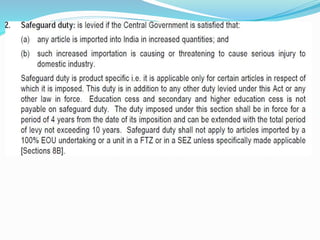

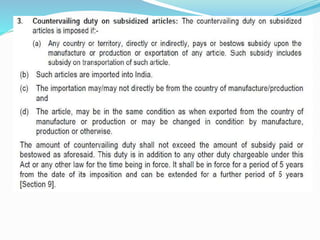

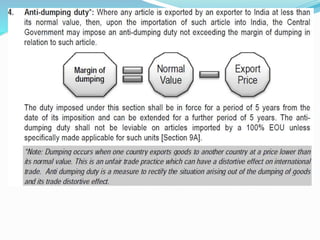

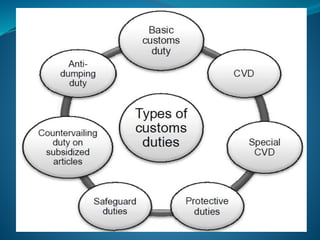

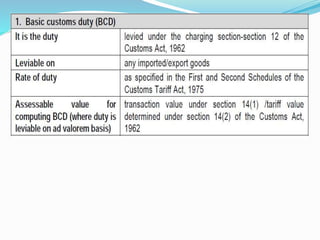

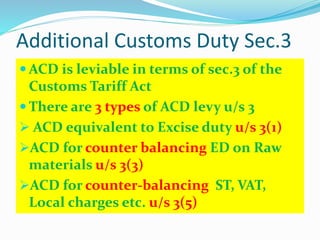

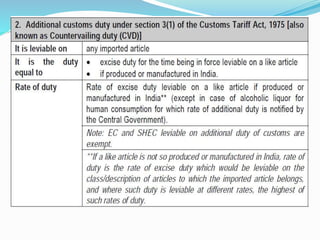

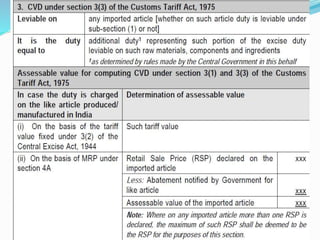

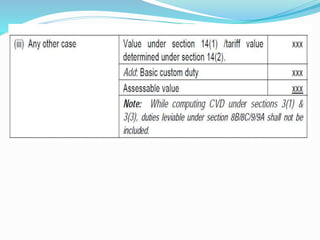

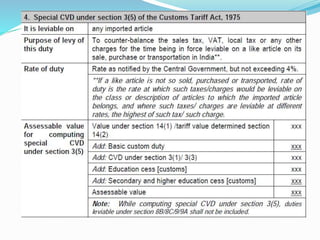

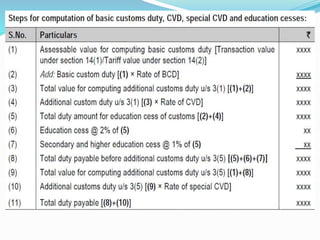

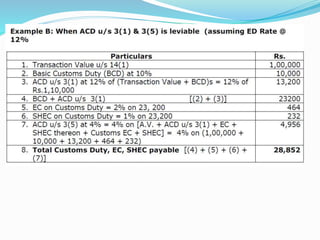

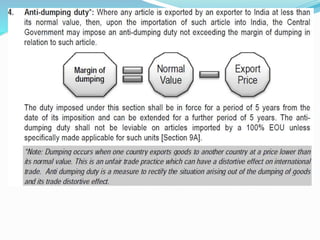

There are several types of customs duties that can be levied on imported goods into India. Additional customs duty as per Section 3 of the Customs Tariff Act includes: 1) duty equivalent to excise duty under Section 3(1), also known as countervailing duty; 2) duty to counterbalance excise duties on raw materials under Section 3(3); and 3) duty to counterbalance state taxes like VAT under Section 3(5). Other duties include protective duties under Section 6, safeguard duties under Section 8B, countervailing duties on subsidized articles under Section 9, and anti-dumping duties under Section 9A.