Embed presentation

Downloaded 14 times

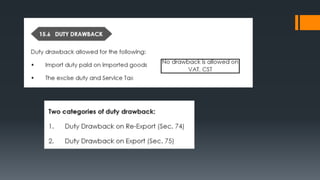

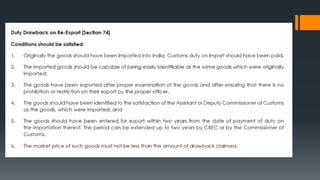

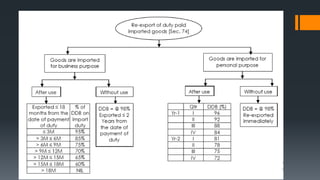

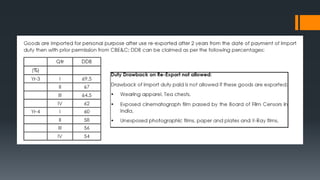

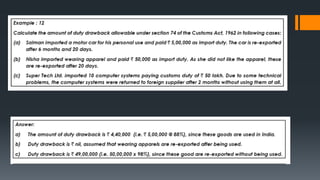

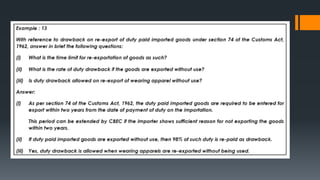

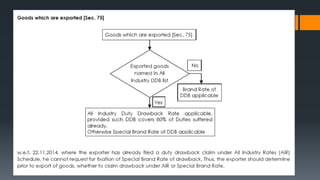

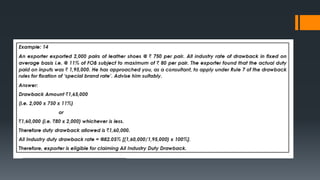

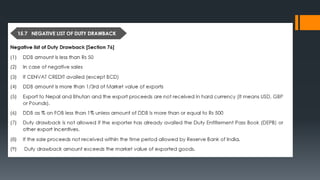

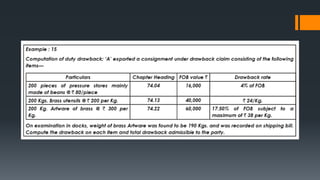

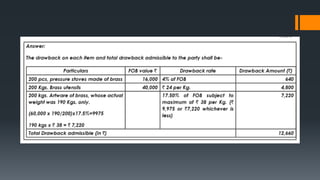

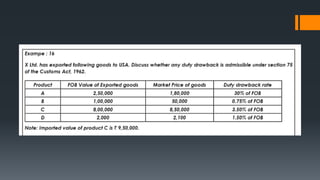

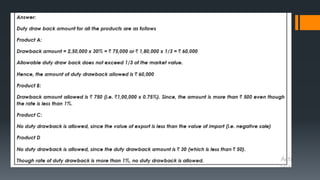

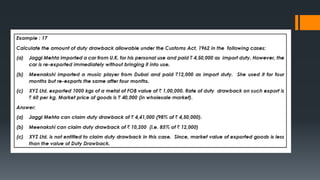

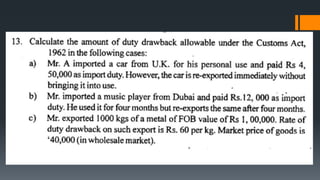

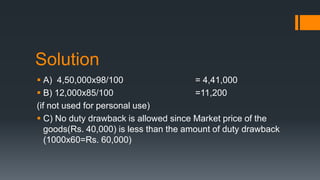

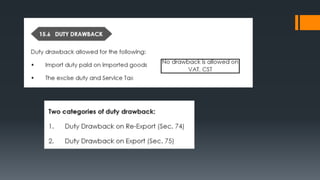

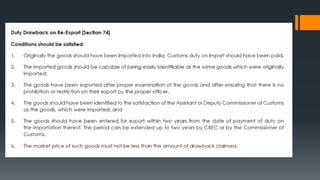

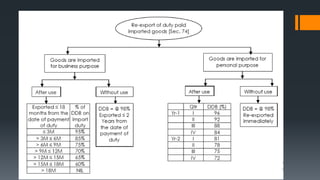

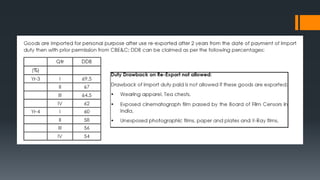

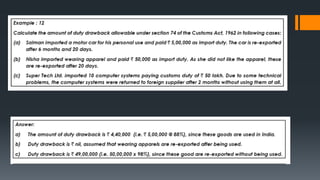

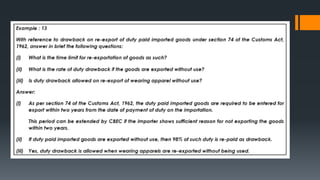

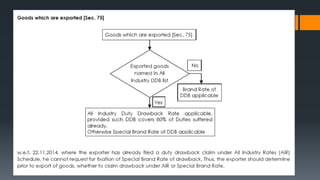

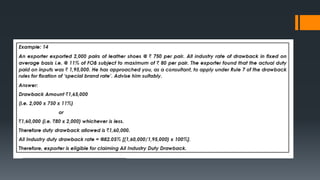

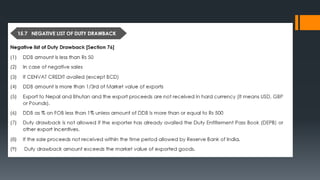

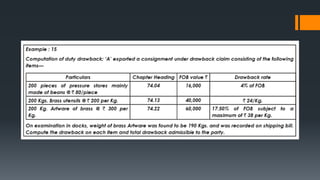

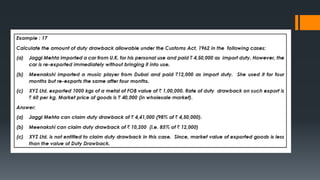

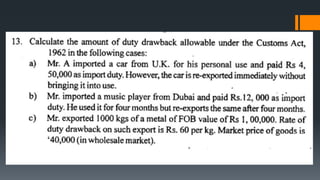

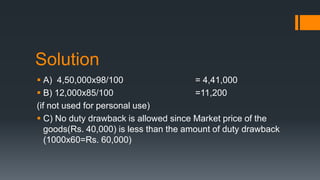

Duty drawback is a refund of excise or import duties paid on goods that are exported. Exporters can claim a partial or full refund on import duties paid on raw materials used for producing exported goods or on imported goods that are exported within a stipulated time period. Duty drawback aims to refund import duties paid to make exported goods more competitive in foreign markets.