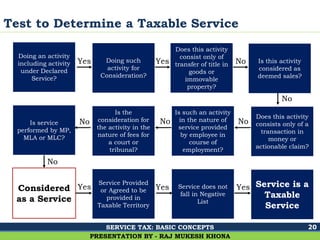

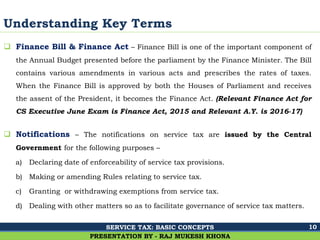

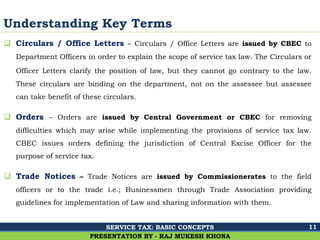

This document provides an overview of key concepts related to service tax in India. It discusses how service tax was introduced in 1994 and expanded in 2012 to apply to all services besides those on a negative list. The administration and legislation governing service tax is explained, including the Finance Act, rules, notifications and departments responsible for its implementation and collection. Key terms like taxable territory, charging section, and the test to determine a taxable service are also summarized.

![Ghalla & Bhansali, Chartered Accountants

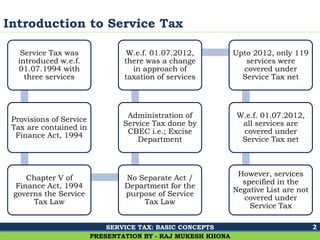

Power to Levy Service Tax

4

PRESENTATION BY - RAJ MUKESH KHONA

Entry No. 97

Residuary

Entry

[Entry No. 92C

not effective]

Union List

of Indian

Constitution

Article

246 – 7th

Schedule

SERVICE TAX: BASIC CONCEPTS](https://image.slidesharecdn.com/basic-concepts-of-service-tax-160214204640/85/Basic-Concepts-of-Service-Tax-4-320.jpg)

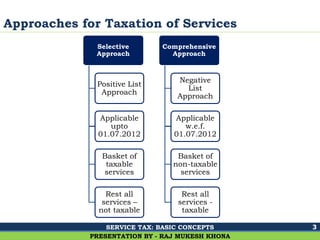

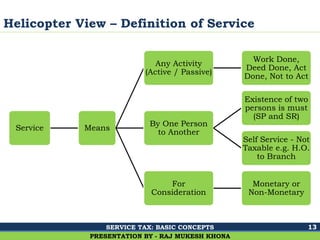

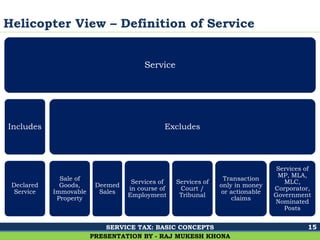

![Ghalla & Bhansali, Chartered Accountants

Definition of Service [Section 65B(44)]

12

PRESENTATION BY - RAJ MUKESH KHONA

means includes excludes

Any Activity

Carried out by a

person for another *

For Consideration

Declared Services

Any activity which

constitutes merely -

Provision of services

by employee to

employer

Fees taken

by court or

tribunal

Transfer of title in goods or immovable property

by way of sale, gift or in any other manner

Transfer which is deemed to be a sale as per

Clause (29A) of Article 366 of the Constitution

Transaction in money or actionable claims

Service

SERVICE TAX: BASIC CONCEPTS](https://image.slidesharecdn.com/basic-concepts-of-service-tax-160214204640/85/Basic-Concepts-of-Service-Tax-12-320.jpg)

![Ghalla & Bhansali, Chartered Accountants

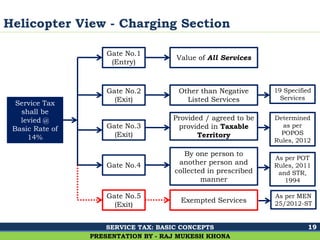

Charging Section [Section 66B]

16

PRESENTATION BY - RAJ MUKESH KHONA

Service Tax shall be

levied on

Value of all services

Provided or agreed to be

provided

In a taxable territory

Other than services

specified in negative list

SERVICE TAX: BASIC CONCEPTS](https://image.slidesharecdn.com/basic-concepts-of-service-tax-160214204640/85/Basic-Concepts-of-Service-Tax-16-320.jpg)