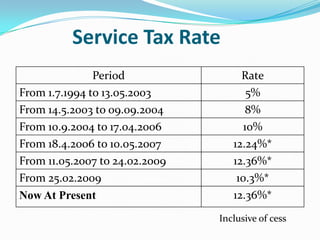

1) Service tax is an indirect tax imposed by the Government of India on the provision of certain services. The current rate is 12.36% of the gross value of taxable services.

2) A wide range of services are covered under service tax including rail travel agents, tour operators, stock exchange services, internet and telecommunication services.

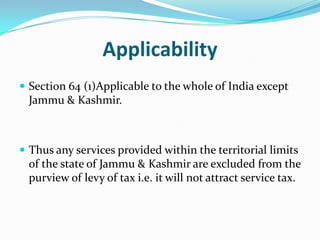

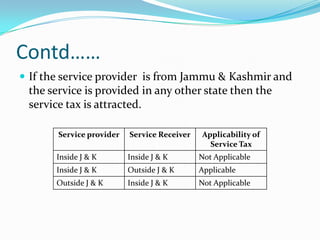

3) Service tax applies throughout India except the state of Jammu and Kashmir. If a service provider located in Jammu and Kashmir provides services outside the state, service tax is applicable.