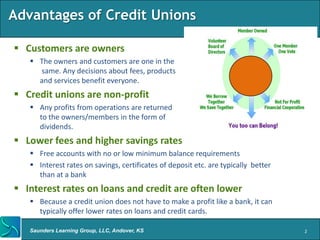

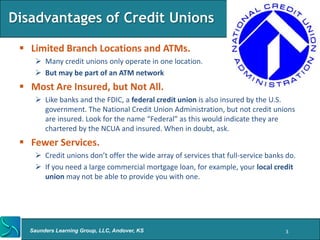

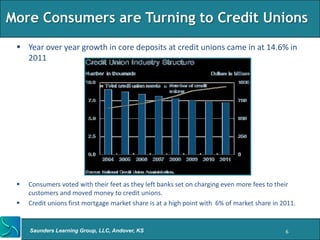

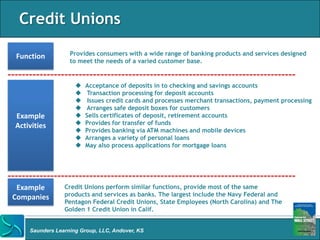

The document provides an overview of credit unions as an alternative to banks, highlighting their advantages such as being member-owned and non-profit, which allows for lower fees and better interest rates. It also addresses disadvantages like limited services and fewer branch locations. Furthermore, trends indicate that more consumers are shifting to credit unions for their financial needs, particularly due to rising dissatisfaction with traditional banks.