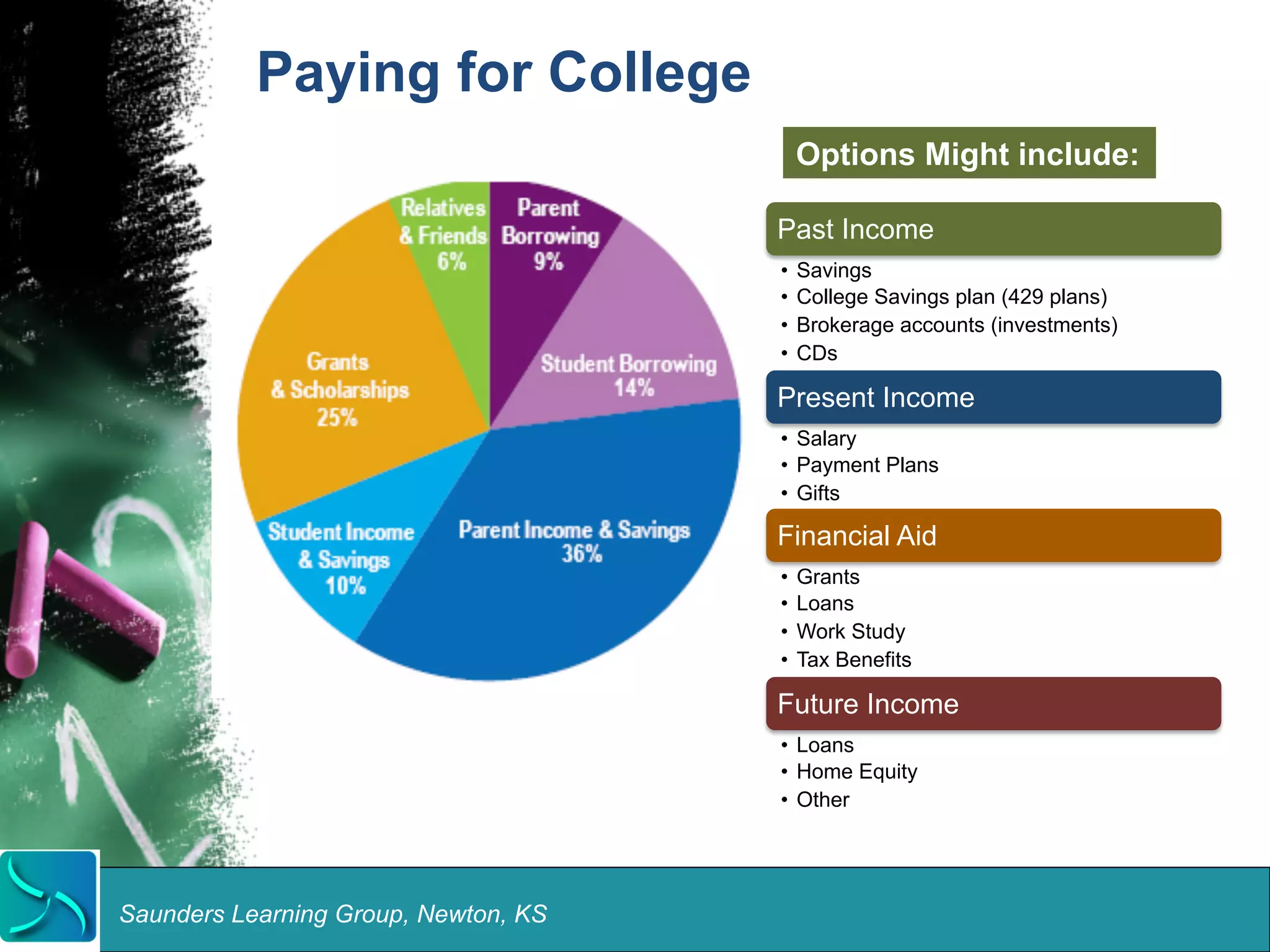

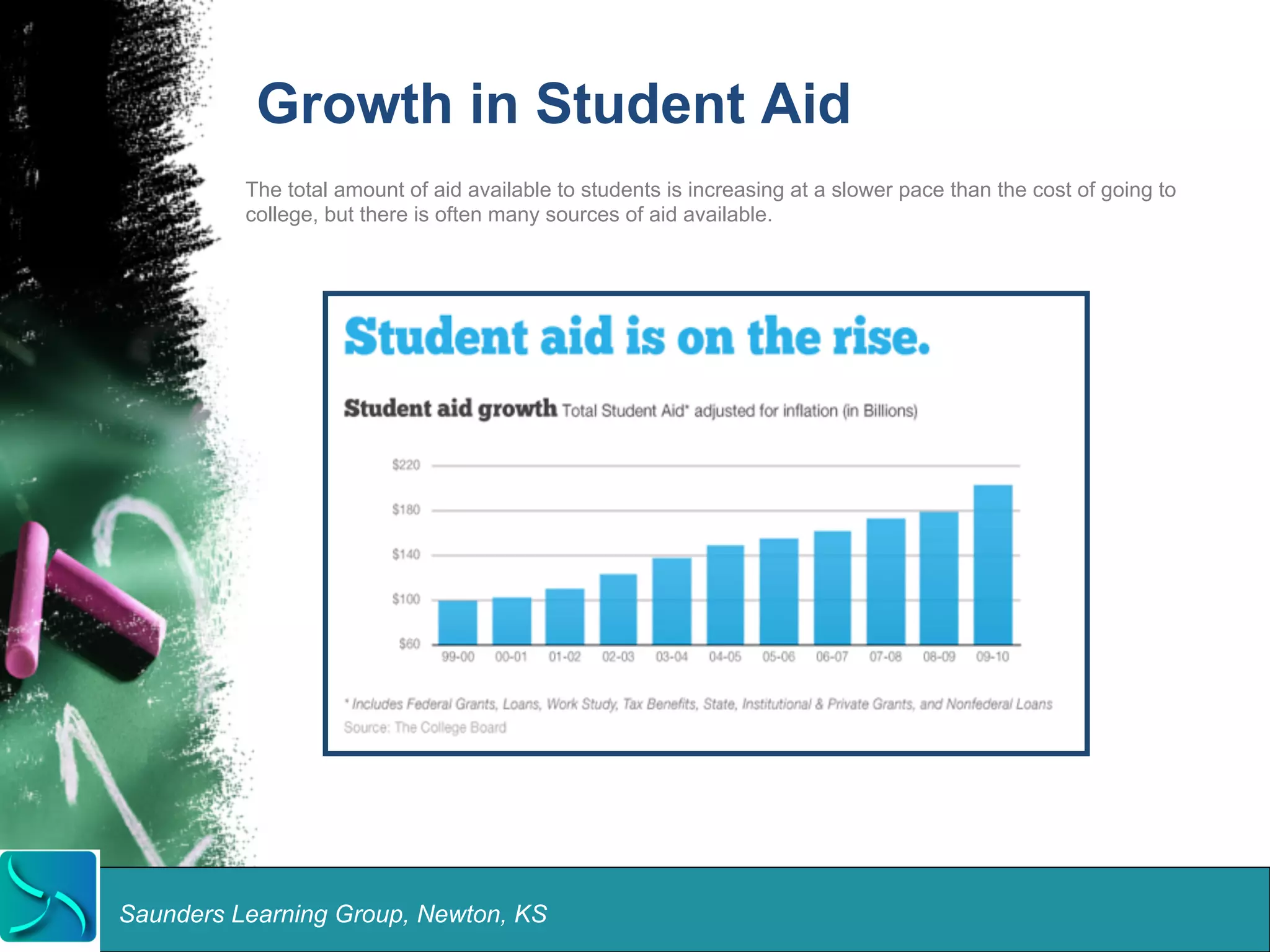

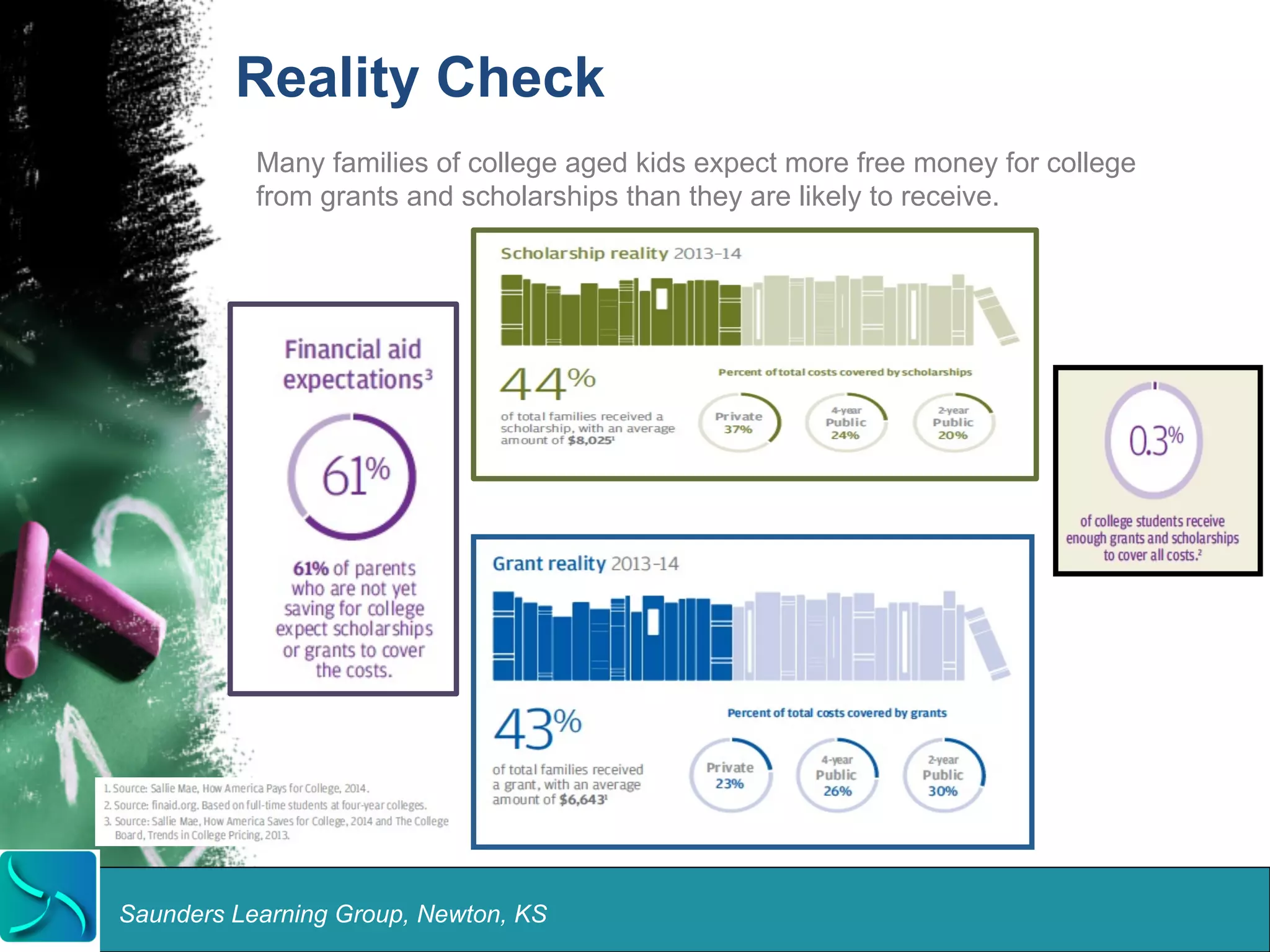

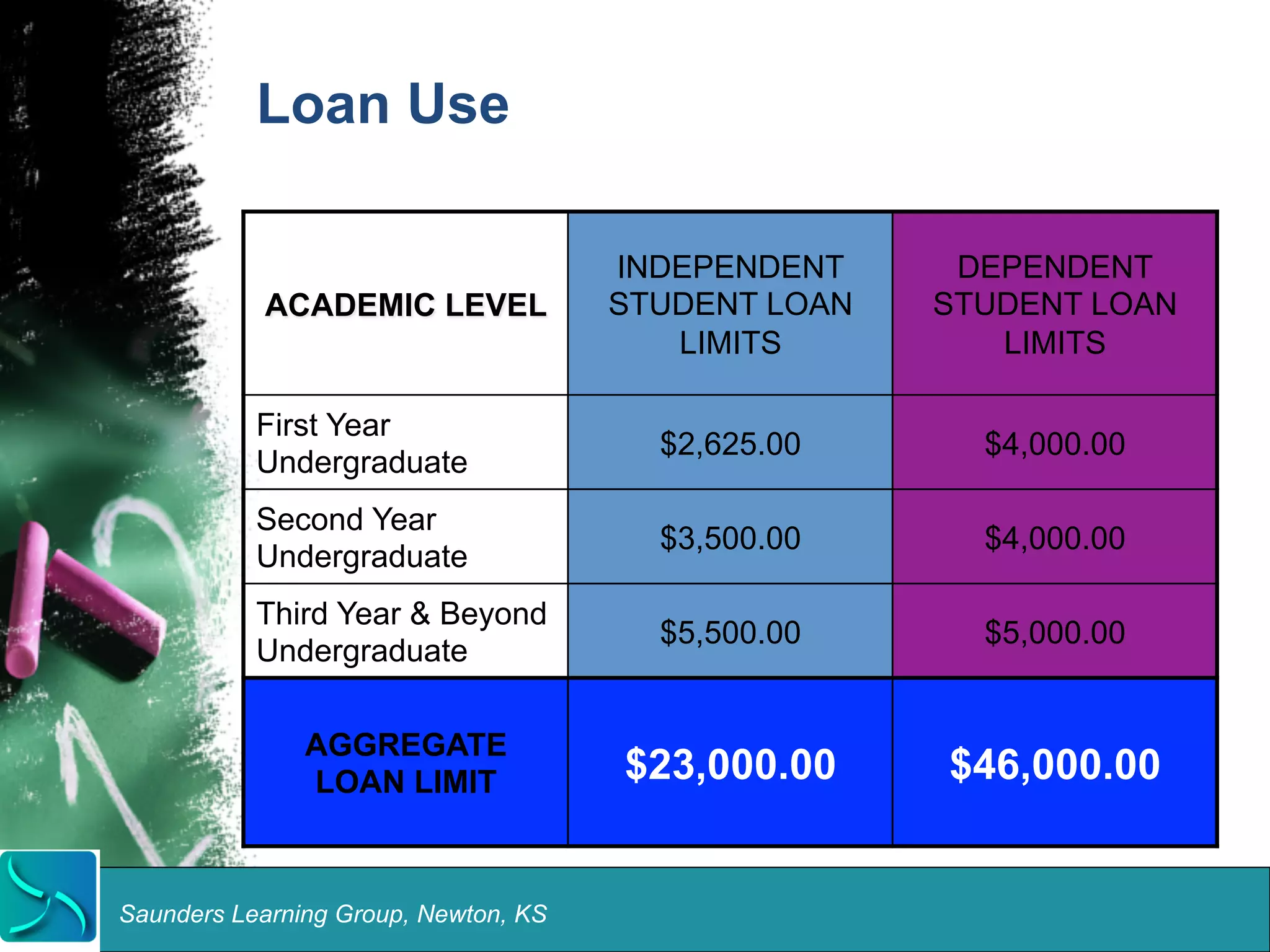

The document provides an overview of financial aid options available for college students, including grants, loans, and savings plans, highlighting the importance of financial assistance in attending college. It discusses the various types of loans, eligibility criteria for federal financial aid, and common misconceptions about expected financial contributions. Additionally, the document offers practical tips for saving and financing education, emphasizing the need for early planning and awareness of deadlines.