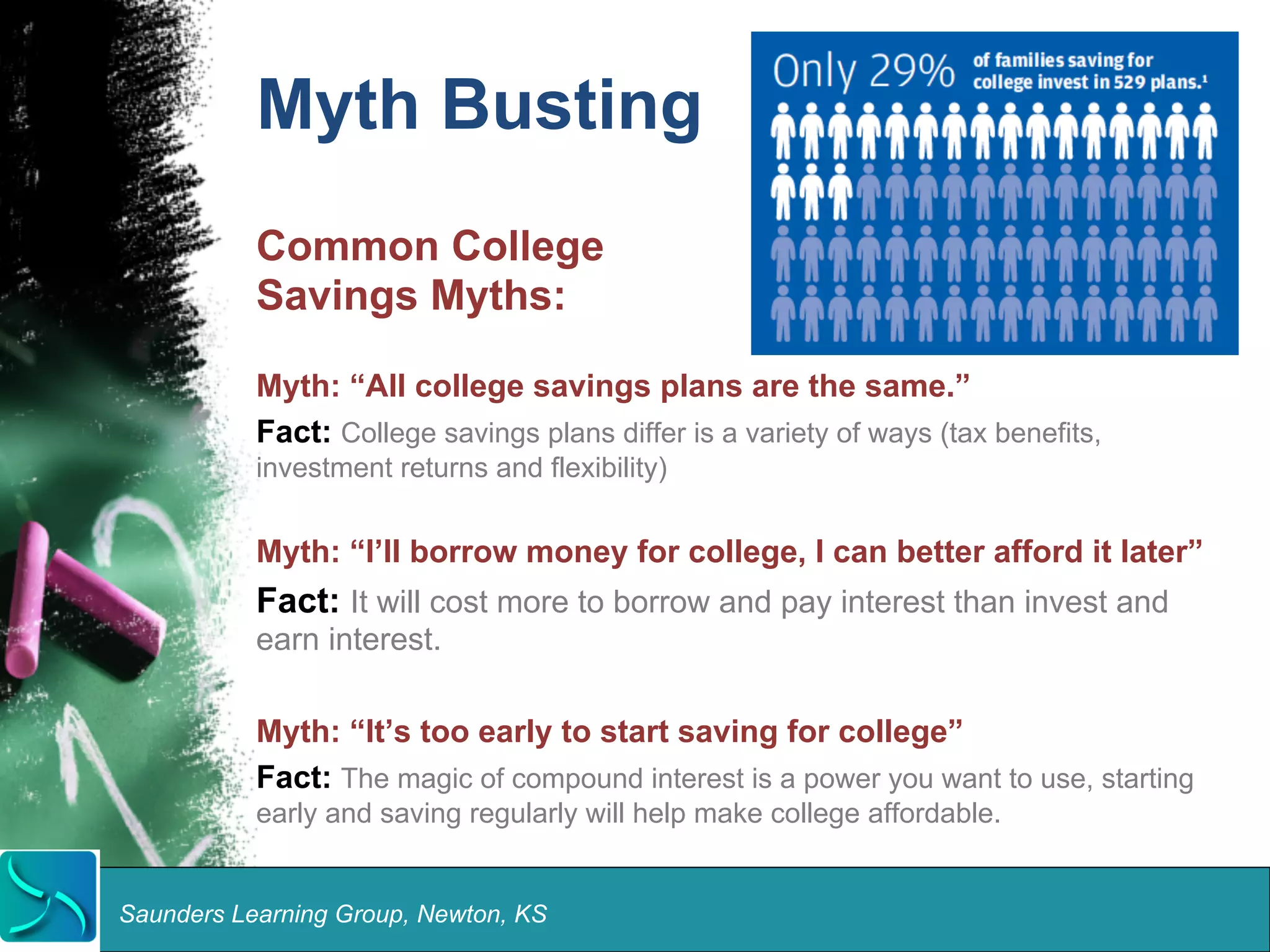

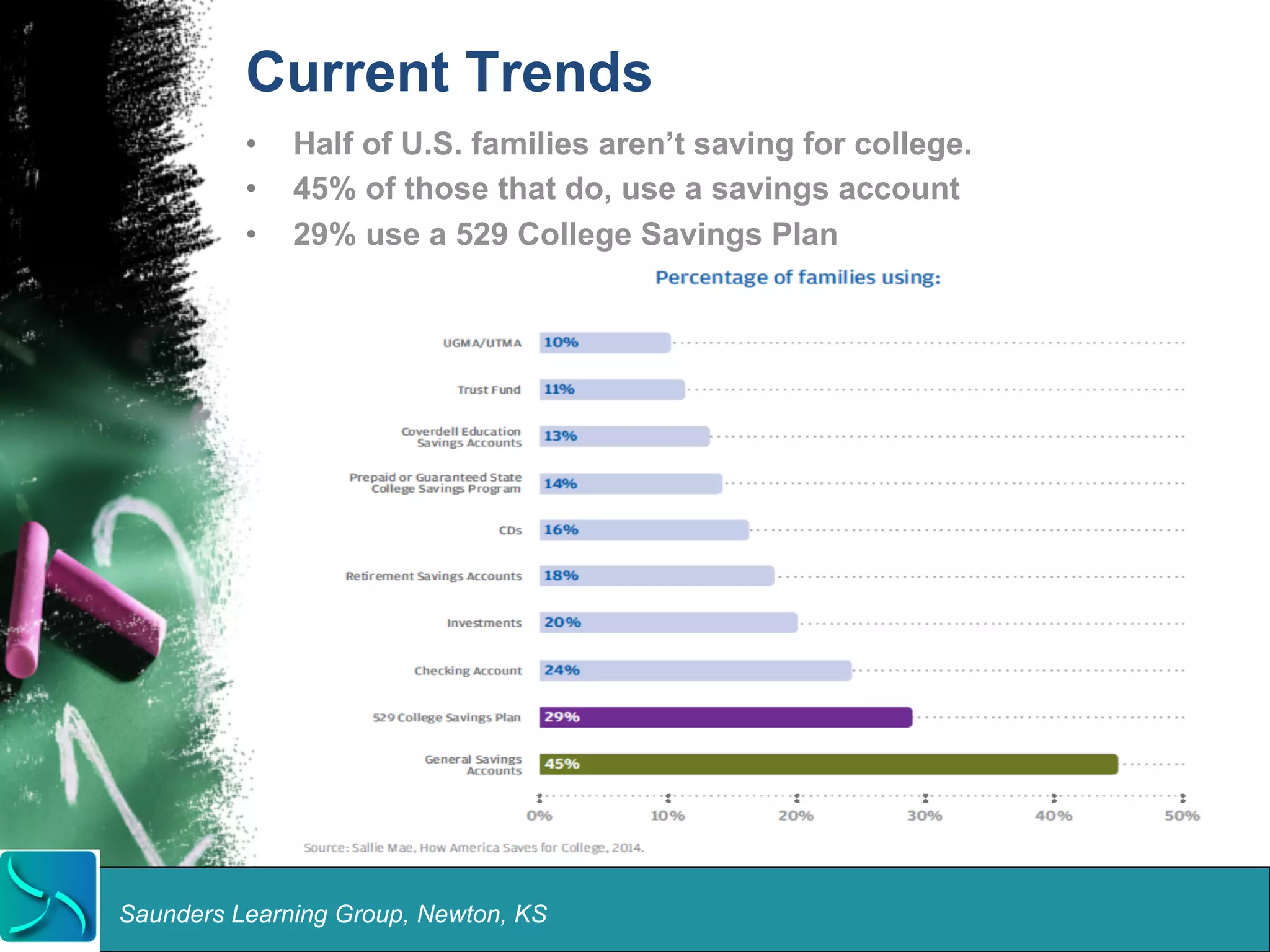

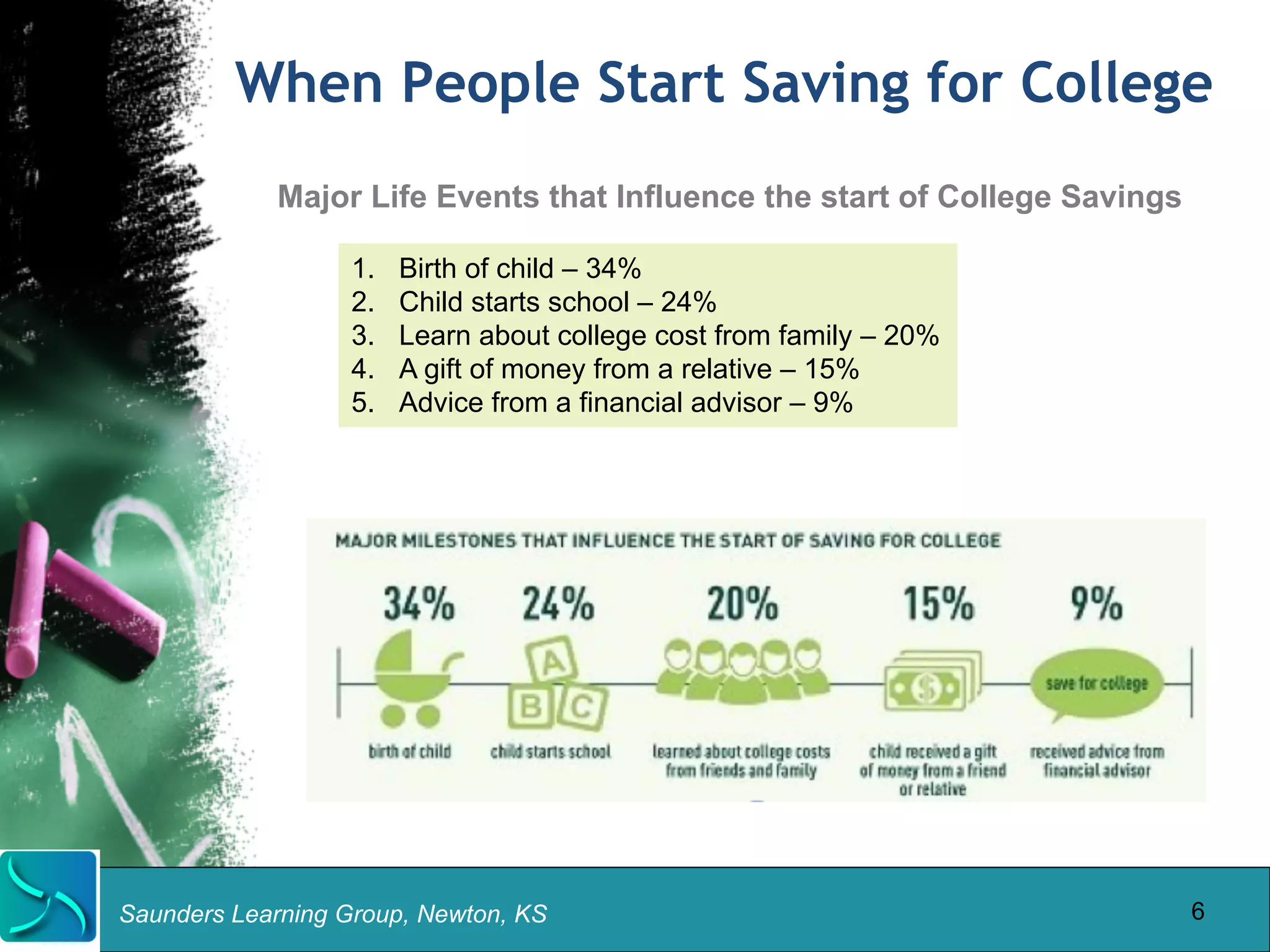

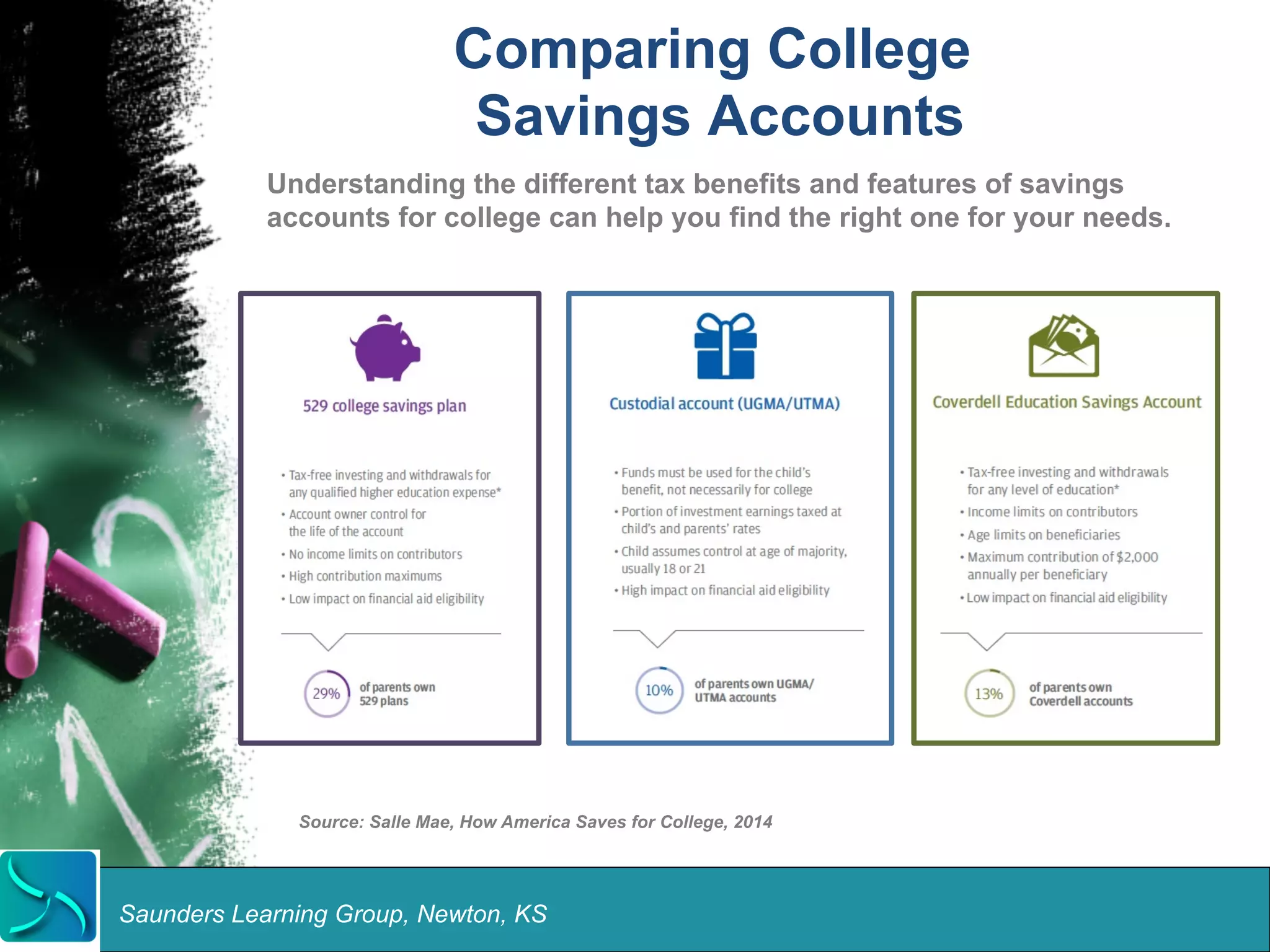

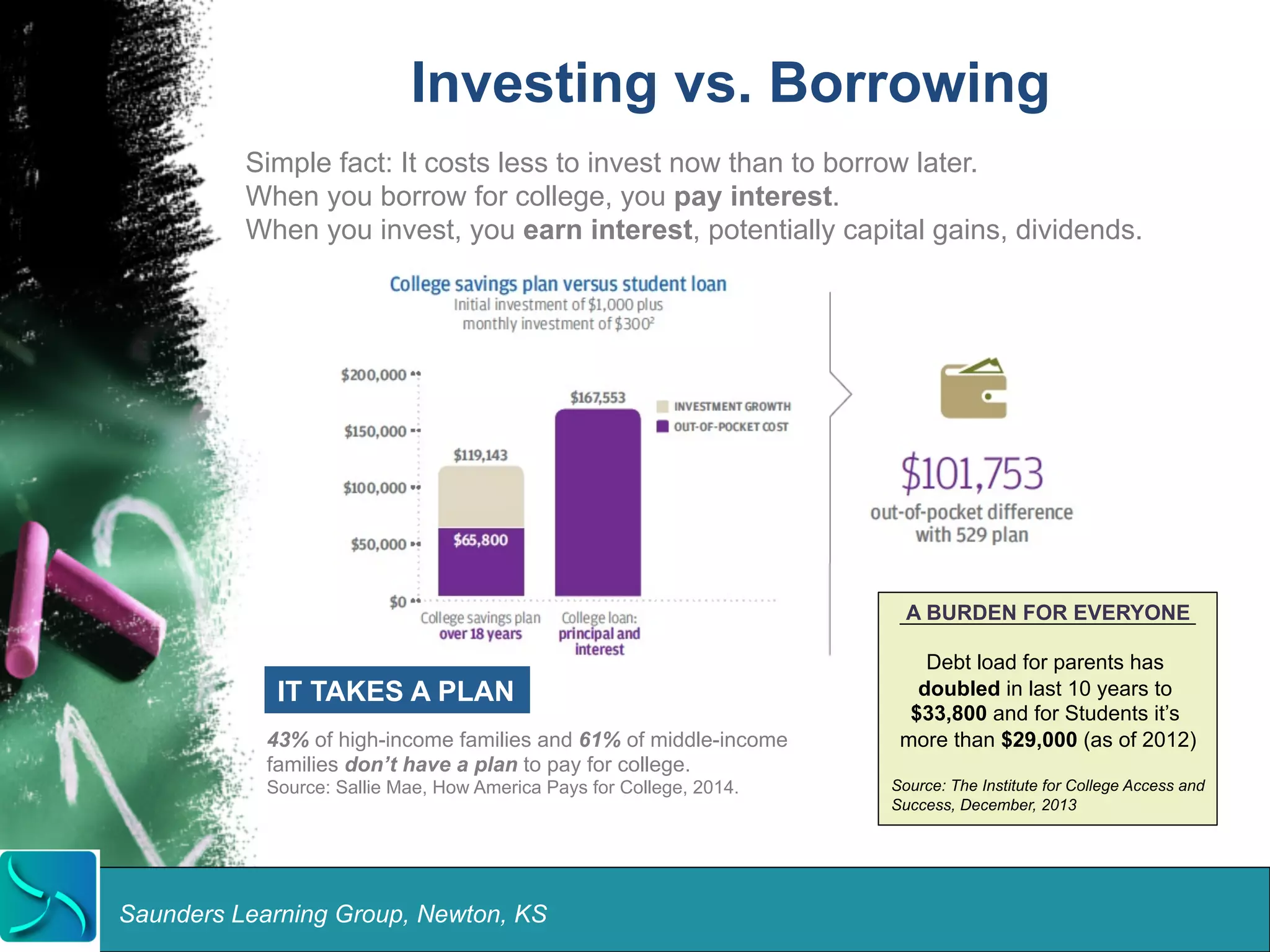

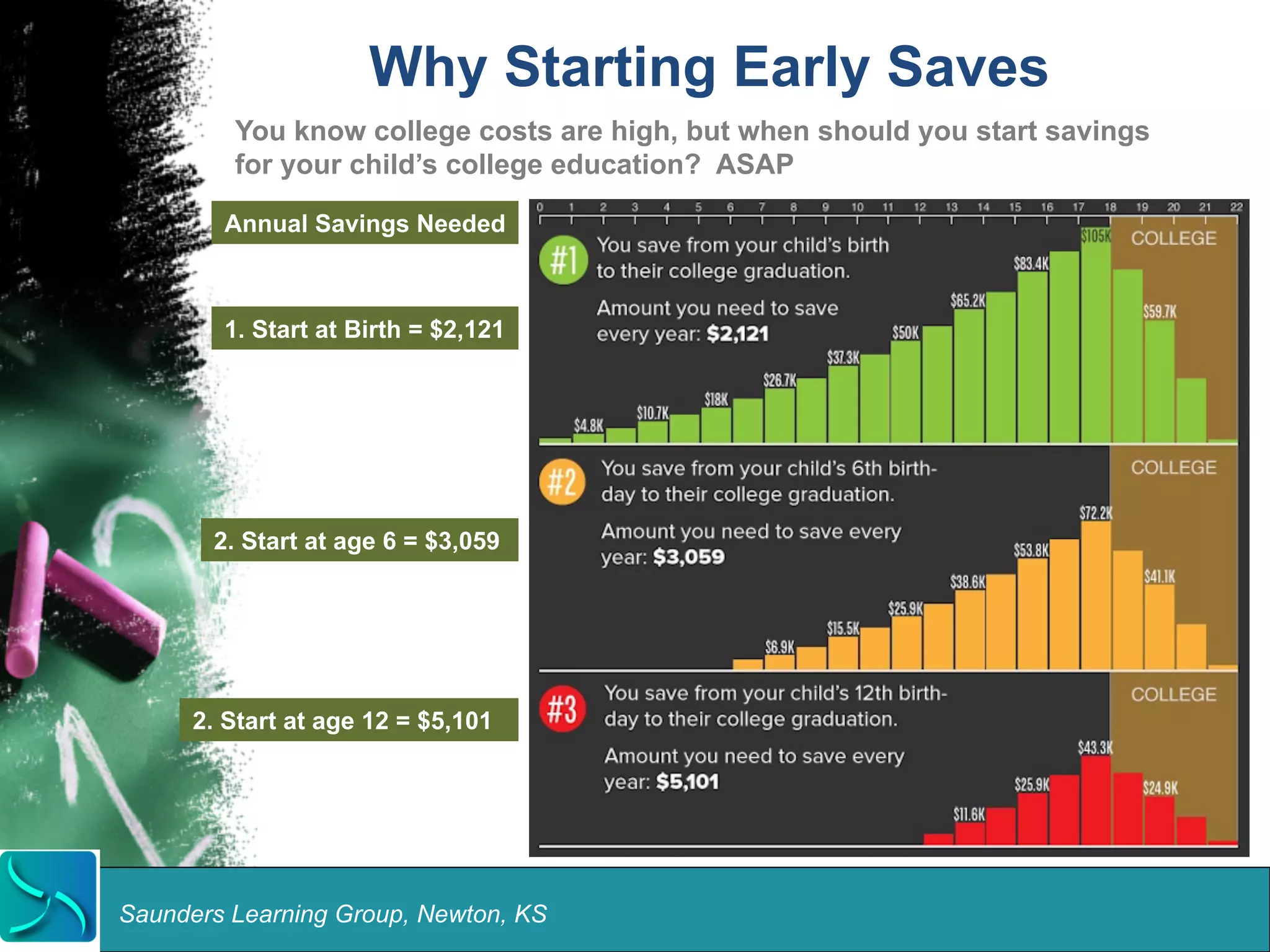

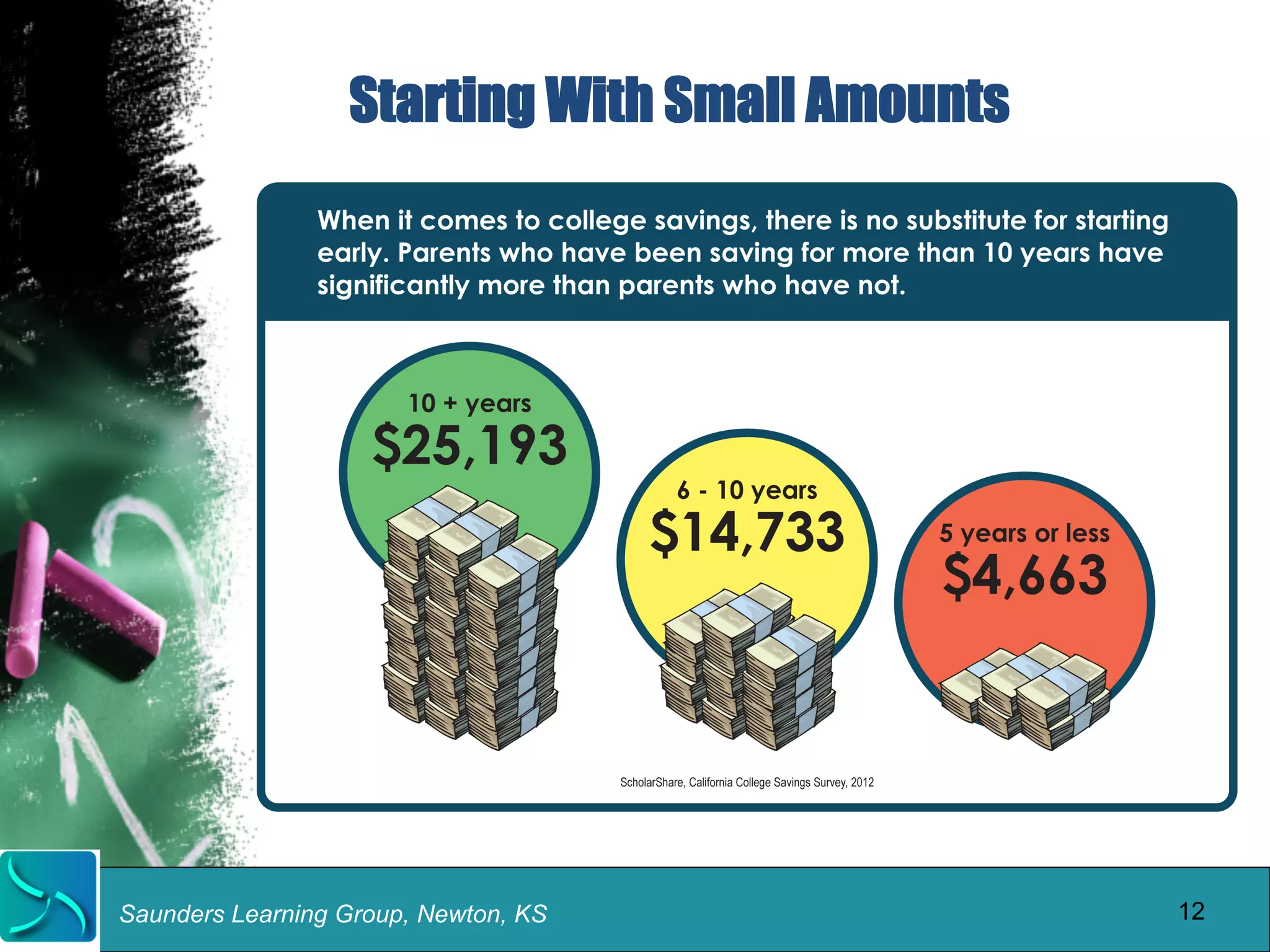

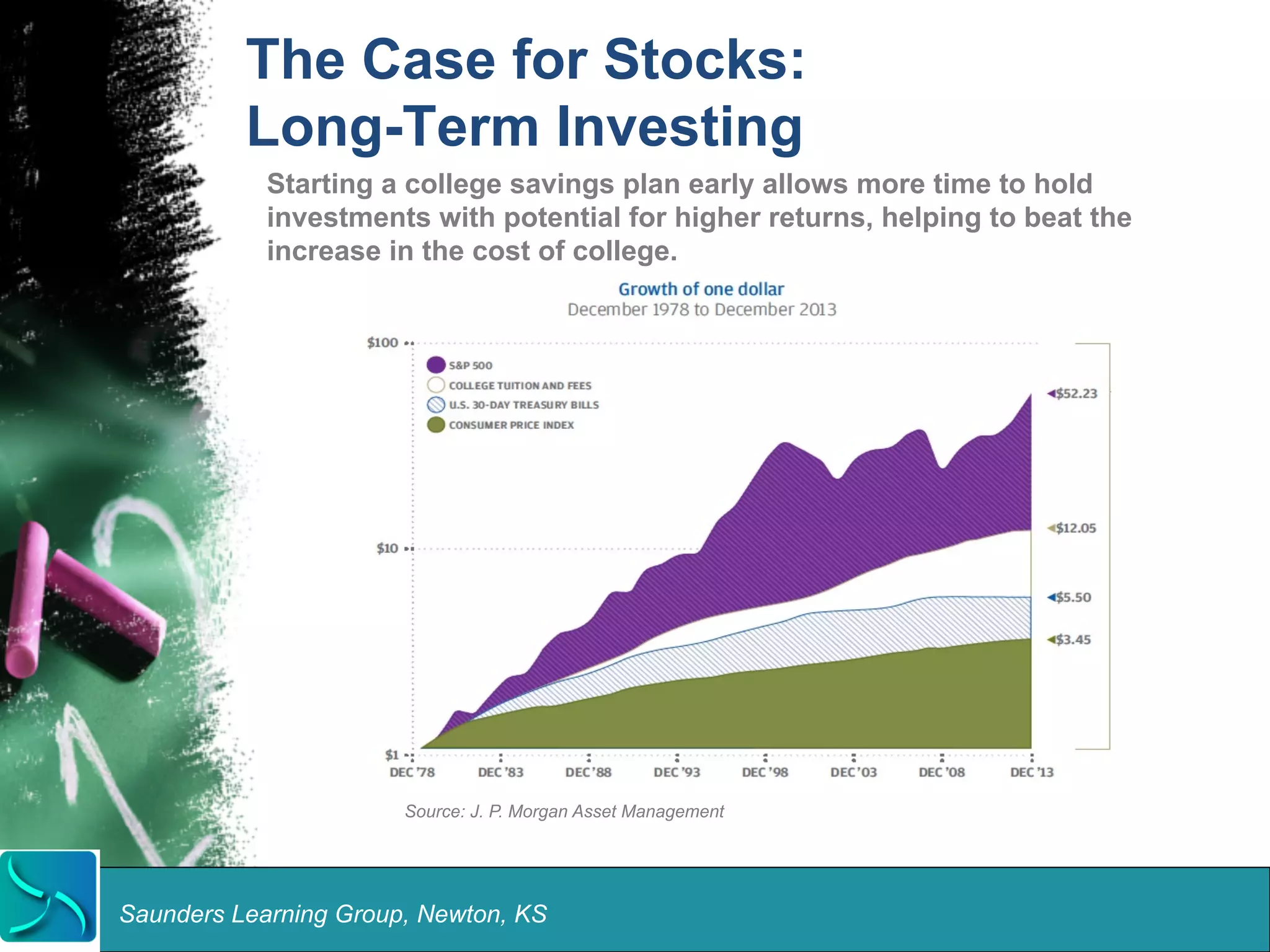

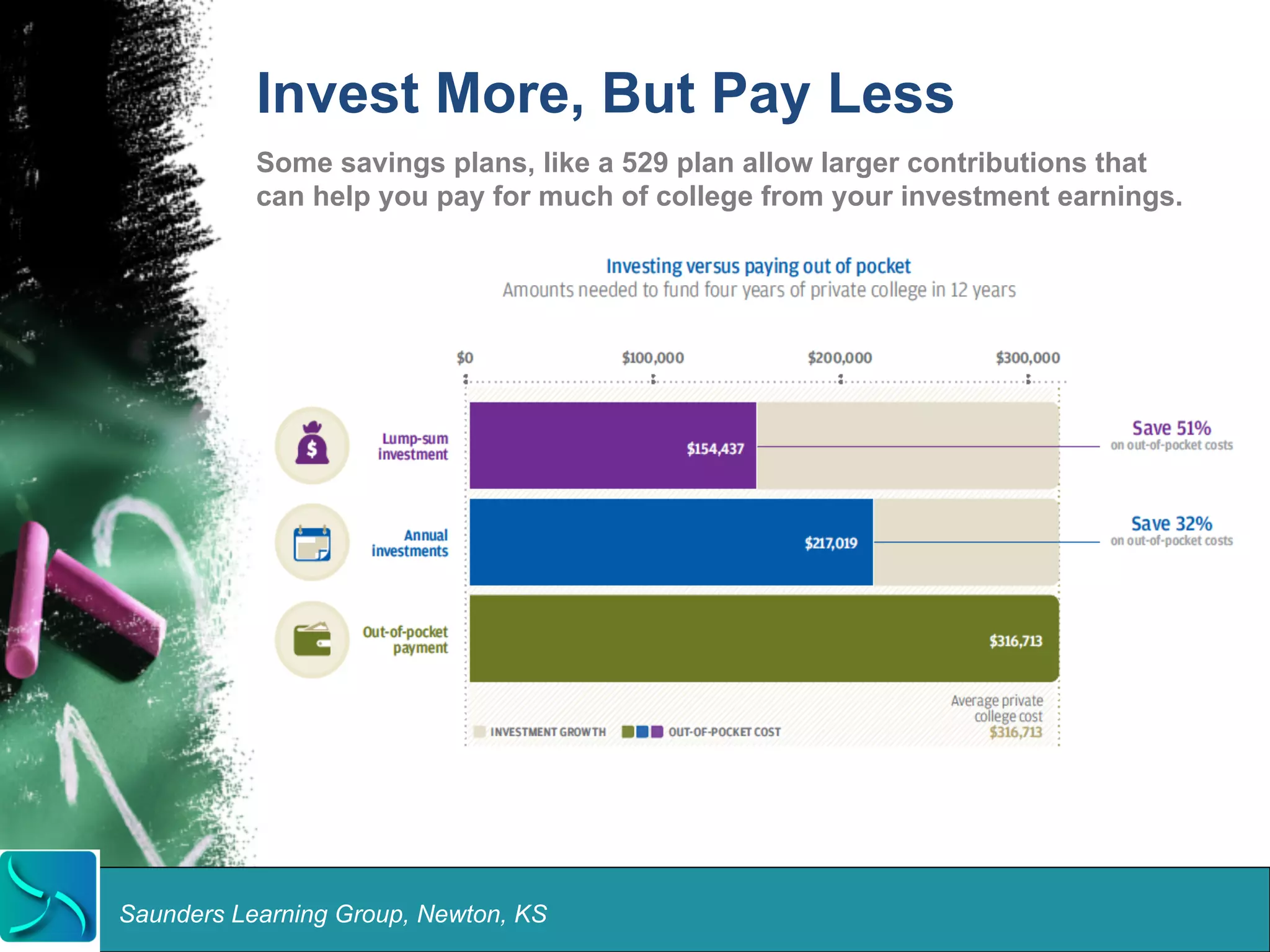

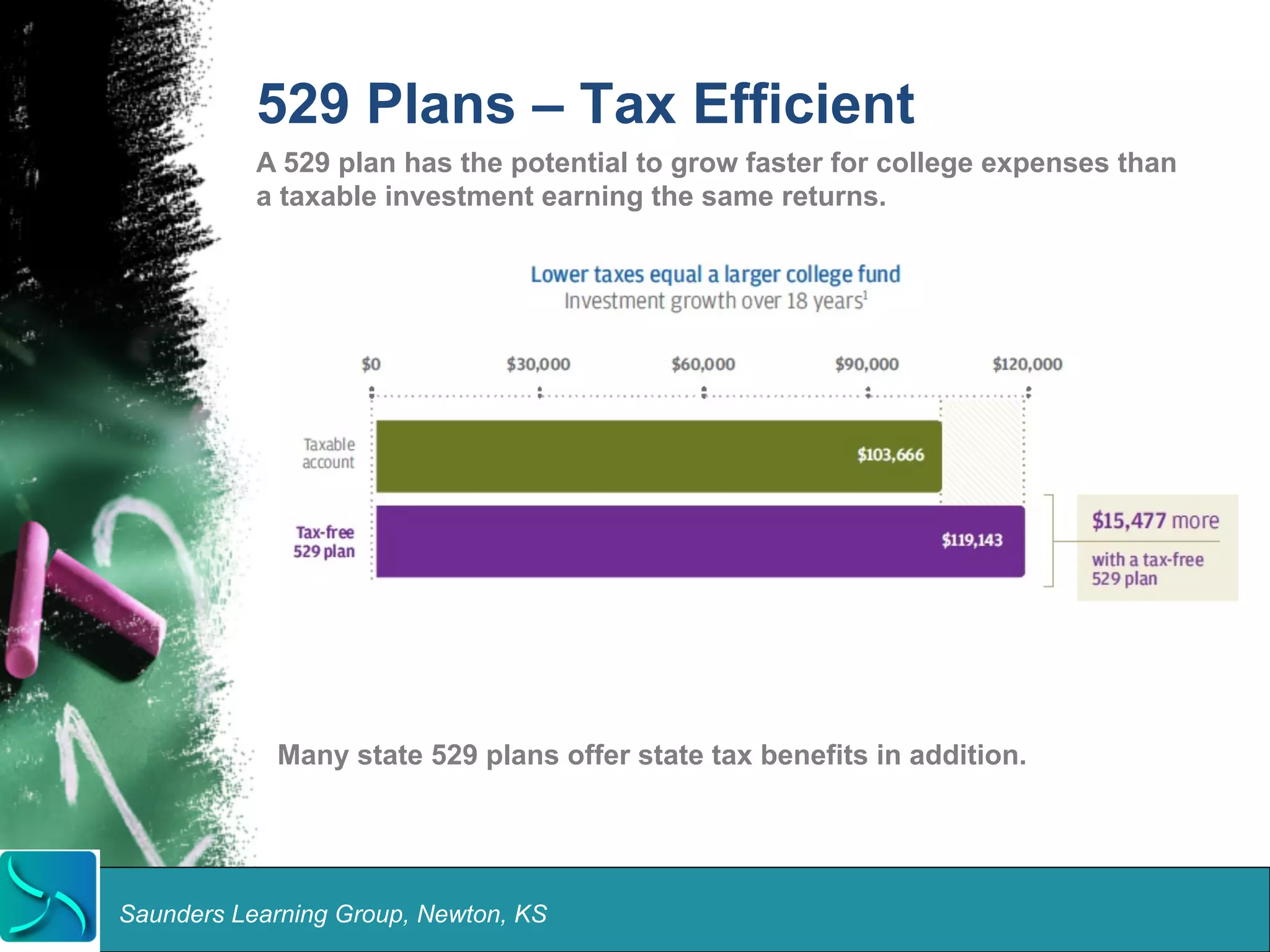

This document discusses strategies for saving and investing for college. It begins by debunking common myths about college savings, such as that it is too early to start or better to borrow money. It then discusses trends in college savings, noting that half of families do not save at all. The rest of the document provides tips for effective college savings, such as starting early even with small amounts to take advantage of compound interest, using 529 plans for tax benefits, and understanding various savings vehicles. It emphasizes that investing yields better long term returns than borrowing and stresses beginning a savings plan as soon as possible.