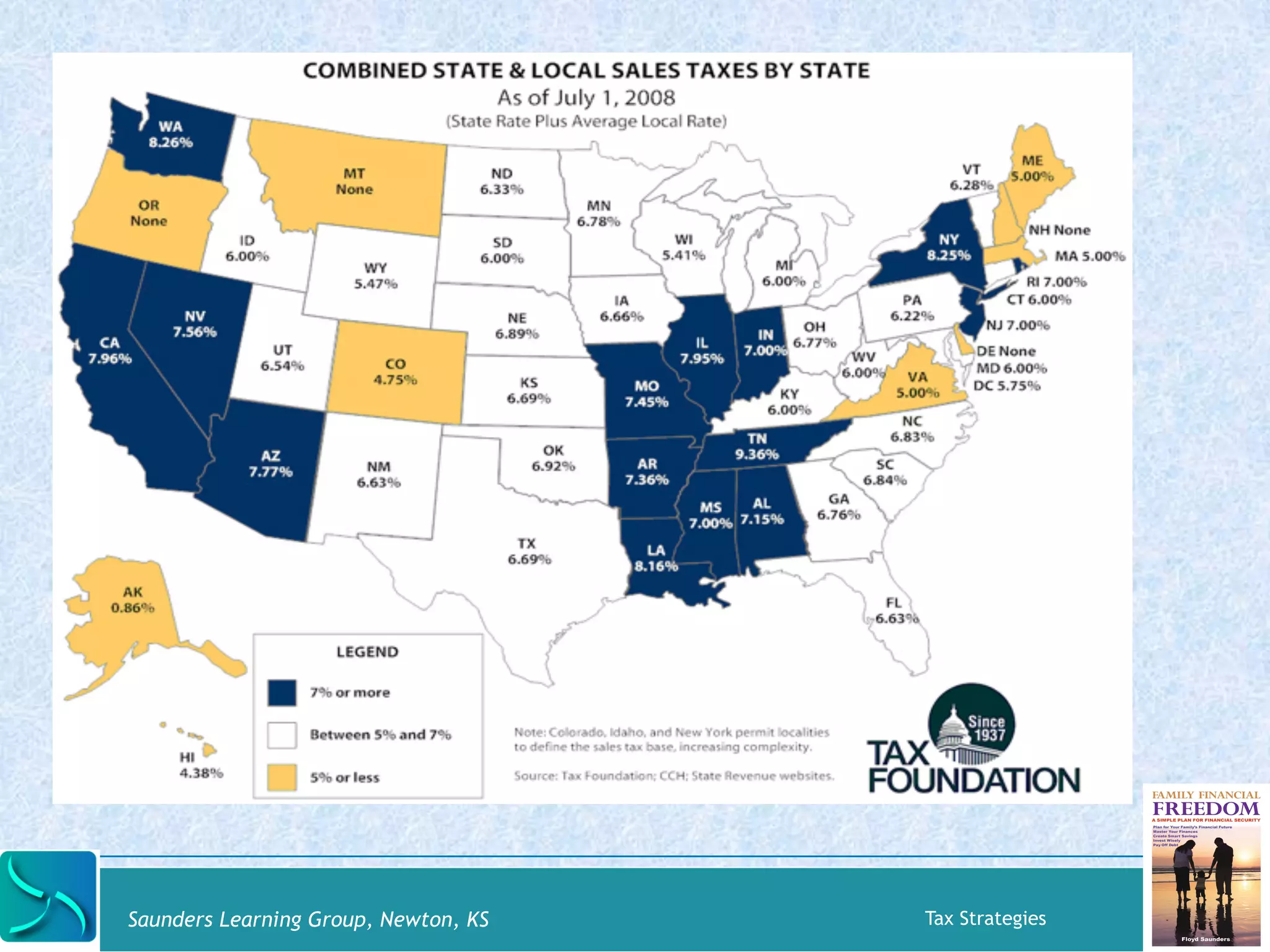

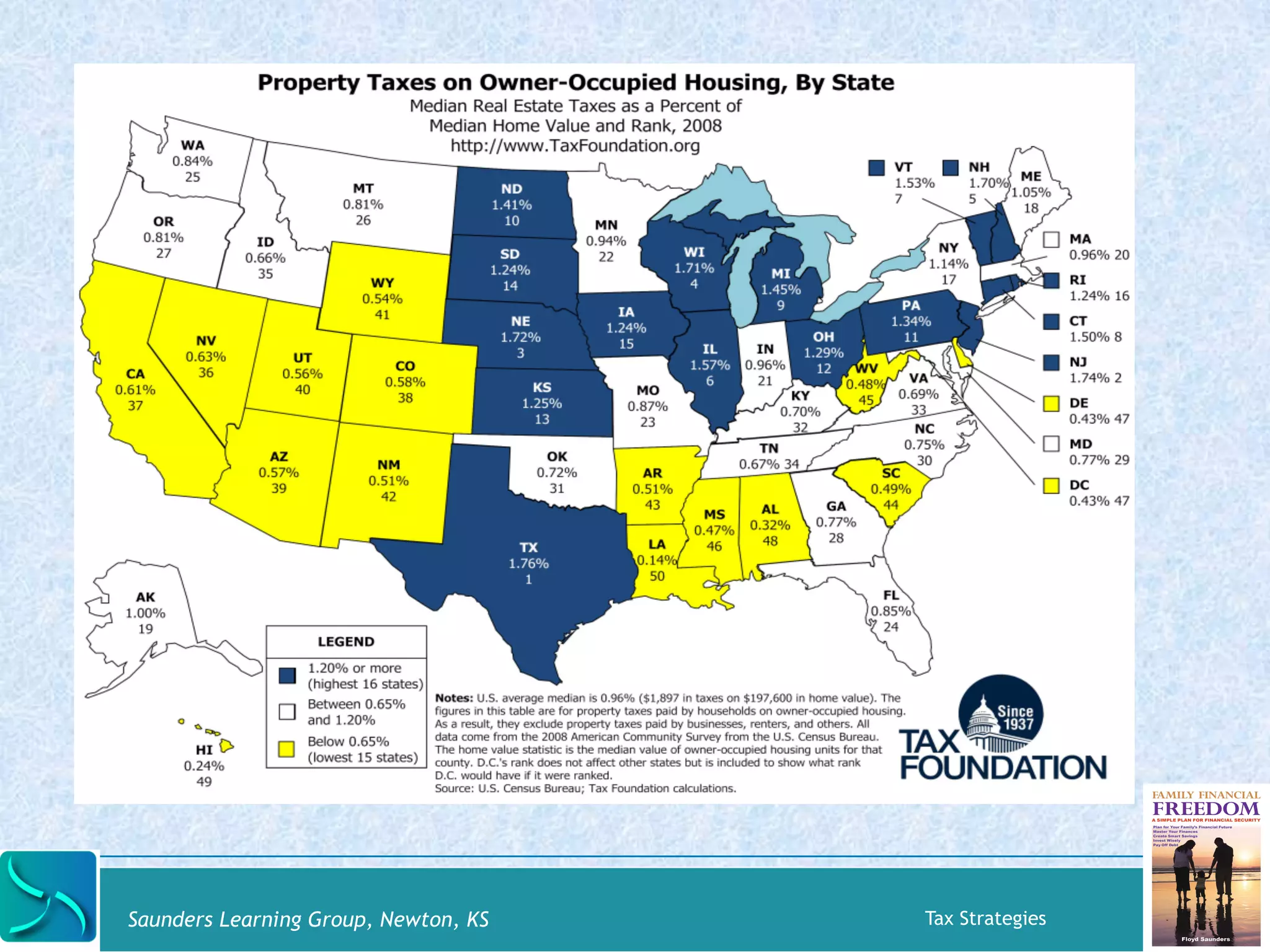

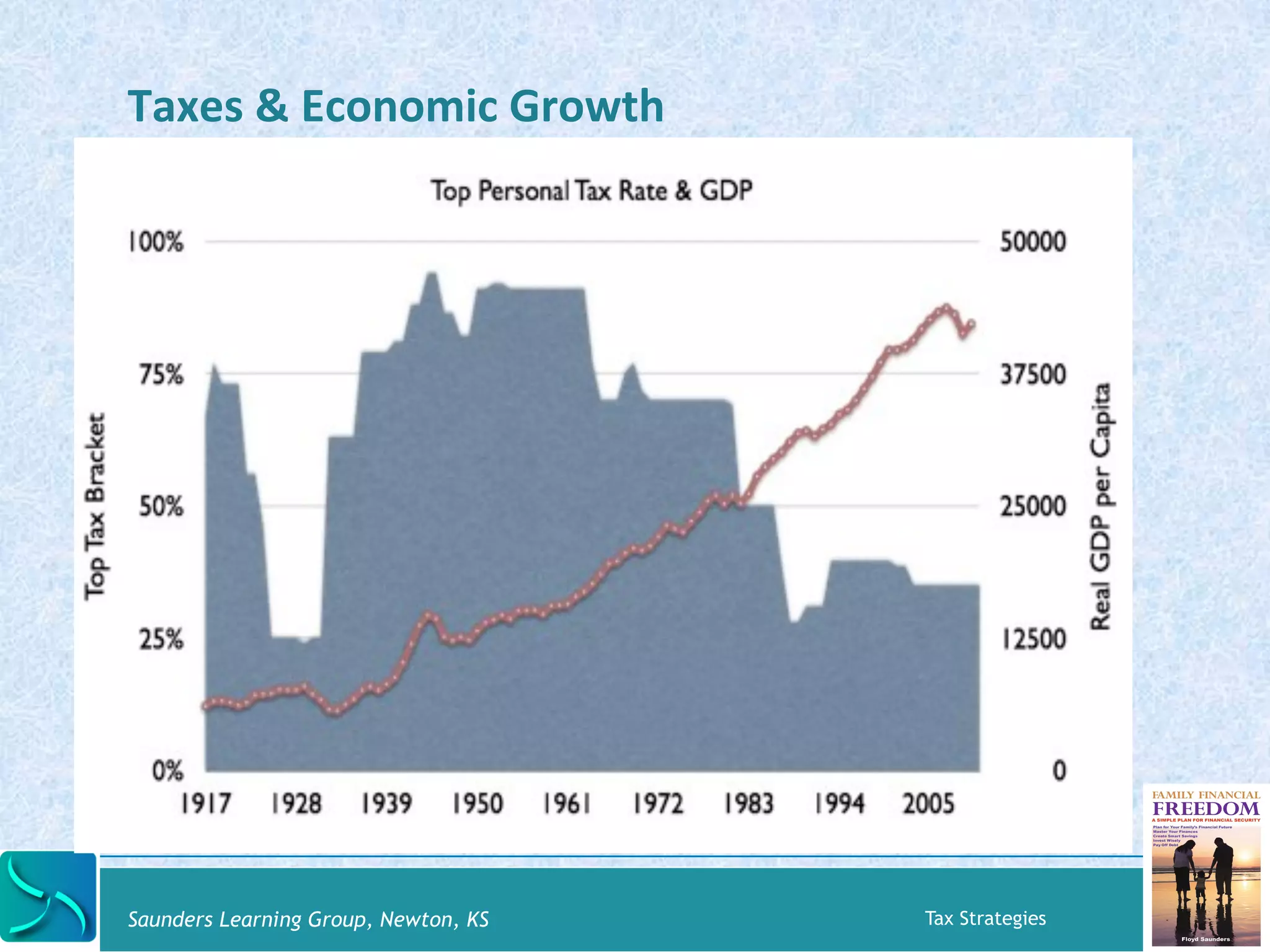

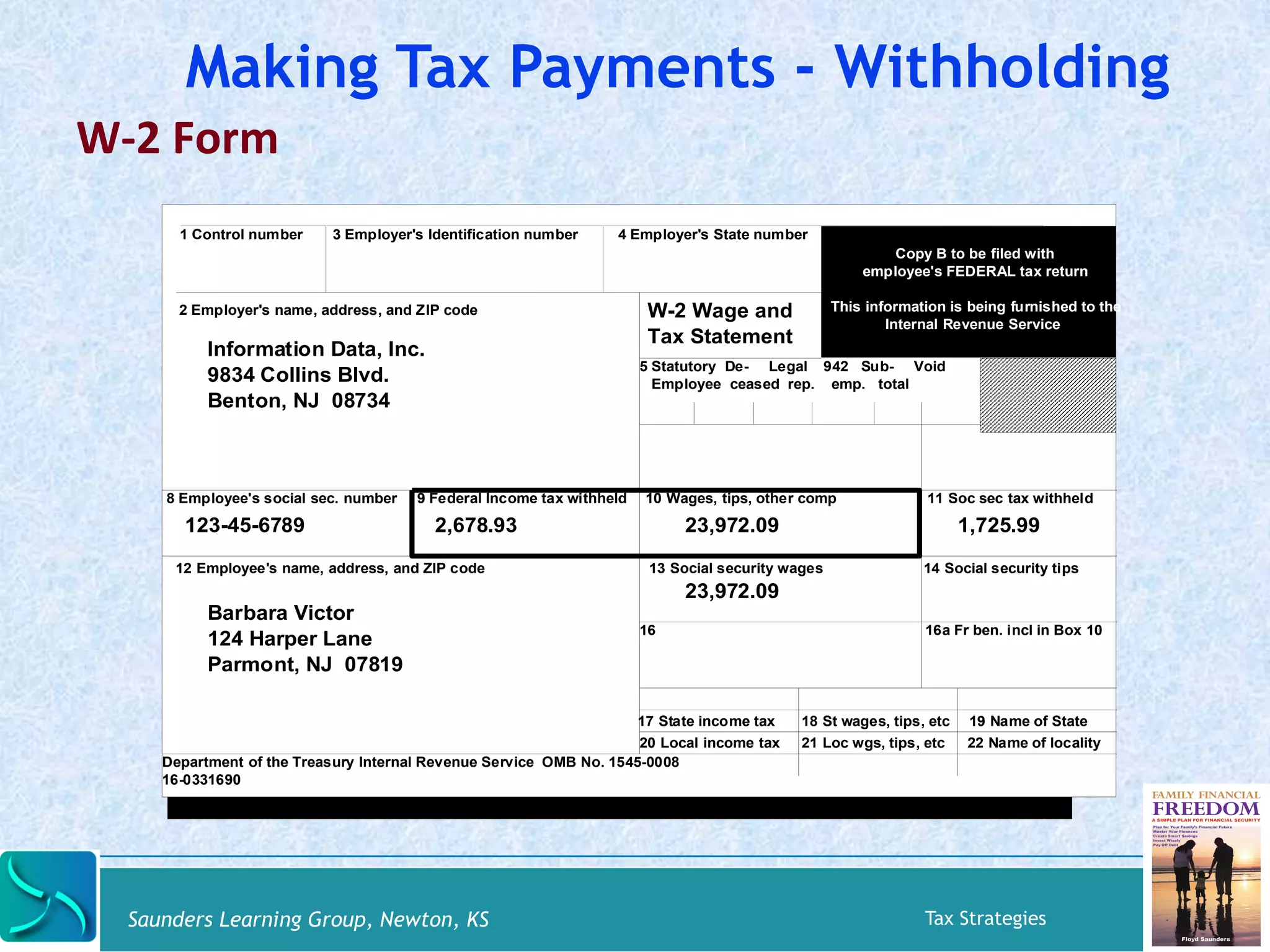

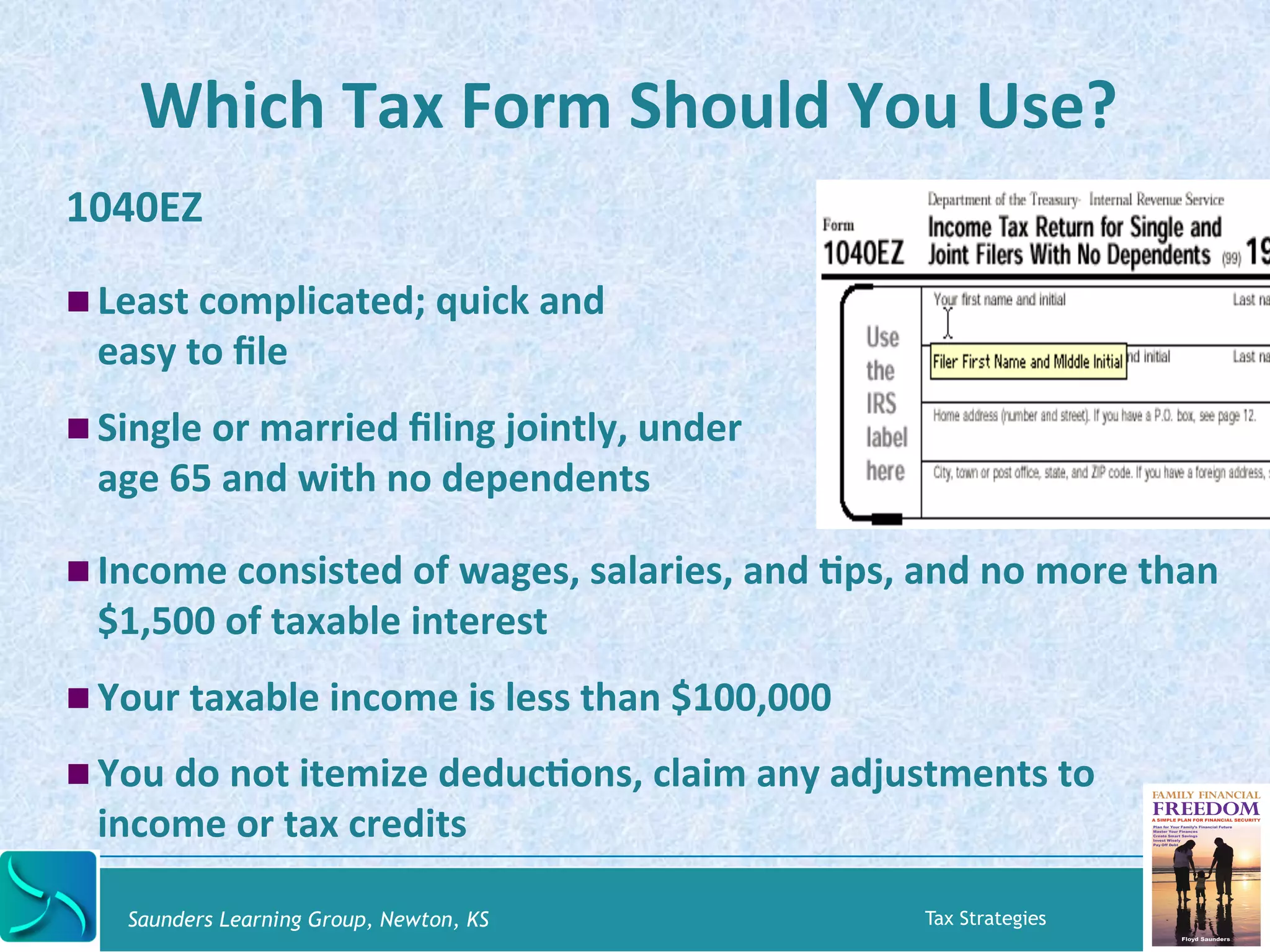

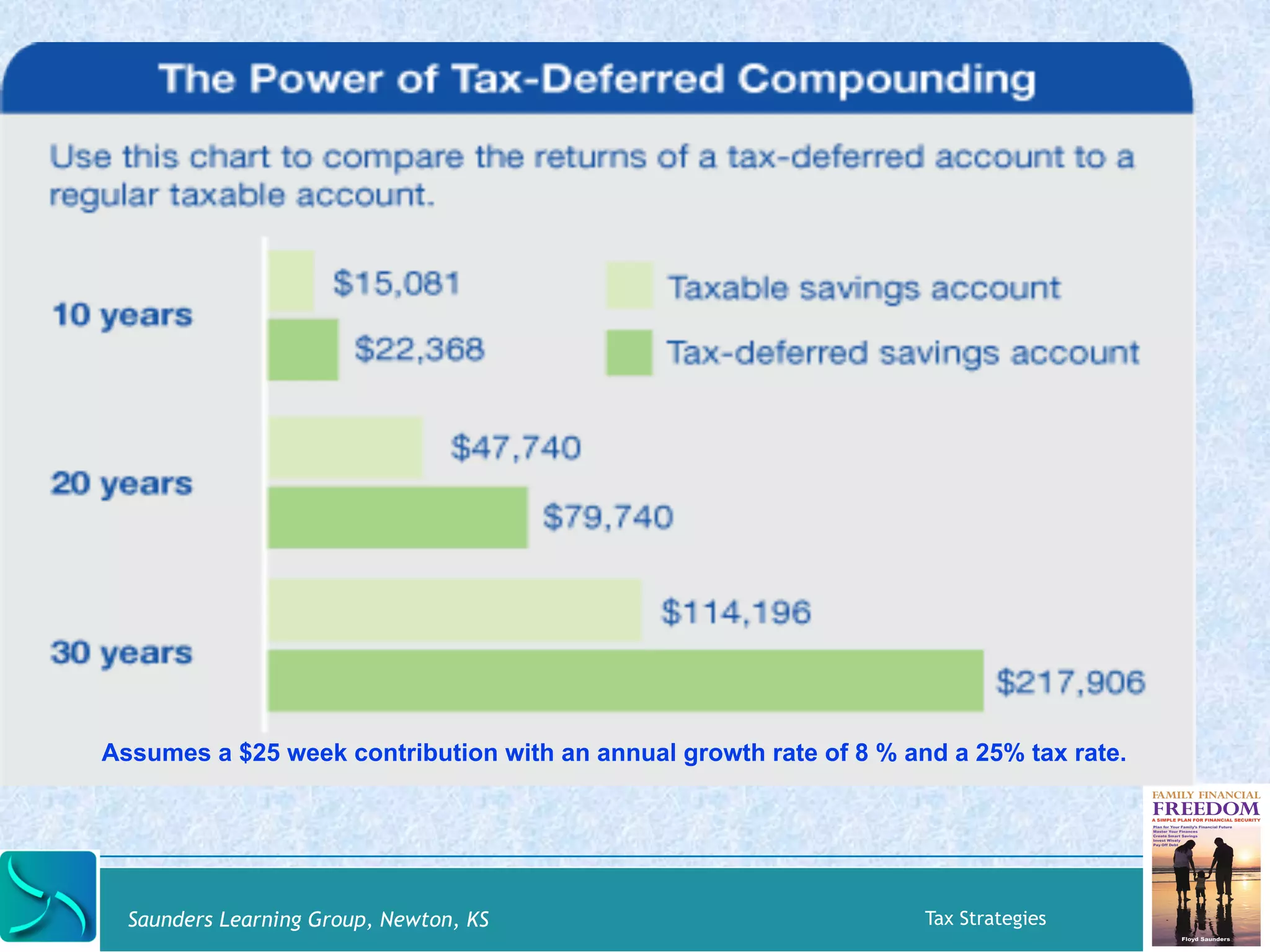

This document provides an agenda and overview for a tax strategies workshop presented by Saunders Learning Group. The workshop will describe the importance of taxes for personal financial planning, teach how to calculate taxable income and federal income tax amounts, and cover tax preparation, sources of tax assistance, and tax strategies for different financial situations. Attendees will learn about the four main types of taxes: taxes on purchases, property, wealth, and earnings. The workshop will also explain how to compute tax liability, deductions, credits, and filing status when completing a federal income tax return.