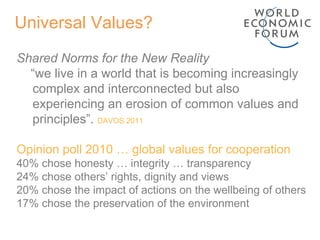

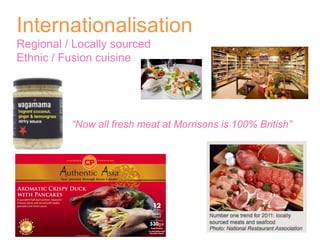

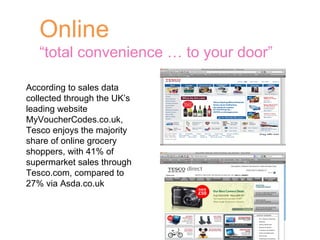

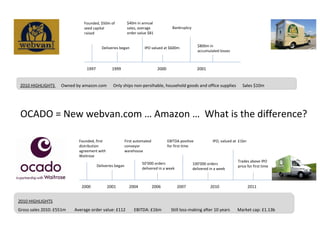

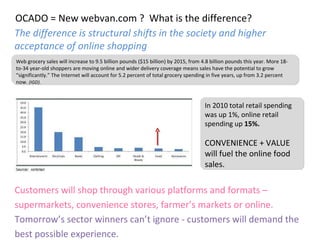

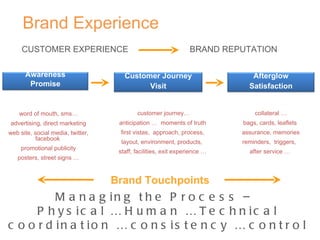

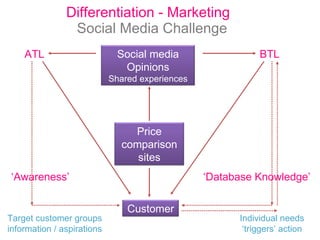

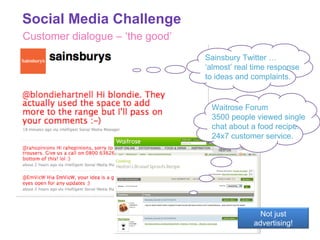

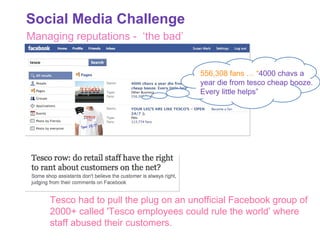

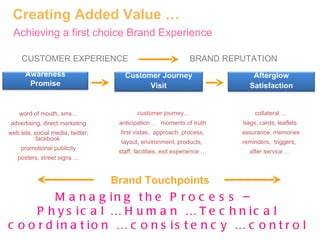

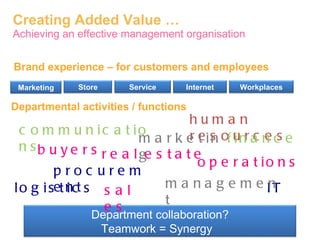

The document discusses trends in the retail industry post-financial crisis, including changing customer mindsets, new shopping formats like online and multi-channel shopping, and the challenges of differentiation and social media. Retailers must stay relevant to customers who value health, freshness, and sustainability. New shopping modes like online and multi-format stores are on the rise. Developing brands and creating value will require effective use of social media while managing reputational risks.