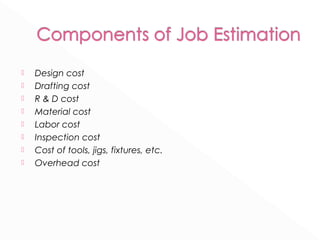

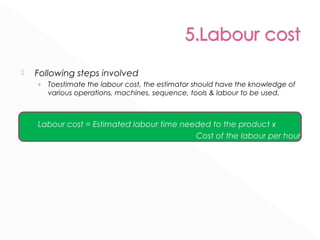

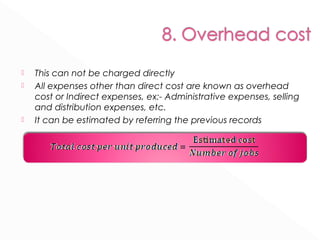

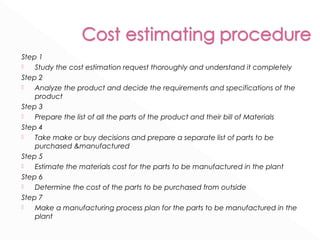

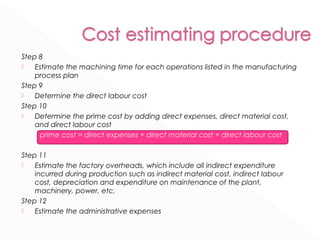

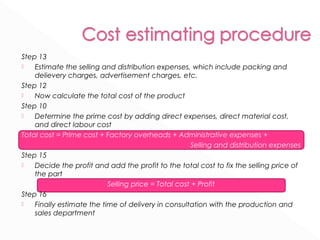

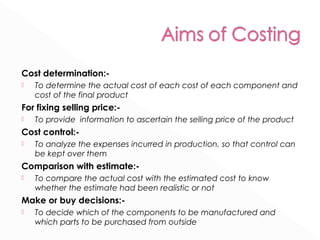

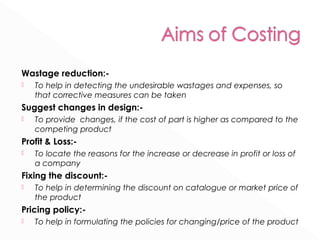

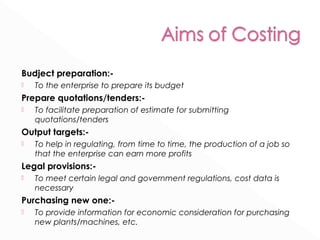

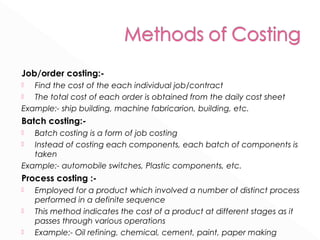

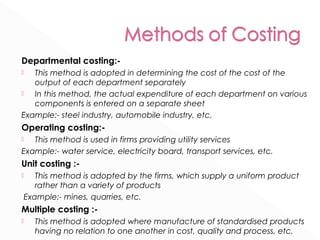

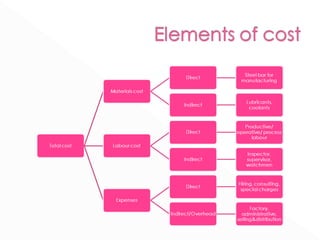

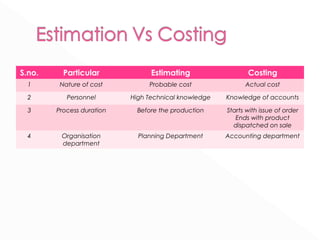

The document discusses cost estimating and costing. It defines cost estimating as determining the probable cost of manufacturing a product before production starts. This involves estimating costs for materials, labor, overhead etc. Costing determines the actual costs incurred during production. It provides information for setting prices, cost control, make-or-buy decisions and more. The document outlines different types of costing systems used such as job costing, batch costing and process costing.