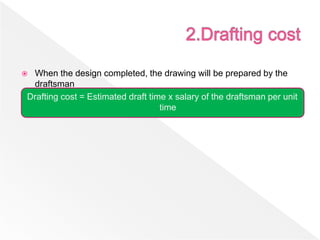

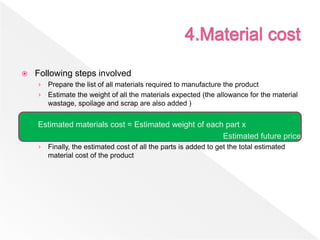

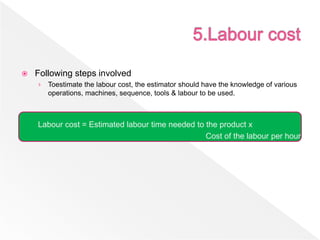

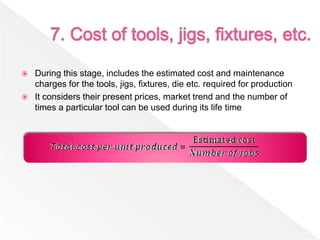

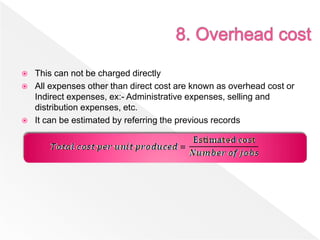

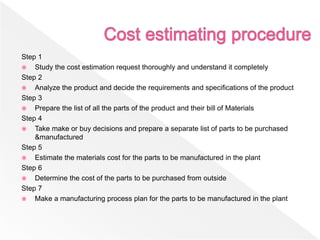

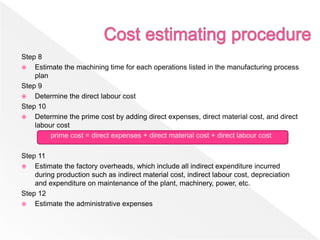

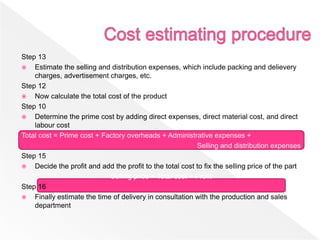

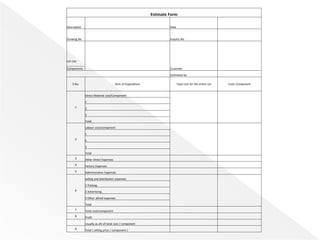

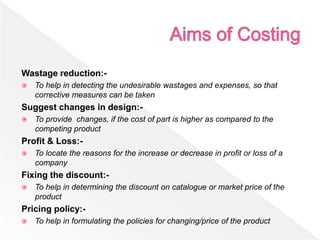

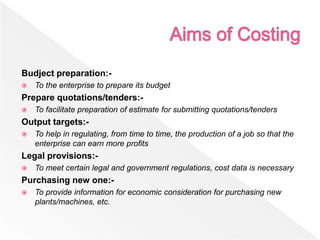

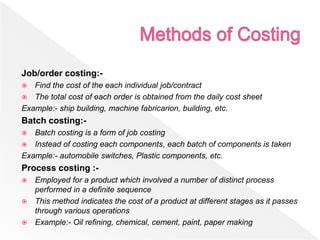

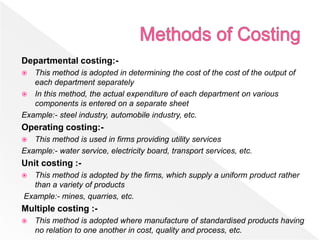

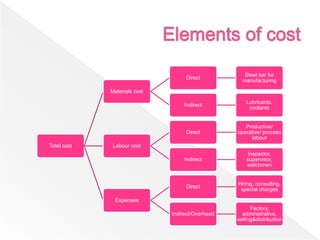

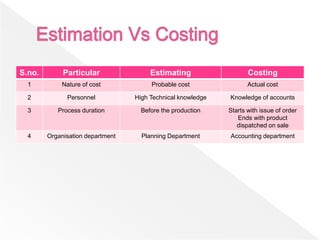

The document outlines the process of cost estimating in manufacturing, detailing its significance for setting product prices and making informed business decisions. It emphasizes the importance of accurate cost forecasting, including the components of design, materials, labor, and overhead costs, and provides a step-by-step guide for estimating total production costs. Various costing methods, such as job, batch, and process costing, are also discussed to illustrate different approaches to cost determination.