This document discusses rate analysis and valuation of properties. It provides information on:

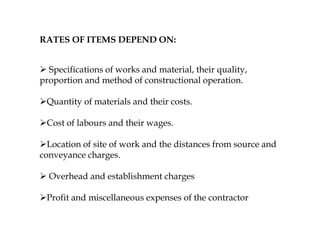

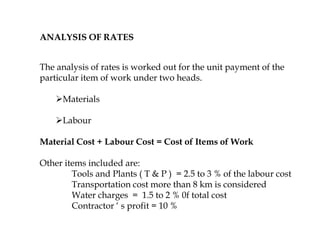

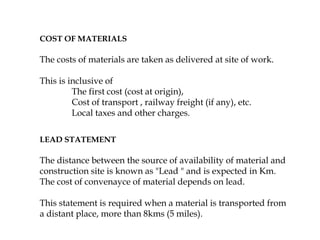

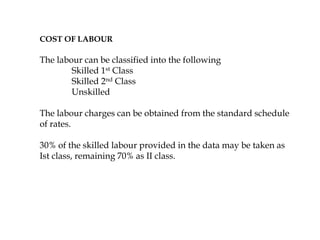

1) Rate analysis is determining the cost per unit of work based on material, labor, and other costs. Rates vary by location. Rate analysis is used to determine actual costs, optimize efficiency, and revise rates due to cost changes.

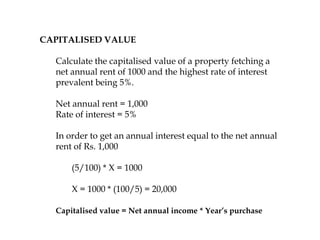

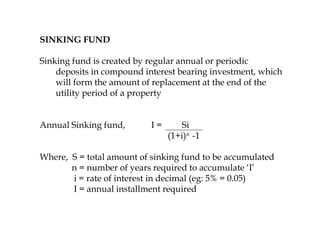

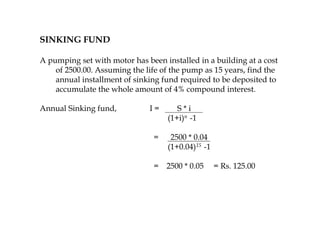

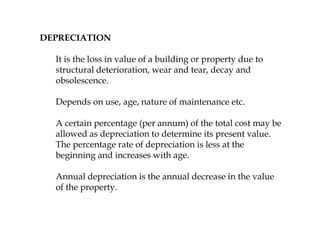

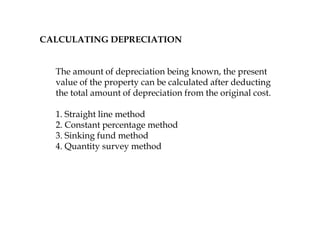

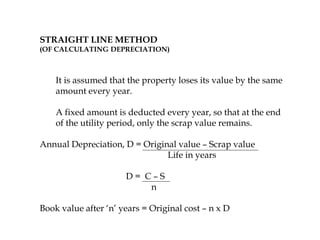

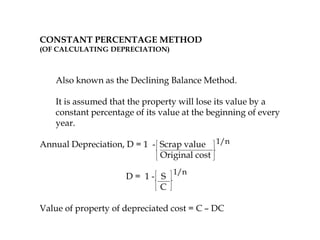

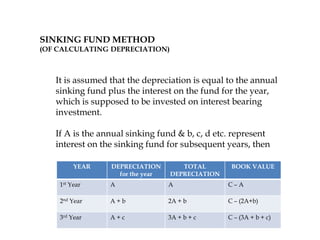

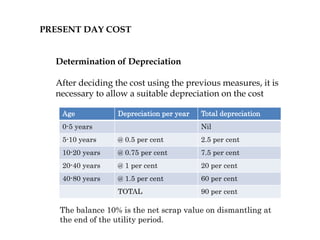

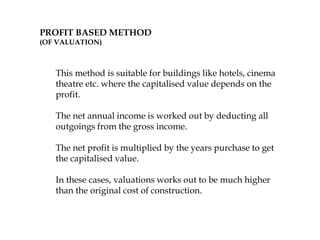

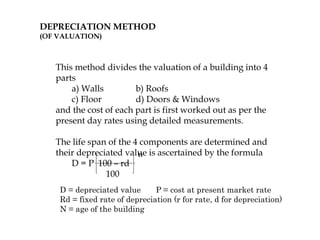

2) Valuation estimates the fair price or value of a property based on type, location, quality, size, and other factors. It is used for buying/selling, taxation, rent calculation, loans, and more. Valuation considers cost, depreciation, income, expenses, and taxes to determine present value.

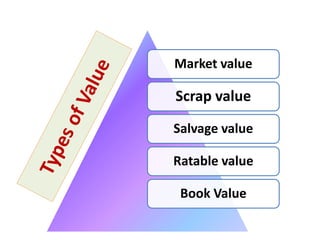

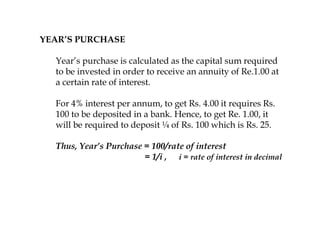

3) Key terms like market value, scrap value, salv