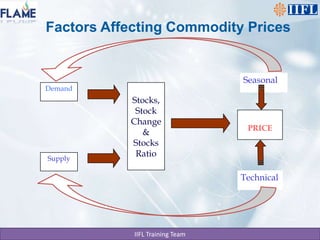

This document discusses several key economic indicators that affect commodity prices, including:

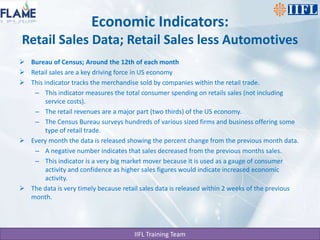

- Consumer confidence index, consumer price index, employment reports, GDP, and retail sales which measure economic activity and consumer spending.

- FOMC meetings and interest rate announcements which can impact inflation and currency valuations.

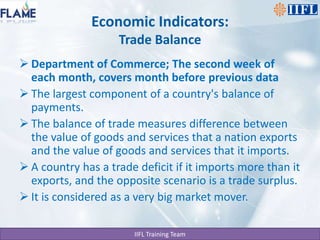

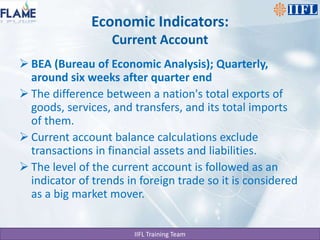

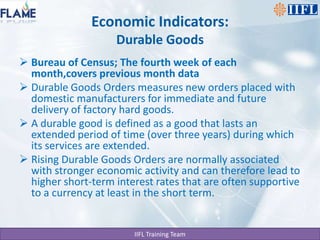

- Trade balance, current account, and durable goods orders which provide insights into international trade trends.

- Housing starts and industrial production which track business investment and manufacturing activity.

These economic indicators are closely watched globally as they can signal changes in commodity demand and supply.